In this Budget we’re putting rocket boosters on the backs of enterprise and productive investment”

George Osborne (March 2016)

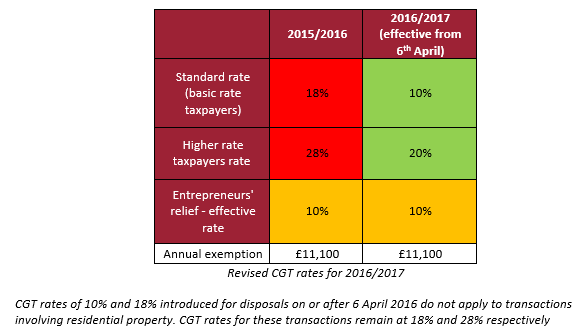

On the 16th March George Osborne announced in his 2016 budget that from 6th April 2016 the Capital Gains Tax (CGT) rate for higher rate income taxpayers is being cut from 28% to 20%, and for basic rate taxpayers from 18% to 10%.

CGT is due on profits from the sale of assets, including company shares and property (with the exception of a main residence). Individuals have an allowance of £11,100 per year where profits can be enjoyed tax-free.

At last, a tax break to benefit all walks of life. The cheers of joy rippled around Britain! The pleasing aspect of this new tax break was that it came out of the blue and was largely unexpected.

It was highlighted that Government sources estimate 130,000 people will benefit from the tax cut, of which around 50,000 are basic rate taxpayers and 80,000 higher rate taxpayers. The current tax free allowance rate of £11,100 will remain unchanged.

Such a large tax cut surely begs the question ‘how will this be funded?’ as we are all aware that what the left hand giveth, the right hand taketh away. Well one way is by not including everyone in these new reductions. Landlords of residential properties will be exempt from the new rates on the sale of a property, so the current 15/16 CGT rates would apply. Residential landlords were not best pleased with being excluded after having recently been subject to a reduction in the mortgage interest relief they can claim, plus higher levels of stamp duty on buy-to-let properties. This now makes it extremely unattractive to invest into buy-to-let which is fast becoming the Government’s new ‘cash cow’ at raising extra revenue (motorists take a breather).

It is forecasted that reducing the rate of CGT will cost the Treasury £2.8 billion over the next five years.

With everything taken into consideration, this is a boost for the Government to incentivise individuals to invest in equities. A spokesperson for George Osborne said, “The Government wants to ensure that companies can access the capital they need to grow and create jobs. These changes are about incentivising individuals to invest in shares, helping British firms access the capital they need to grow and create jobs”.

Ultimately an 8% tax saving on the disposal of assets above the tax free allowance is a welcome surprise by all concerned and one that will hopefully aim to increase investment in the UK.

As always, please contact your Courtiers Adviser if you have any questions regarding these new CGT rates.