“It’s Beginning to Look a Lot Like Christmas”

(Written by Meredith Wilson and recorded by Bing Crosby et al…)

Phew, she did it! Janet Yellen put up US interest rates yesterday by 0.25% and saved me the ignominy of explaining why my forecast of a US rate rise at our seminars on 8th and 11th December, and again in my article of 15th December, was wrong.

Some of you have been extremely complimentary about my predictive powers (one of you even asked if I could name the Ascot Gold Cup winner for 2016) but, in truth, if ever there was a “non-brainer” for an economic forecast then this was it.

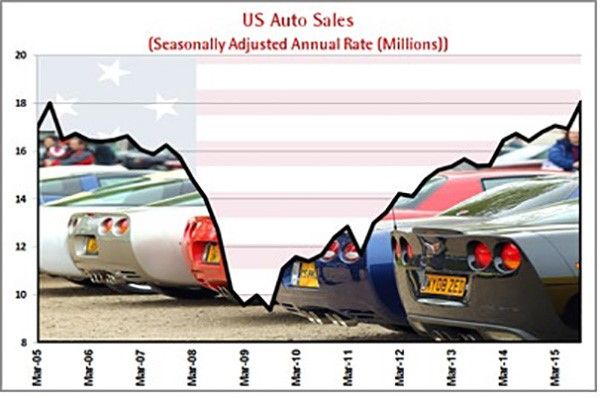

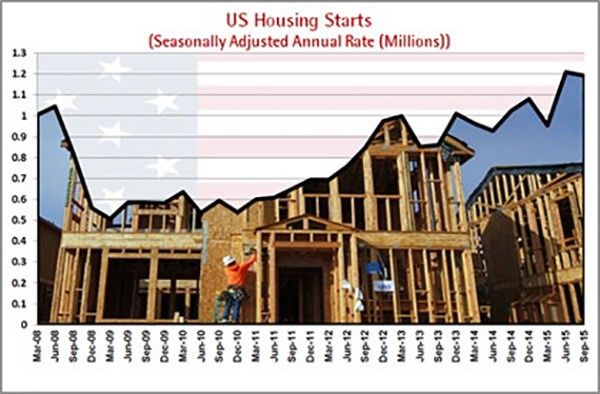

The US economy has been doing very well. Housing starts are picking up and US-built cars are racing off the forecourt. The American consumer can, and will, spend more because, having paid-off family debt to the tune of nearly 20% of GDP, the cost of servicing borrowing is at a near all-time low. With unemployment down to 5%, wages rising faster than inflation and the likelihood of the price of a barrel of oil returning to $100 being pushed into the dim and distant future, consumer spending will go up. Retailers are likely to do well over the festive season.

An improving economy and a return to an environment of normal interest rates is not good for everyone. It is very bad for those holding long-dated bonds.

The UK Treasury 3.5% January 2045 gilt issue can currently be bought for just over £118. It pays interest of £3.50 per annum, and gives you back £100 when it closes just after Christmas 2044. Allowing for the payment of the coupons, and repayment of the capital after 30 years, the return is 2.6% per annum. That is a paltry sum. Even over the last 20 years, when bond returns have been lower than normal, the average has been 4.45%. To put this in context, although the UK base rate is currently 0.5%, the average over the last 100 years is 5.5%. If 30 year interest rates return to 4.5%, which is where they were back in 2009 and again in early 2011, then the owners of UK Treasury 3.5% January 1945 will see the price of their bond fall by 30%.

Bond holders do very nicely in periods of deflation and ultra-low interest rates, which is what we have seen for the last 10 years. They do very badly once the economic cycle turns. It is for this reason that we have been concentrating our bond exposures in secure issues with relatively short maturities. This seems prudent as these bizarrely low long-term interest rates offer scant reward for the risks long-term bond investors are taking.

December is often quiet for markets as analysts and traders get into the festive spirit. Not so this month which, up until yesterday, was beginning to feel like The Grinch and Scrooge, in the guise of falling equity prices and rising volatility, had conspired to ruin the celebrations. However, in the immortal words of Bing Crosby, “it’s beginning to look a lot like Christmas” as the market response to the Fed rate increase has been positive.

I would like to finish by thanking all clients that have entrusted us with the management of their assets over the last year, something that we take very seriously. I hope you, and all our readers, have a very happy Christmas and a peaceful and prosperous 2016.