Judging by the number of questions I am receiving on this subject, the second coming of “the Donald” seems to be causing more worries than his first incarnation, with investors’ concerns centred around protectionism and geopolitical tensions.

The US is the biggest single market in the world and the incoming president knows it! As a successful property developer (and whether you like him or not, he is that) Trump understands how to leverage a strong position, so he will use access to American consumers as a club with which to beat his enemies, and allies, into submission. The war of words and tweets has already started, even before the president-elect takes up residence in the White House.

Trump is threatening a range of tariffs on Canadian, Mexican, Chinese and European imports to name but a few. The economies targeted by Trump may avoid pernicious tariffs by:

- stopping illegal immigrants entering America,

- and/or building new factories on US soil,

- and/or increasing spending on defence (especially effective if it results in the purchase of US armaments),

- and/or strengthening their currency against the US dollar (or at the bare minimum stopping its decline, especially if they are Chinese),

- and/or importing more American goods,

- and/or preventing illegal drugs getting onto the streets in US cities

A US President veering towards protectionism backed by a popular mandate from the electorate signals an end to the over-40-year period of fast rises in free trade coupled with the growth of neo-liberalism, which started in the early 1980s (championed by Ronald Reagan and Margaret Thatcher). It would take a very brave person to predict that these changes will have little effect on how the world shapes up over the next four decades. I will be covering this topic in our forthcoming seminars.

Tariffs will push up prices, but if these are a “one-off” then the effect is unlikely to be inflationary. Trump – having got elected because poorer Americans felt the pinch from higher food, fuel and energy prices – will not want to rile those same supporters that he has pledged to make better off. So, I suspect tariffs will be a one-off, early weapon of choice for the new administration, followed by a constant threat of more of the same in the following four years.

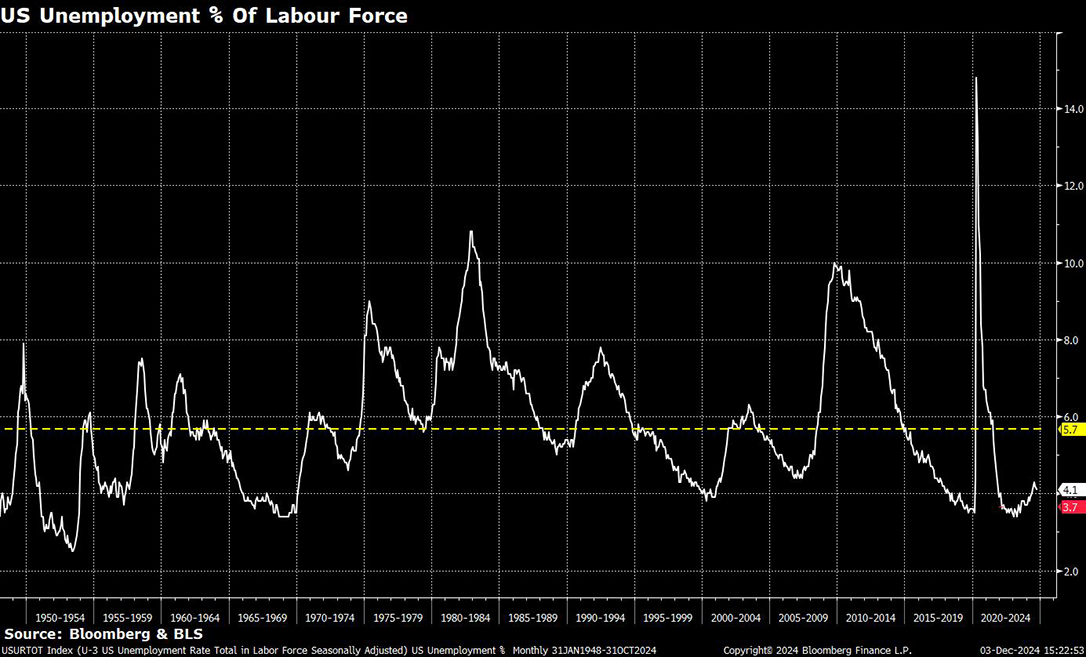

Although potential tariffs are grabbing the headlines, the likely main threat that Trump poses to the American economy is through the possible repatriation of illegal immigrants. This may not, at first, seem obvious, but consider this: US unemployment is currently at 4.1% and well below its 75-year average of 5.7%. However, in 2022, as Covid lockdowns were ending and economies around the world opening, it fell to 3.7% as a labour shortage developed. The result was a massive spike in inflation. Huge immigration solved this problem for America (as it did in the UK too), but anything that depletes the workforce and creates another labour shortage is likely to push up labour costs and prices at the same time.

Whilst new US trade and immigration policies may prove inflationary it’s worth remembering that the incoming president can spin on a dime and, like his last term in office, I suspect he will do considerably less damage than his opponents claim he will. Which, incidentally, cannot be said for the “sound money” politicians that Britain has elected in recent years. The so-called “conventional” UK and European politicians that advocated free trade with austerity discovered, to their economies’ costs, that prudence doesn’t always pay after all. Perhaps their more unconventional American counterpart will have better luck. Let’s hope so.