It is over seven years since the collapse of Lehman Brothers marked the height of the global financial crisis and the beginning of a world-wide economic slump. Everyone associates the crisis with excessive borrowing, but the years leading up to that Lehman’s moment were characterised by excessive saving. The two (excessive borrowing and excessive saving) are synonymous; to have a borrower, you must first have a lender.

According to the IMF (International Monetary Fund), the world saved 21.94% of GDP in 2002. By 2007, this had risen to 25.05%, and earlier this year the IMF forecast the global savings rate in 2019 at a record breaking 26.59% of world-wide output.

There are two distinctively different types of savers: the metal bashing exporters (e.g. Germany, Japan and China) and the commodity exporters (e.g. OPEC, Brazil and Russia). One of the common denominators in this process was China, which was vociferously exporting cheap manufacturing goods and using the savings to re-invest in infrastructure, building roads, airports, railways and a host of public buildings that required raw materials and a lot of energy. This drove up the value of commodities and oil. These influences are beginning to wane.

China’s economic boom started at the beginning of this millennium. The oil price (Brent Crude) moved from $17 per barrel in November 2001 to $146 per barrel in March 2008, drastically increasing transport and energy costs for consumers, particularly those in western economies. But the times are changing, and for two main reasons.

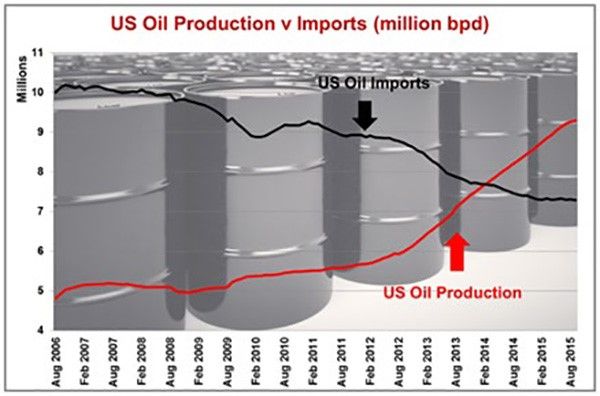

Firstly, America has dramatically increased domestic oil production through the introduction of fracking. The US was producing just 4.8 mpd (millions of barrels per day) in 2006, but this has risen 93% to 9.3 mpd. Over the same period, US imports of oil have dropped 27% from 10 mpd to 7.3 mpd. In other words, the US is a lot less reliant on foreign supplies of oil than it used to be. This additional supply of oil, together with more efficient use of energy in developed economies, has caused the oil price to drop, and because fracking can be turned on and off relatively quickly (within three to six months), providing instantly accessible reserves, the oil price will stay low for some time. This is good news for consumers.

Secondly, Chinese economic growth has slowed. It averaged 9.6% over the last 15 years and peaked at 14.9% in June 2007. Official Chinese figures show growth at 6.9% and similar in 2016. We suspect actual growth is much lower. This is all part of Premier Xi Jinping’s “re-balancing” of the Chinese economy which must move from being investment-led (in 2011 investment spending was an eye-watering 47% of GDP) to being consumer-led (consumer consumption in 2011 was just 37% of GDP). In the US consumer spending is 69% of GDP, and investment spending 19% of GDP.

Lower commodity and oil prices will shift billions of dollars from savers to consumers, especially those in the US and the West, and provide a much needed boost to global demand. As usual, the US is at the forefront of the economic cycle. American families have paid-down debt by around 20% of GDP, and housing starts and new car sales have bounced back from their post global financial crisis lows. With unemployment falling to 5% (below the long-term average of 6.1%) the labour market is tightening, which has created an increase in real incomes for US workers.

William McChesney Martin once said that the job of the Fed (the US Federal Reserve Board, ie., the American central bank) was to take away the punch bowl just as the party gets going. I doubt Janet Yellen, current Fed Chairperson, disagrees with McChesney Martin, which is why I expect US interest rates to increase tomorrow (Wednesday 16th December). This will mark the end of the epoch of post-crisis US loose monetary policy and, hopefully, the start of a period of more balanced global economic growth.

I shared these views with over 300 of you at the Courtiers client seminars in Henley and Derby last week. I also promised to do a video comment after the Fed announces its rates tomorrow. If I am wrong, that video will be of a Courtiers CIO with considerable egg on his face!