There remains a gap in performance between Value and Growth which, whilst not as exaggerated as in recent years, has nonetheless persisted through 2025, with the MSCI World Value Index returning 10.89% year to date, compared to 17.09% from the MSCI World Growth Index (both in GBP terms, i.e. this is what sterling-based UK investors would have received up to 31st October 2025).

Before I provide more detailed comment, let me just recap on the difference between Value and Growth, and then explain why we lean towards the former:

Value:

Value investing made its debut in Ben Graham’s classic book Security Analysis, first published in 1934. The book sets the ground rules for effective financial analysis. Ben Graham’s star pupil is Warren Buffet, and Buffet spent a lifetime implementing what his mentor taught him. He also provided a moving foreword to the 6th and latest, 2008, edition of Security Analysis.

Security Analysis is a long book and unlike Buffett, who has read it four times, I’ve only read it twice. But I’ve got 25 years on the master, so I may yet catch him up! It advocates digging deep into the financials of any company before investing. In particular, Ben Graham advocates looking for stocks that have a “margin of safety”. We use a phrase based on this at Courtiers, where we look for stocks and assets that will “survive and thrive”. i.e. get through a crisis and thrive on the other side of it.

Growth:

Growth stocks, however, are ones where consensus expectations are for above average-earnings growth, which tends to make them “expensive” on relative tests for value. In comparison, Value stocks can be defined as ones that are “cheap”, based on one or more relative tests of value.

Growth companies tend to reinvest the majority of their profits as their business projects are expected to deliver above average returns (i.e. investors accept that growth is delivered through reinvesting profits as opposed to distributing them as dividends). This means dividends from Growth stocks will be lower than the dividends from Value stocks.

Value-style investing:

- Focuses on “cheap” stocks (i.e. where the investor believes the price does not reflect the true economic value of the business).

- Is not concerned with drivers of earnings growth.

- Normally assumes that the Price to Earnings Ratio (PER) is below its justifiable level, which will be rectified by an increase in share price as other investors realise the benefits of the stock.

Growth-style investing:

- Focuses on companies that are expected to exhibit rapid growth of earnings.

- Is more likely to be momentum orientated.

- Normally assumes that the PER will remain at its current level (i.e. that the stock price will increase linearly with the growth in earnings).

Why we advocate for Value investing

Now you are probably thinking that I am an acolyte of Value investing, but I am not. It’s just that I have found no better way of managing portfolios for investors with long-term objectives who are trying to meet specific goals, like paying the bills, going on holiday or covering care costs. If you tasked me with trying to shoot the lights out and beat all other managers over a year, I would likely go for momentum (probably with massive leverage), but doing so runs the risks for big downsides with elevated volatility, something Courtiers investors generally want to avoid.

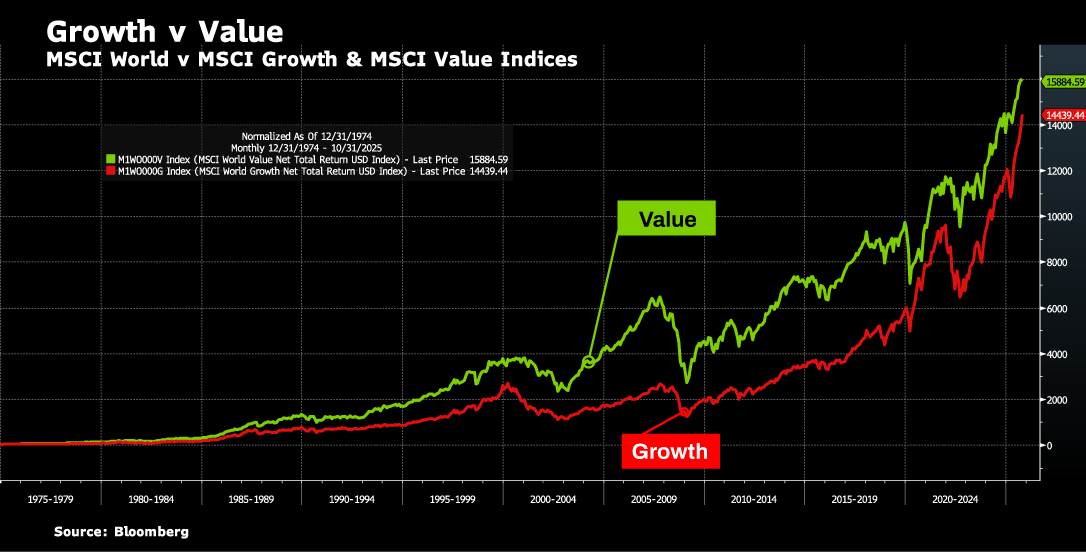

The price at which we buy assets matters, and for the patient value investor, the rewards have been exceptional. The below chart shows the % return from Value investing (in green) compared to Growth investing (in red), since 1974.

Whilst Value outperforms, the gap has been narrowing over the last 10 years and especially since the advent of the latest tech and AI boom, whose main participants are invariably growth-type businesses (e.g. Nvidia, Apple, Microsoft Alphabet, Meta, Tesla & Amazon – the “Mag-7”). The rise in the share prices of these growth businesses has been meteoric, with the result that they now form over 30% of the main US share indices.

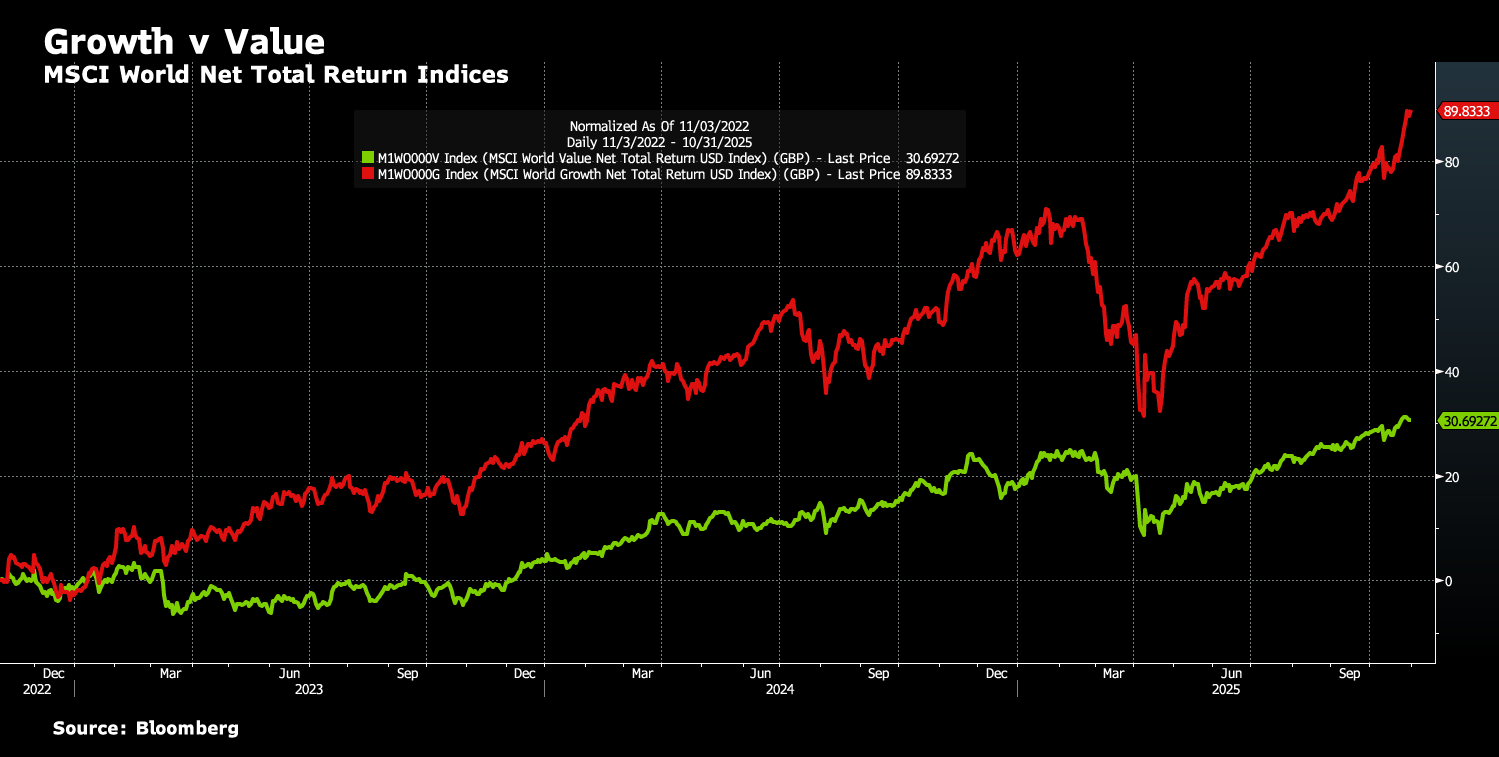

The chart below shows Growth smashing Value over the last three years.

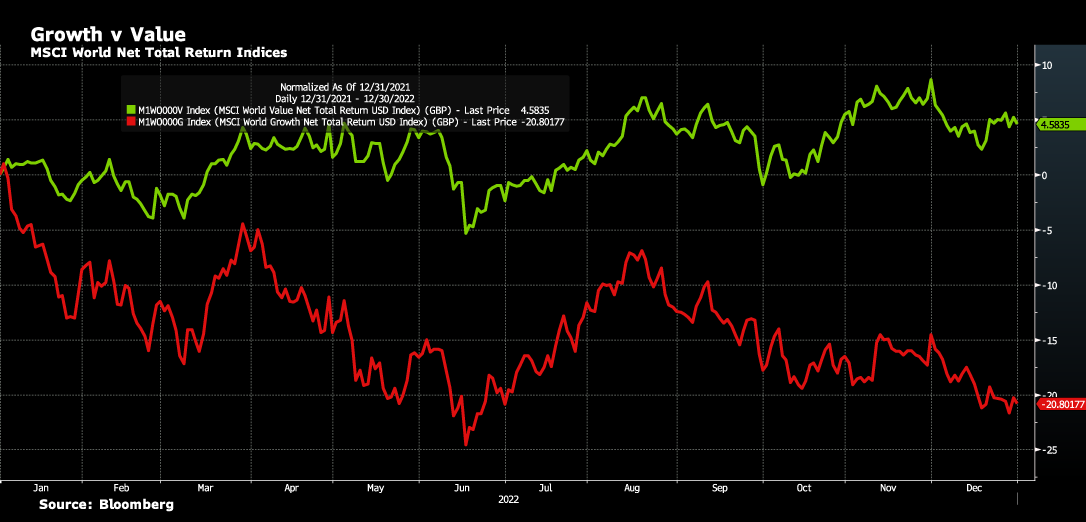

But if you go back to 2022, Value outperforms in difficult markets, as the chart below shows.

Returns from the different styles diverge, and sometimes quite dramatically, like in 2022 when Value eclipsed Growth, and then in 2023 and 2024 when the relative out-performance totally reversed. But Value has the advantage of being safer over the long run. This is why it should be the preferred style for private investors that are focused on achieving goals rather than shooting the lights out.

One final note:

You will note that Value has returned 10.89% and Growth 17.09%. If you compare these results to our Growth Fund, you’ll see we returned 15.92% over the same period. Not bad for a fund with a Value bias!