Fuelled by an incredible run of optimism over the past 14 months, the ‘Magnificent Seven’ have significantly affected the S&P500 – thereby affecting 70% of worldwide equity indices.

Setting off red lights for our Investment Team, we discuss how, while we do have exposure to it, by not concentrating all our investment into this ‘bubble’ , we ensure a longer-term, more stable outcome. Especially as, with the Magnificent Seven reducing to the Magnificent Three, it could be a matter of time before they all topple.

Who are the Magnificent Seven?

When we mention the Magnificent Seven, we mean high-earning tech companies Microsoft, Nvidia, Google/Alphabet, Meta, Amazon, Tesla and Apple. In 2023, they returned more than 106%, doubling the Nasdaq 100’s nearly 54% gain and significantly outperforming the S&P 500’s 24% gain. These high valuations are untenable, with the overall market relying on their performance and reacting poorly when these companies fail to meet expectations.

We will not chase the bubbles

In our March 2024 CIO talk, Gary Reynolds discussed how we avoid the Magnificent Seven to ensure that the bottom doesn’t blow out of your wealth.

“But it does mean you’ve got to accept that when certain sectors are racing away, and the market is chasing, we’re not in it.” Gary Reynolds, CIO – March 2024

The problem is, Gary explained, that investing in the Magnificent Seven now means that you’re paying for their next phase of their growth in the hope that they will grow again. However, history doesn’t work like that.

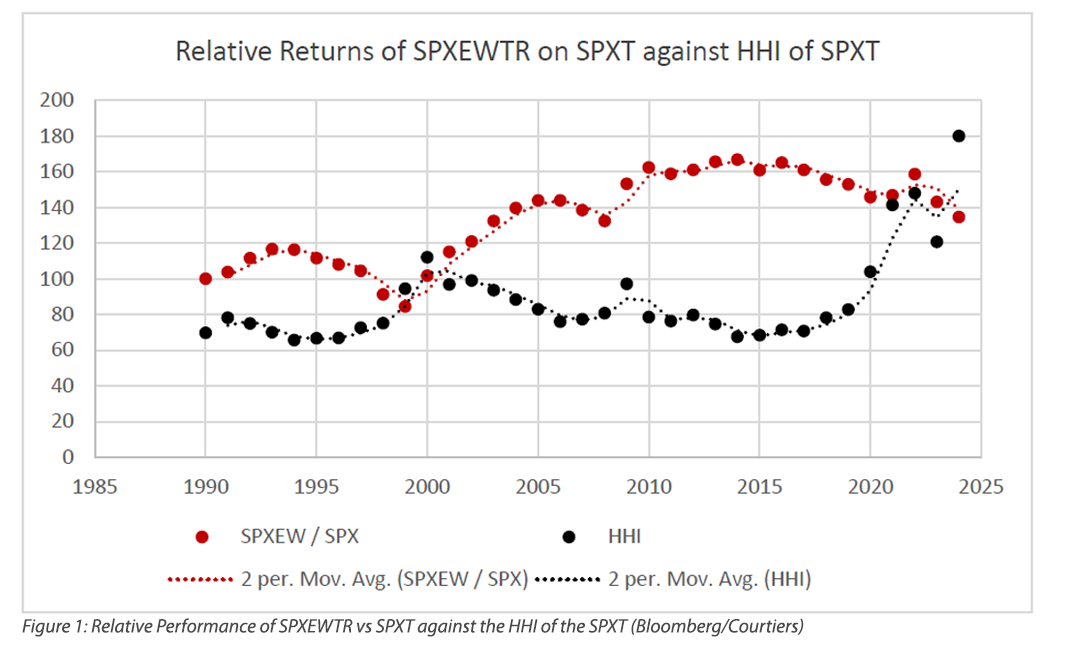

Jumping to September 2024, Gary adds that looking at the relative returns of the S&P Equally Weighted Index on the S&P500 against the HHI of the S&P500, you can see the high blue (HHI) measure in the top right corner is the reflection of the effect of the Magnificent Seven on the S&P 500 index. For a deeper delve into this information, we will be publishing an in-depth study around historical indices concentration, talking about Cisco in 2000 when it exploded in the market as well as other stories. Expect to hear from Investment Analyst Sam Keen soon.

This is setting off alarm bells for the investment team because, as both Gary and Jacob Reynolds point out, it means that if the Magnificent Seven are affecting the S&P500 that much, it’s increasing the S&P500’s exposure to risk. While American companies have possibilities, this measure shows how concentrated the market has become, and when it breaks, it will break rapidly.

“It does not pay within markets to follow the crowd, but it’s difficult sometimes.” – Gary Reynolds, CIO, September 2024.

Ultimately, while the Magnificent Seven is a growth investment, Courtiers focuses on value investments. This means that while we may miss out on these bubbles in the market, our investment strategy thrives on longevity, delivering over a period that will outshine these business booms. It’s “time in the market, not timing the market” meaning we promote consistency over speculation.