Making gifts to family and loved ones is a popular way for people to mitigate the effects of inheritance tax on their estate. In an ideal world, anything you gifted during your lifetime would be tax free. In the real world of course, tax isn’t like that.

While some gifts are automatically exempt from inheritance tax, others are potentially exempt (exempt transfers, or PETs), and only become exempt when certain conditions are met.

The seven year rule states that a person gifting a PET must survive for seven years from the date of gifting it for the value to fall outside their estate for inheritance tax purposes. Where the donor doesn’t survive for seven years after gifting a PET, it becomes a failed potentially exempt transfer, which may then be liable for IHT.

While many people will probably be aware of the seven year rule, the so called 14 year rule is more likely to have slipped under the radar. However, it’s importance should not be underestimated. If triggered it could result in an unexpected and unwelcome tax bill, but one that with judicious tax and estate planning might well have been avoided.

What is the 14 year rule and when might it apply?

The 14 year rule effectively extends the seven year rule so that under certain circumstances gifts made by a person up to 14 years before their death can be taken into account when calculating IHT.

So, what are those circumstances?

- When a person makes a gift to most types of trust (in the jargon, a chargeable lifetime transfer or CLT) and less than seven years later makes a PET.

- If the donor subsequently dies within seven years of the date of the PET that PET becomes what’s known as ‘a failed PET’.

- When this happens, to assess for any potential inheritance tax, it’s necessary to look back a further seven years from the PET for any CLTs.

An example

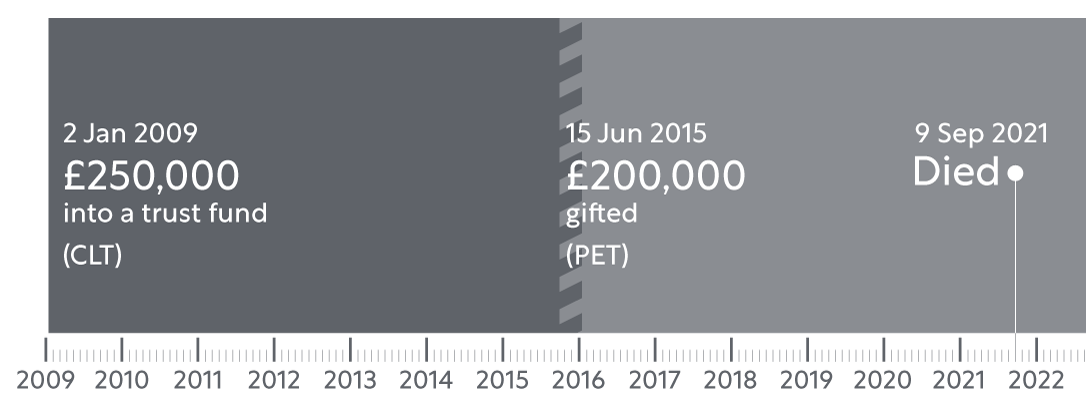

On 2 Jan 2009 Caroline put £250,000 into a trust fund for the benefit of her grandchildren, Paul and Jennifer. This is a CLT.

On 15 June 2015 she gifted £200,000 to Rebecca. This is a PET.

On 9 September 2021, Caroline died.

In this example, because Caroline died within seven years of her 2015 gift it became a failed PET. And consequently, in order to assess for any potential IHT, it’s necessary not only to take this failed PET into account, but to look back a further seven years from the date of this or any other PET for any chargeable transfers.

Doing so in this example, uncovers the 2009 CLT. This uses up £250,000 of Caroline’s £325,000 nil rate band (NRB), leaving only £75,000 left to set against the failed 2015 PET of £200,000 and resulting in a gift worth £125,000 that’s chargeable to IHT. Rebecca is liable for any tax charge.

A separate IHT charge may be liable on Caroline’s estate.

Takeaways

Timing when you gift is vital. In the above example, had Caroline allowed seven years to elapse after her gift to the trust before making the PET, the whole of her £325,000 NRB would have been available to set against the PET.

The 14 year rule would not have been triggered and because the value of the PET is less than Caroline’s NRB, no IHT would have been payable.

It would also have meant that Rebecca, the recipient of the 2015 gift would have avoided the nasty shock of a tax bill many years after getting the gift.

If you don’t wish to wait for the full seven years after a CLT before making a PET, one option is to take out insurance against any IHT liability.

Alternatively, you could include a codicil, which is an amendment to your will, stating any IHT due on gifts made within seven years of death must be paid by your estate.

If you are considering gifting both a CLT and a PET it might be advisable to gift the PET first as subsequently making a CLT won’t trigger the 14 year rule.

If a loan trust is being used, this is not a CLT, so it won’t have any impact on the taxation of subsequent gifts.

It’s vital to keep an accurate record of all gifts, including the dates, the recipients and their value.

Where a donor dies within seven years of making a gift, taper relief can reduce the amount of IHT. Someone who survives for six years will pay less than someone who survives for five.

Depending on the value of their estate on death, a separate IHT charge may be made on the donor’s estate.

The 14 year rule highlights the importance of tax and estate planning. Especially if there are several CLTs and PETs, this can be a complex area which your Courtiers Adviser can help you navigate through.