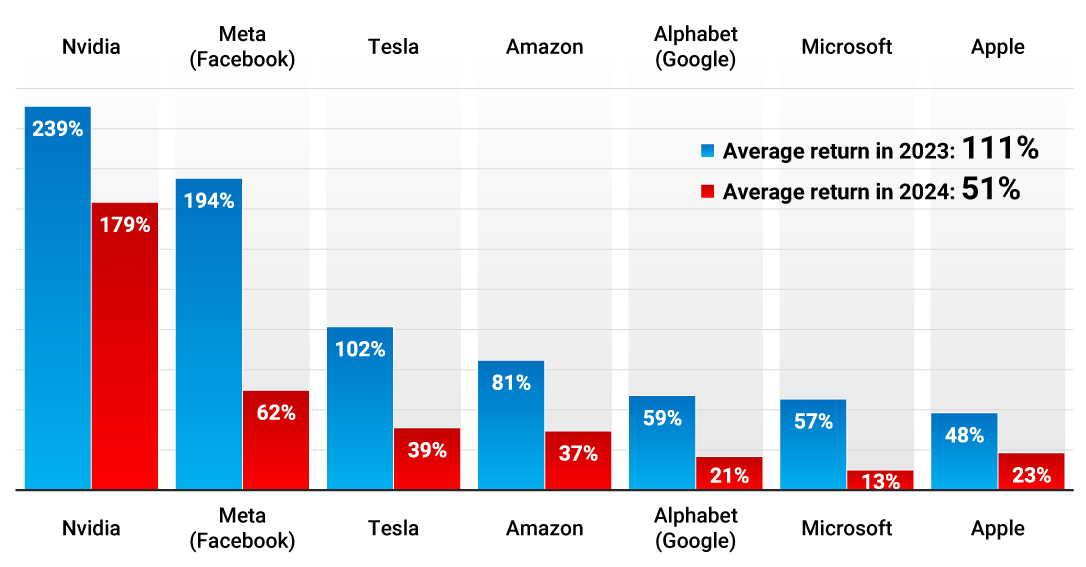

Those of you that attended Courtiers’ December Client Seminar last year will recall James (Timpson) covering the stellar returns from the Magnificent 7 (Mag-7) companies in 2023 and 2024. To recap, below is the data that James shared in his presentation:

Source: Bloomberg & Courtiers. Chart shows price returns from 30/11/2022 to 30/11/2024.

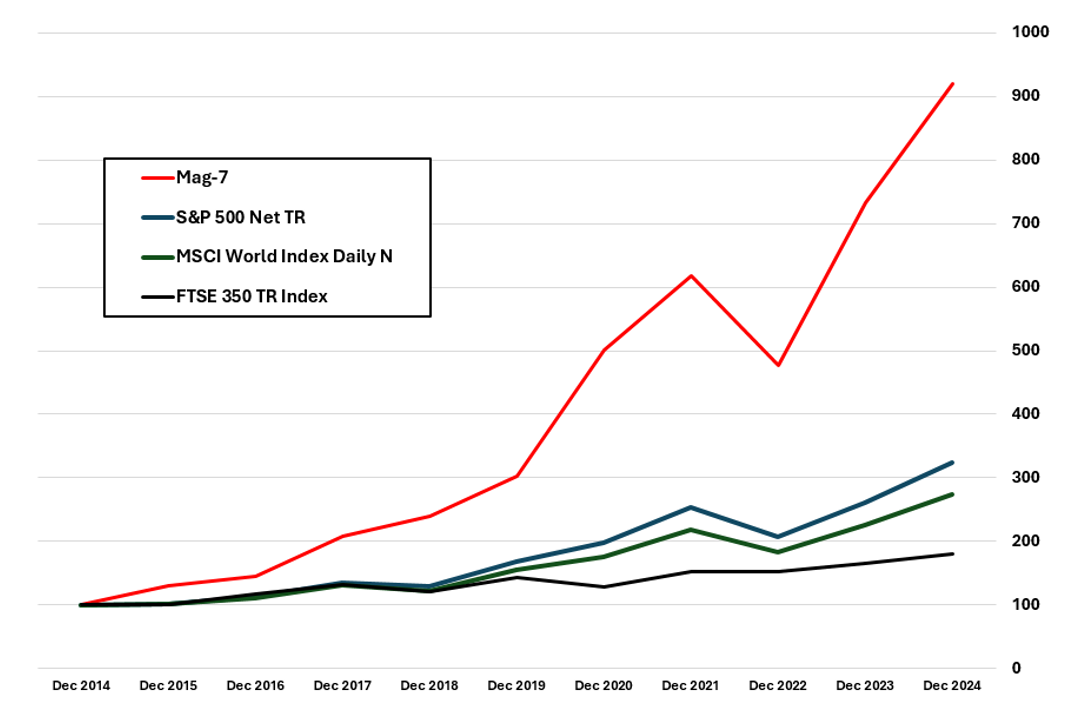

Last month I conducted some further research into Mag-7 stocks, looking at their ten-year performance and current metrics. I also created my own Mag-7 Index, which highlighted how these seven companies have outperformed the market between December 2014 and December 2024. You can read the full research at the end of this summary.

Source: Bloomberg & Courtiers

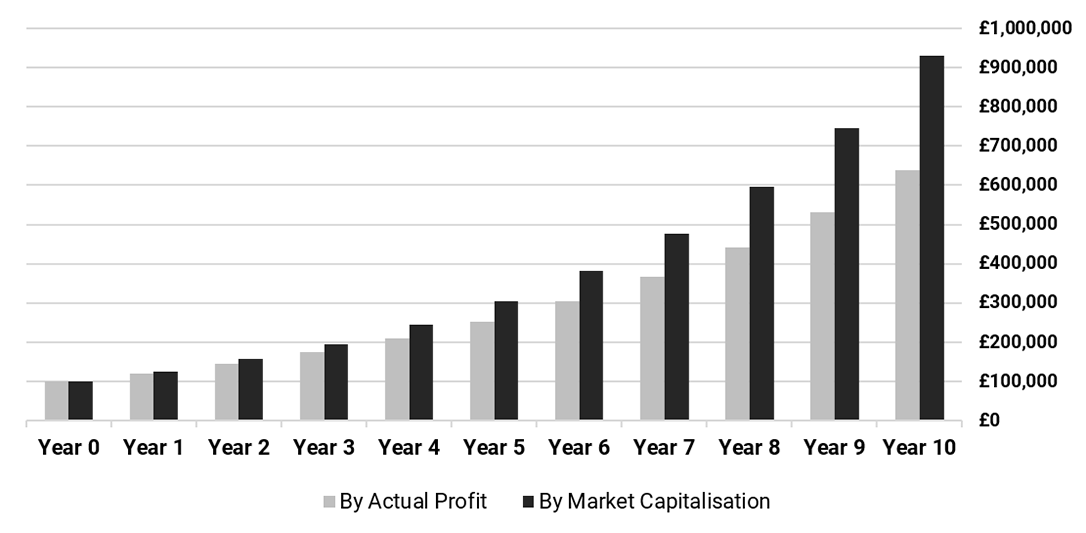

During the decade ending December 2024, average profits from Mag-7 companies rose by 20.39% per annum. This is impressive, but not as impressive as the rise in their market capitalisation, which averaged nearly 25% per annum.

Source: Courtiers

In just ten years, a return of 25% p.a. turns £100,000 into £931,000. That’s impressive, but why, you may ask, did the value of shares rise at a faster rate than the growth of profits? The answer is because as these seven big tech companies did well, investors were prepared to buy their shares at higher and higher valuations. Accordingly, whilst the average ratio of share price to profits (the price-to-earnings ratio) of Mag-7 companies started the ten years at 24.78, by the end of 2024 it rose to 35.62. This means that if you had been fortunate enough to hold Mag-7 stocks at the end of December 2014, over the next ten years you received a return of 540% from increases in profits and dividends and a further 291% from other investors who were prepared to pay higher multiples for your shares. Will Mag-7 owners be as fortunate over the next ten years? Maths and history are not on their side.

The market average price-to-earnings ratio for the S&P 500 (an index of the biggest companies in the United States) in recent decades has been 20. History shows that price-to-earnings ratios tend to mean revert (i.e. return to their historical average) over time. If that happened with the Mag-7 then, absent any growth in earnings (profits), holders of these companies’ shares would lose 43% of their value by the end of December 2034. Of course, everyone expects profits to rise, but by how much would they need to rise to justify valuations at these levels?

Bearing in mind that Mag-7 stocks are more volatile than the market (the annualised volatility of the UBS Mag-7 Index has averaged 28.87% since its introduction in 2018, whilst the volatility of the S&P 500 index has averaged 19.55%) investors in these seven companies expect higher returns.

In my research note of last month I estimated that Mag-7 investors were expecting a return of 17.8% per annum versus an expected return from the S&P 500 of 14% per annum. If Mag-7 price-to-earnings ratios mean revert, then to achieve this figure Mag-7 profits would need to grow by a staggering 24.8% per annum – that’s higher than their stellar growth rate of the last 10 years.

Mag-7 companies are all pioneers in their fields and grew to dominate in their sectors. They are great businesses. But remember, in 1997 Apple nearly went bust and was rescued in the nick of time by the return of Steve Jobs, its brilliant founder. In 1998, Google was a concept in an academic paper written by its founders and inventors of large-scale search engines, Sergey Brin and Larry Page.

What currently failing business or new concept company will rise to challenge the Mag-7 market leaders in the next decade? When DeepSeek hit the news in January, Nvidia shares fell by nearly 20%. Perhaps that is the early warning tremor of more serious disruptions to come.