Double-digit inflation and an energy crisis were already giving me flashbacks to the topsy turvy days of the Wilson and Heath governments from 50 years ago. But the events of the last week with Sterling tumbling and gilt yields sky rocketing made it look like the 1970’s all over again. Of course, everybody knows that history doesn’t repeat, but it does sometimes rhyme.

For lots of people reading this piece, rising prices and high interest rates are a new phenomenon. Since the early 1990’s interest rates have declined steadily as inflation all but disappeared. Central bankers around the world patted each other on the back believing that they had tamed the inflation beast. How wrong they were. QE (Quantitative Easing) has let inflation out of its cage and it’s in no hurry to go back.

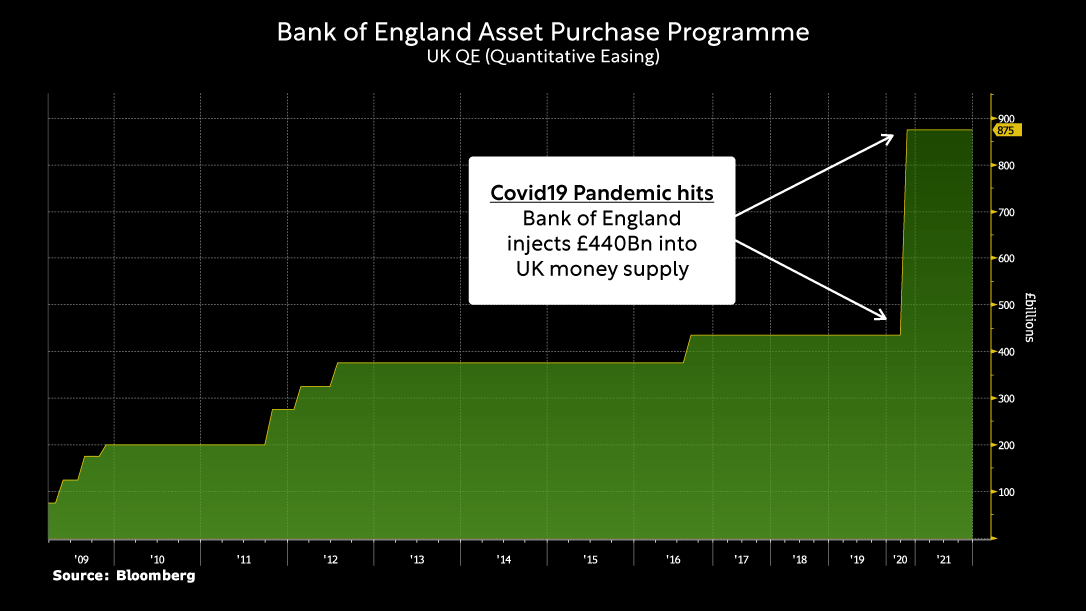

Inflation is running high for a host of reasons, not least of which is that we had to shut down the world economy for much of the last couple of years and then expect it to function normally as the Covid crisis passed. The fact that large parts of China are still closed doesn’t help because it’s a major supplier of products globally. But the supply-side of the argument isn’t enough to explain inflation, to get double digit price rises you need a lot of demand. Inflation is an excess of demand over supply, but to have demand you need money and that brings us to Milton Friedman’s description of inflation as “always and everywhere a monetary phenomenon”. This bout of inflation is more monetary than people think and it can be traced back to the QE (Quantitative Easing) program which the Bank of England instigated in the summer of 2020.

QE was first introduced by the Bank post the global financial crisis in 2008/2009 and was designed to keep interest rates ultra low and improve liquidity at a time when it was drying up. The Global Financial Crisis had not wiped out supply but it had wiped out a lot of demand and dampened our “animal spirits” for buying goods and investing. QE mark 1 worked extremely well and central banks guided us through a difficult period without a repeat of the 1930’s depression.

The problem with the monetary policy of 2020 was that we were shutting down supply and so QE was no more than tokenism because people couldn’t spend all their money even if they wanted to. Accordingly, they saved and the £440 billion that the Bank of England injected into the economy that summer was hanging around and ready to be spent as lockdown ended but, by that time, supply simply couldn’t meet demand. In short, the Bank of England, and other central banks, scored own goals. It’s a classic example of a central bank simply using the most recent policy tools without considering the current circumstances. Why would you hand out hundreds of billions of pounds when your country is shutting down supply?

As for the so called “sterling crisis” I’ve lived through a few of these. Between June 1973 and October 1976, the pound collapsed 38% against the dollar. It rallied by 52% between October 1976 and October 1980 but following new Thatcherite policies and the controversial budget of 1981, by February 1985 it had dropped 56% against the dollar. Tories often have a romantic notion of the 80’s and forget that Margaret Thatcher wasn’t popular to start with and were it not for the Falkland’s crisis she may not have won her second election in which case “Thatcherism” would have been viewed as a failed experiment.

2022 is proving tough for investors. So far this year, long dated UK government bonds are off -41.42%. That is a crippling blow from securities that are meant to be “safe”. Equities have fared better with the MSCI World Index returning -21.09%, the US S&P 500 index returning -22.98% and the basket of large European stocks (the Euro-Stoxx 50), returning -21.93%. The FTSE 100 did much better with a decline so far of just -3.86% but UK mid-caps (the FTSE 250) tanked -26.93%. Against this background I am very pleased that year to date our funds have proved defensive. Our Investment Grade Bond Fund and our Cautious Risk Multi-Asset Fund have so far lost just -0.93% and -7.03% respectively. Our Balanced Risk and Growth Multi-Assets Funds are down -11.16% and -15.93% respectively. Regarding our Equity Income Funds, Global (ex) UK equity Income and UK Equity Income are down -10.07% and -23.65% respectively. I am fortunate to work with a team of investment analysts that keep their heads in febrile markets, manage risk well and are always on the look out for value.

A few people have asked me “What are you doing about the crisis?” firstly I’m not sure it is a crisis. The Bank of England stepped in last Wednesday claiming that there was “dysfunction in the gilt market”. If there was dysfunction it was the previous ludicrously low interest rates available to holders of long dated gilts. We were going through no more than a bit of mean-reversion spurred on by fear that the Chancellor’s budget would tank the economy. What seems bizarre to me is that the Bank of England, whilst increasing interest rates, is again engaging in QE, the central banker’s panacea for all ills! That’s like driving a car with one foot on the accelerator and the other on the brake.

So, what are we doing? An economist friend of mine, Dario Perkins, likes to quote one of his all time sporting heroes, the outstanding Italian defender Paulo Maldini, who said, “if I have to make a tackle then I have already made a mistake”. When markets hit rough times its too late to adjust, unless you are banking profits, which we were doing in the late summer of 2016 post Brexit when we made money being short sterling. I’m more than happy with the relative value of the equities that we own in our funds and I am, of course, delighted that we weren’t holding long dated bonds at the start of the year. We are currently making some adjustments to the portfolios by reducing exposure to the dollar as we believe sterling is over-sold and we are also starting to re-build exposure to gilts.

As always happens during periods of market turmoil, opportunities appear for those that take a long term view and have liquidity to buy. That includes us and we will be looking to acquire assets that look attractive after being sold-off.