Are tariffs bad? The short answer is, economically, yes. Mathematically tariffs are always proven economically bad. However, politicians use tariffs to protect domestic industries, winning votes from the employees (and their families) who work in them. In a post-Brexit article published on 24th October, 2016, I gave an example of the benefits of free trade using hot dogs. You can re-read that example at the end of this article.

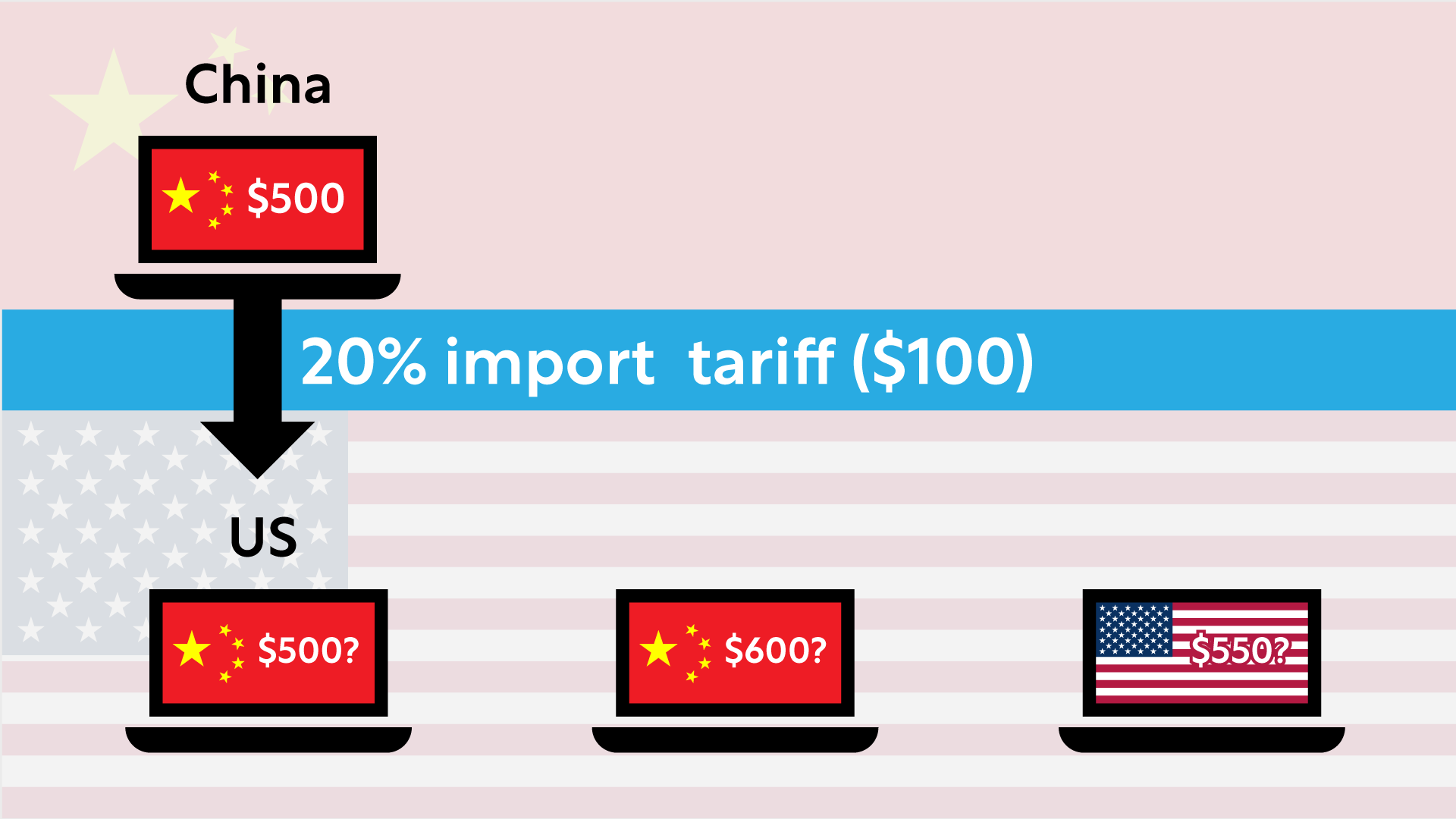

Lots of you are asking whether the current US administration imposing tariffs will cause problems for the American economy and rattle investment markets. The answer, and the outcome, depends on who pays. Allow me to illustrate with a simplified example:

Assume a Chinese computer manufacturer exports laptops to the US at a sale price of $500 (to keep this example simple we will ignore whether this is the retail or wholesale price). Now, assume the Trump administration imposes a 20% tariff on these laptops, making the tariff payable to the US government on each laptop $100.

If the Chinese company absorbs the tariff, paying the $100 charge to the US government whilst keeping the laptop price the same, they bear the cost and have lower profits. Meanwhile, the US government collects additional money which it can use to reinvest in the economy and/or reduce taxes. Whether this is good or bad for the overall global economy depends on whether the $100 tariff collected by the US government is put to more productive use than the $100 lost by the Chinese manufacturer.

Now assume that the Chinese manufacturer adds the tariff to the price of the laptop, increasing the price of the laptop to $600. Two things can happen here: US consumers could pay the extra charge, reducing what they spend elsewhere or US consumers could find a substitute product, such as an American laptop selling at $550. Either way, the American consumer has less money in their pockets because they are paying higher prices for a product that previously cost $500. This is how tariffs create inflation.

Tariffs are generally applied across a very wide range of goods, including finished products and components, and the country whose products are under tariffs will likely retaliate with tariffs of their own, making the final outcome complete. It’s nevertheless a “beggar thy neighbour” policy. Churchill realised this over a century ago. In his 1906 book “For Free Trade”, he said that everyone should have the right to buy whatever they want, wherever they choose, at their own good pleasure, without restriction or discouragement from the State.

We humans never do much linearly. We move forward and backward, test and retest old ideas (like tariffs), adjust and then get going again once we decide if something works or not. US tariffs will hurt the American economy, and while initially this may not be significant, subtle damage will already be taking place. Businesses, unsure how future tariffs may apply to goods sourced through global supply chains, will be less willing to invest and forced to waste time finding alternative suppliers not yet subject to tariffs. Most of all, tariffs distort price signals from the global market whereby consumers, businesses and governments can source the best products at the most competitive prices. That $550 American laptop may be OK, but if it’s not as good as the $500 Chinese version, the buyer paid an extra 10% for an inferior product.

Read our 2016 PDF of ‘The benefit of free trade proven with hot dogs’

Appendix: The benefit of free trade proven with hot dogs

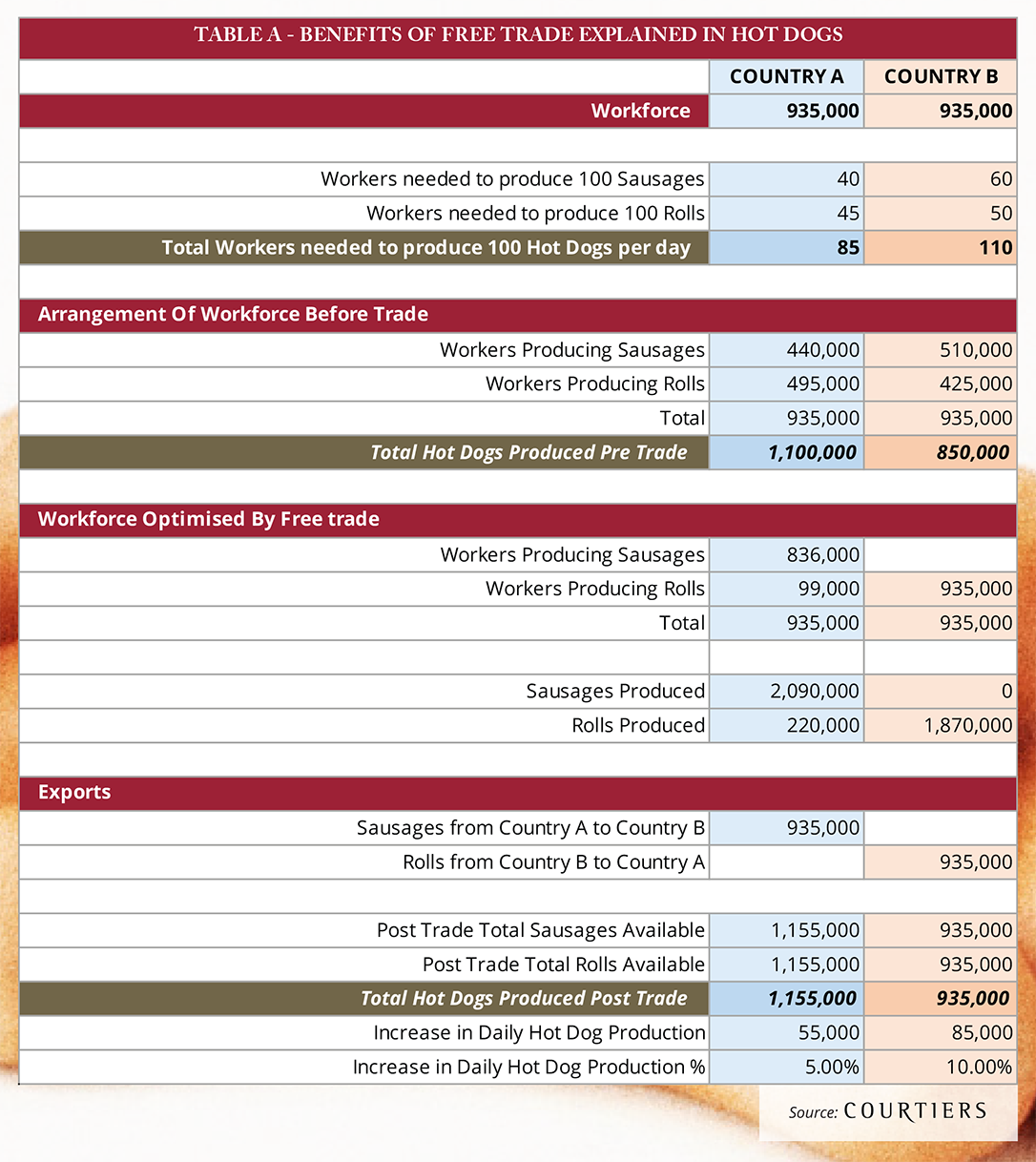

Country A and Country B produce only hot dogs and have, by amazing coincidence, 935,000 workers each.

In Country A it takes 40 workers to produce 100 sausages per day. Country B is less efficient, requiring 60 workers to produce the same 100 sausages.

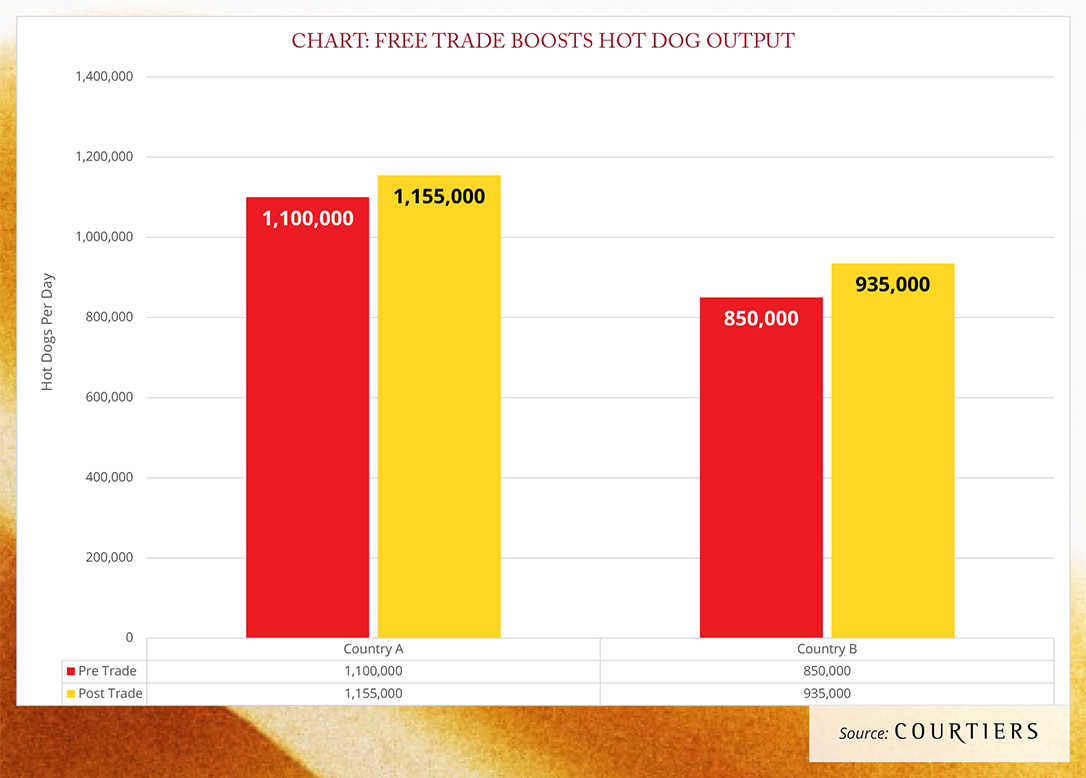

In Country A it takes 45 workers to produce 100 rolls per day, and in Country B, 50. Bearing in mind that each country produces exactly the same number of sausages as rolls to make hot dogs (one sausage plus one roll) the total hot dogs produced per day by Country A is 1,100,000, and by Country B, just 850,000.

Should Country A trade with Country B when Country A can produce both sausages and rolls more efficiently than Country B? The answer is yes (as proved in Table A).

David Ricardo said that the less productive country should produce the goods for which it has a “comparative advantage”, i.e., the goods that it produces with the least amount of inefficiency. In the case of our hot dogs, Country B produces sausages 50% less efficiently than Country A, but it produces rolls 11% less efficiently. According to Ricardo, Country B should devote all its resources to producing rolls and not sausages.

The outcome is extraordinary. With its 935,000 workers producing just rolls, Country B produces 1,870,000 per day. It offers to exchange half of them with Country A in return for 935,000 sausages. To accommodate this trade, and to maximise production of hot dogs, Country A puts 836,000 of its workforce towards producing sausages and 99,000 towards producing rolls. It now produces 2.09 million sausages per day and 220,000 rolls. It exchanges 935,000 sausages with Country B for 935,000 rolls.

If you do the maths, you find that, post trade, Country A has 1.155 million hot dogs per day to consume, and Country B, 935,000. As if by magic, Country A is better off in hot dogs by 55,000 (5%) per day and Country B by 85,000 (10%) per day.

Sub note:

The sharp-eyed economists among you may have noticed that the ratios of efficiency with which Country A and Country B produced rolls and sausages follows the same ratio as in Ricardo’s example of English and Portuguese cloth and wine production in “On the Principles of Political Economy and Taxation”. In converting Ricardo’s cloth and wine into hot dogs, I borrowed from an excellent article by Paul Krugman of 24th January 1997 in which he uses hot dogs to prove the benefit of globalisation. Imitation is the greatest form of flattery: Ricardo and Krugman were free-thinkers with original ideas, I have merely copied them.