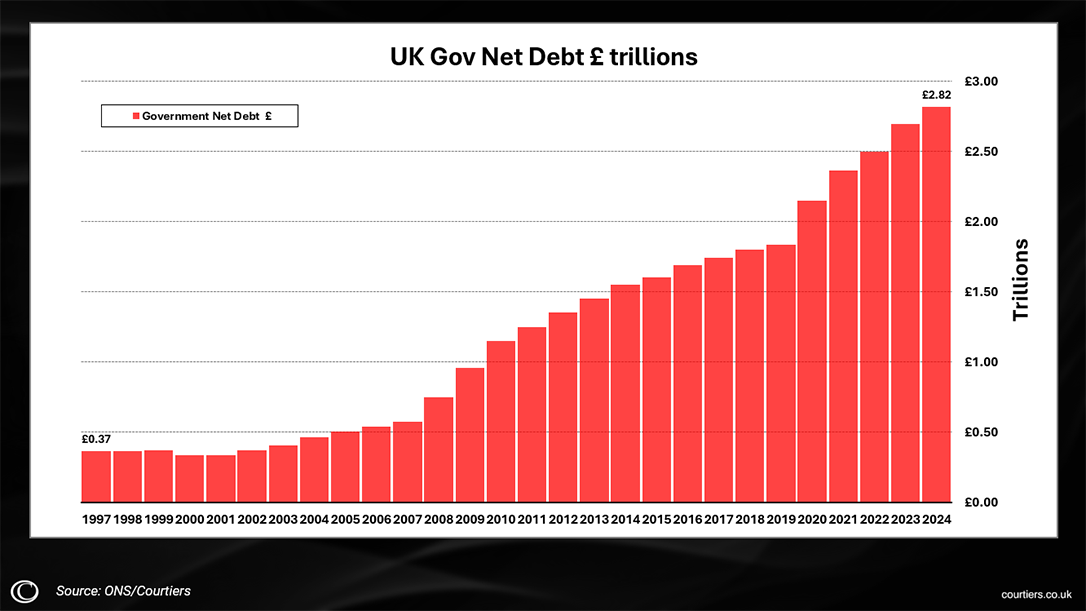

Gary took to the stage at the 2025 Client Seminars to talk about what he’s consistently covered before; how the £22 billion ‘black hole’ that the Government is using to push tax increases doesn’t exist.

Gary Reynolds has been consistent in his research: Government debt and household savings are two sides of the same coin; one balances the spending of the other. So, the idea of a £22 billion public finances black hole seems ridiculous to him, and with charts illustrating his point, he’s fed up of the excuse. That was the main theme to his talk at the Courtiers 2025 Client Seminars.

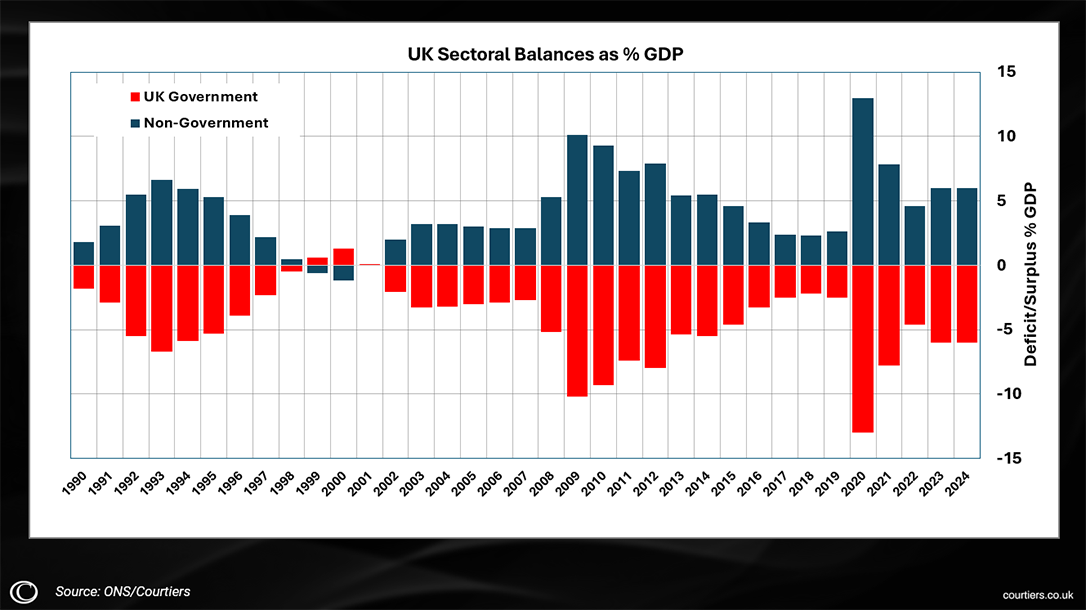

As we detailed in our September article, Should gilt investors fear the UK government’s burgeoning debt?, “if you add up the sectoral financial balances across the government, households, corporations and overseas transactions, you get a big, fat, zero. Why? Because money sits on both sides of a balance sheet and one person’s asset is another’s liability. Think of it like this: if you run a deficit in your personal finances, it means you’ve spent more than you earned. This gap must be filled by you borrowing from someone else. That’s only possible if the lender has a surplus.”

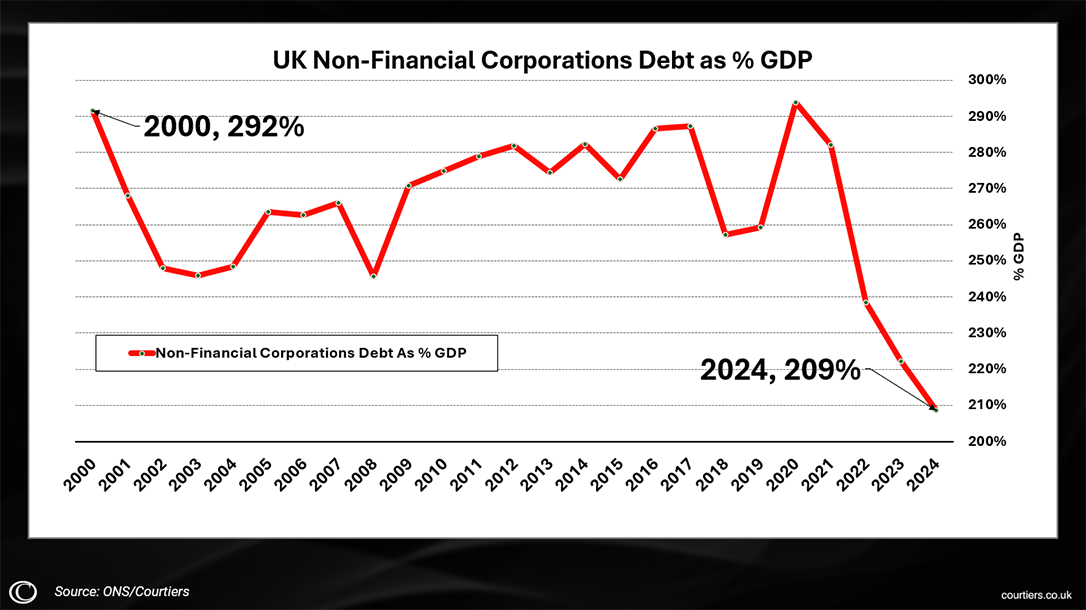

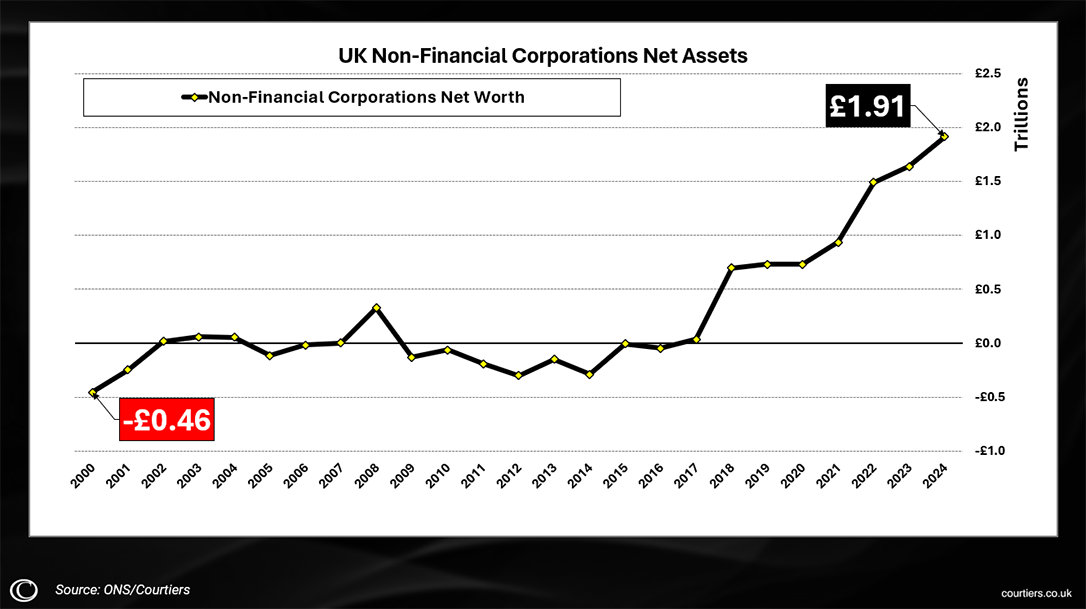

In fact, Gery Reynolds points out that private businesses aren’t borrowing (as shown in the graph above), but have been investing (shown below), building up a surplus on £1.9 trillion in assets.

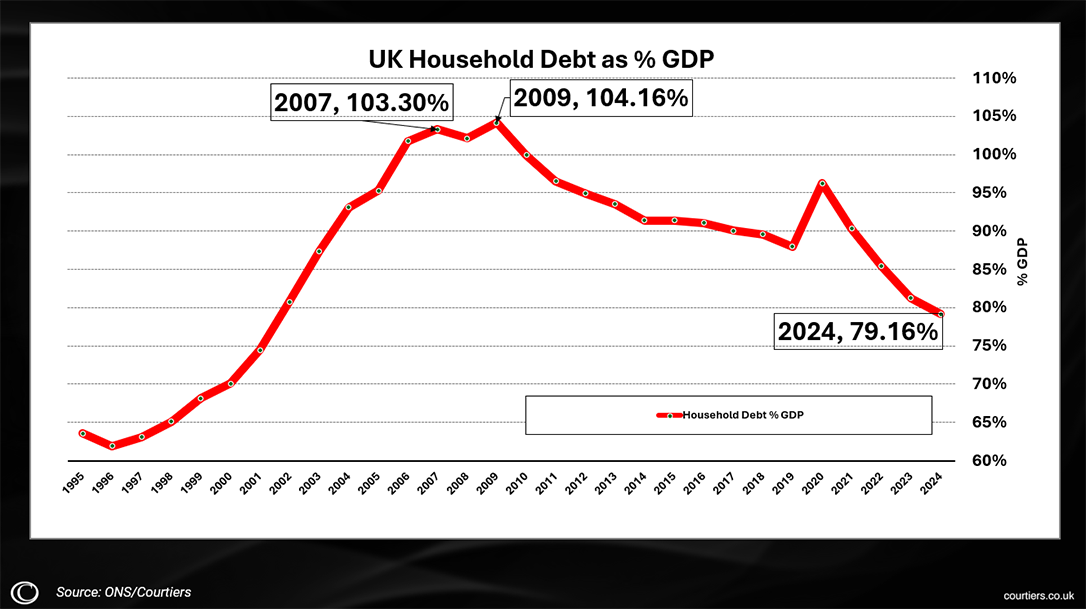

What are households doing?

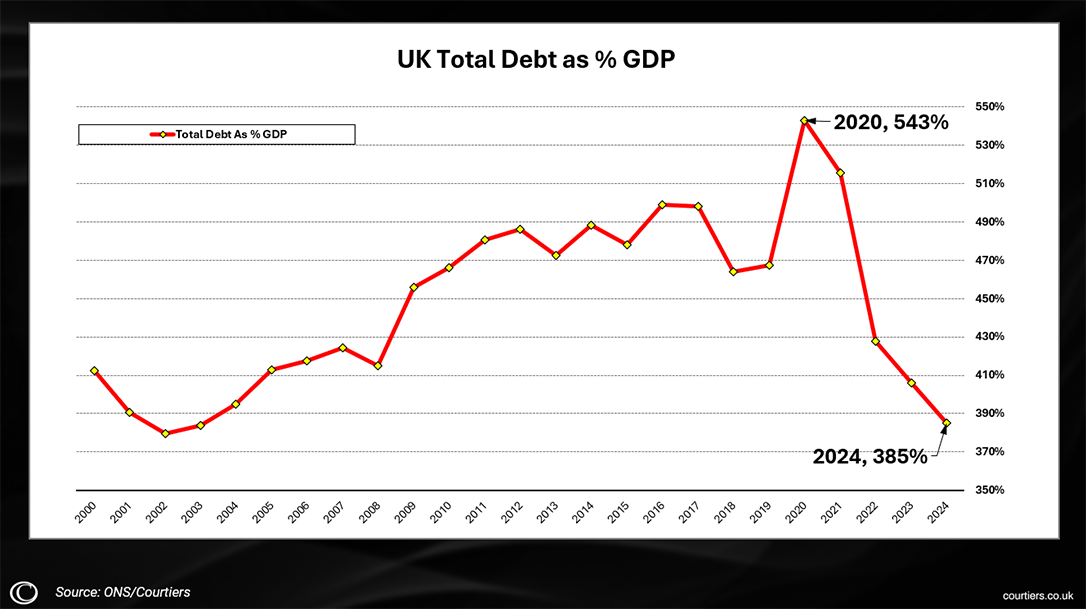

Households have also been paying down debt and saving.

Putting it all together

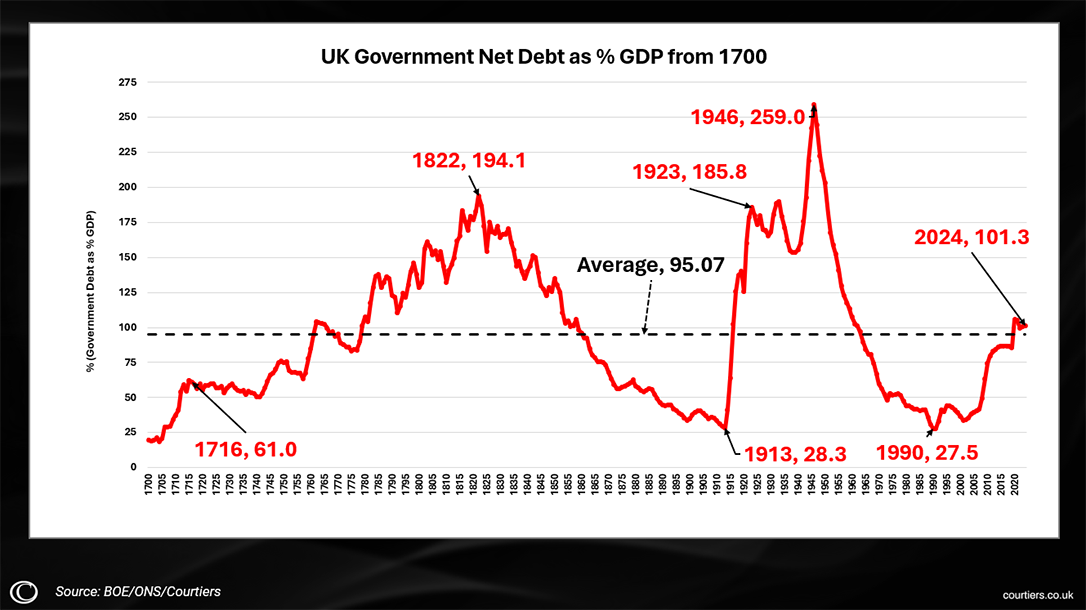

If you put all of this together, debt to GDP is actually much lower.

So it’s more of a case of looking at whether we want the government to borrow, or if we (private businesses and households) want to borrow. The latter have chosen to pay down debt, while the government runs up a deficit. Generally, all government parties want to get borrowing down, but the government will always run a deficit if households are able to save.

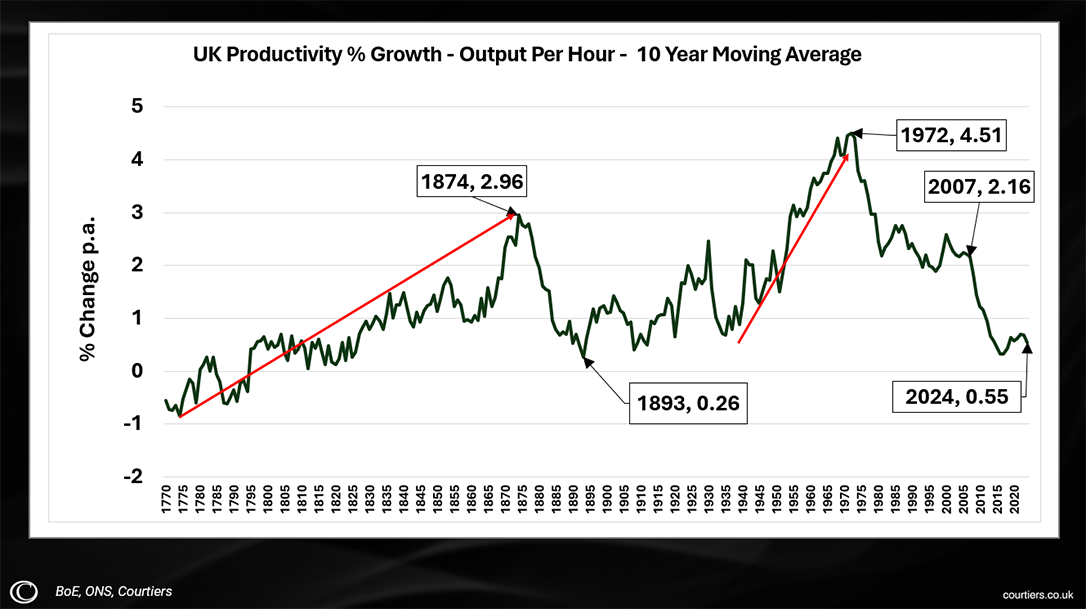

The government deficit doesn’t always go up, because the economy can grow faster than government borrowing. It does this by productivity increasing, which is what everybody (i.e. all government parties) want. That is how the percentage of GDP can change, like the table below.

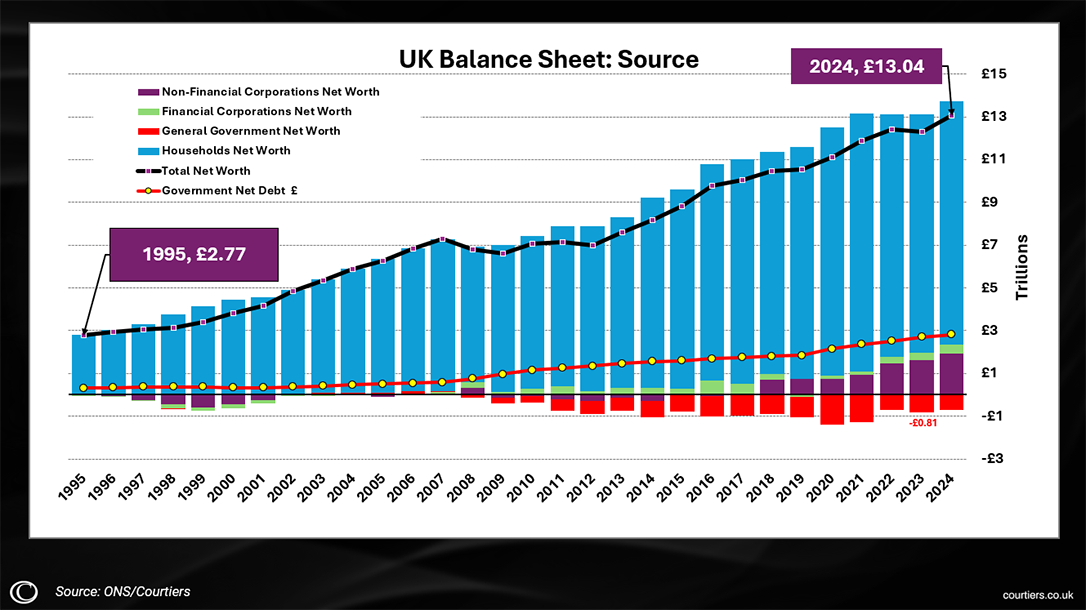

The collective balance sheet of the UK shows that households have been building its net worth, the red and yellow line is the government debt. However, if you combine all the figures, you get the key figure at the top – 13 trillion. “Not such a bad position to be in,” says Gary.

Productivity is the golden ticket

Productivity is the issue, however. It’s the lowest it’s been since 1893, and when productivity slumps, it’s difficult. Rachel Reeves is worried about this as it’s eating into her margin and the OBR keeps reducing its forecasts. What helps productivity is if you spend more money and increase business services, responding by providing more.

What doesn’t help is when Government depresses people by saying there is a black hole and worrying people to save their money. Take heart; productivity will change, and if history is anything to fall back on, it will happen.

Read more Client Seminar articles

Gary Reynolds explains How our Growth Fund outperformed the Mag 7.

James Timpson covers Positive returns for Courtiers Funds in 2025.

Jake Reynolds addresses equities and stocks in Attacking the difficult questions we had this year.

If you have any questions or would like to know when we will run the Client Seminars again, contact your Courtiers Financial Adviser or get in touch through the Contact Us page.