The 47th president of the United States was elected on a promise of tariffs. Seen as more business-friendly than his predecessor, markets responded positively when, in November last year, Donald Trump won the popular vote and all seven swing states. In what now looks like an act of ‘mass delusion’, Wall Street convinced itself the new Republican administration would shelve the idea of damaging, penal, levies on imports and so the rise in American share prices continued unhindered. After all, why would the new president do anything to harm the wealth of the ‘Magnificent Seven’ (Mag-7) billionaires who lined up to support him on the front row of his inauguration?

U.S. business leaders should have been paying closer attention. Trump is a big fan of William McKinley, who was elected in 1897 as the 25th president of the United States on a platform of protectionism and high tariffs, which helped bring about the demise of late 19th century globalism. President Trump is simply following in the footsteps of his hero.

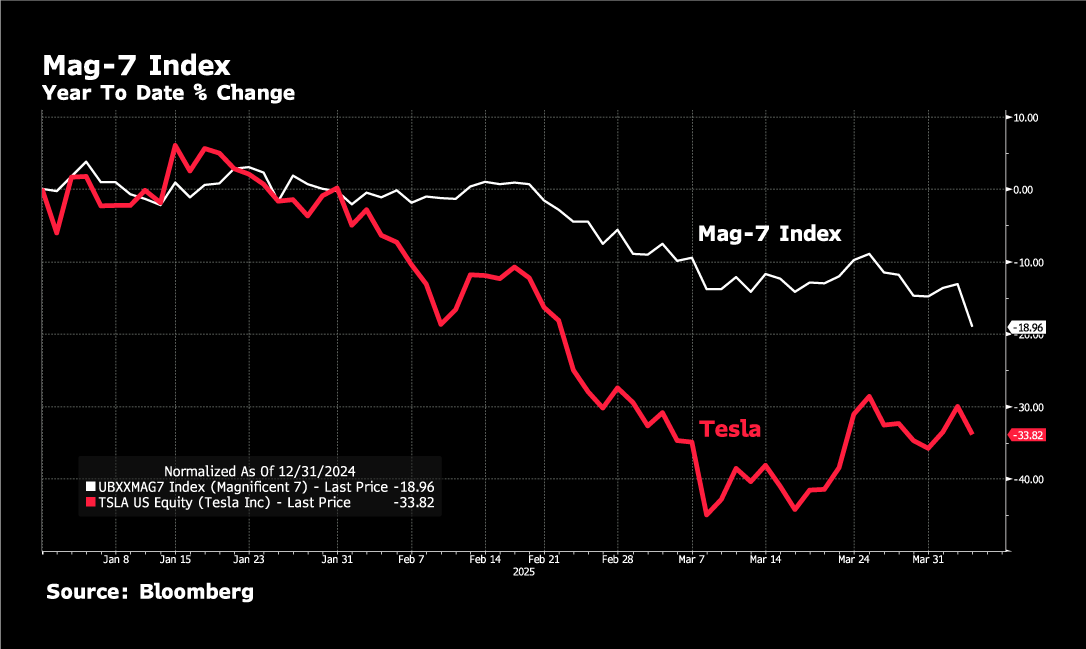

As for the tech billionaires that form part of the ‘presidential bromance’, they are quickly learning that getting too close to the Trump star can lead to your wealth and career burning up and crashing back down to earth (look what happened to Mike Pence and Rudy Giuliani). The Mag-7 Index is down -19% so far this year and Tesla is off -34% as Chinese EV manufacturers eat into its market with better quality cars at lower prices whilst its founder concerns himself with DOGE.

Mag-7 Companies 2025 Year to Date

America has been one of the top performing economies over the last 15 years and one of the best places to invest your money. In 2023, the rate of US unemployment sank to just 3.4%, way below its long-term trend of 5.7%. America became a job-creating machine. That’s the main reason immigrants flooded into the country. There really was no need to “Make America Great Again”; it was, and is, great. However, I suspect it will be less so after this president finishes his term – and Wall Street just woke up and sniffed the coffee.

The Courtiers funds have not, as I am sure you are all aware, been heavily invested in expensive US big tech. Any exposure we have is incidental to general positions on indices. Even then, we have dramatically downsized our exposure to the market cap-weighted S&P 500 for all the reasons I – and the rest of the Investment Team – have banged on about over the last 18 months.

There will be lots of twists and turns with the Trump administration because this president is a wheeler-dealer and will spin on a dime. But when his time in office ends, I suspect he will be seen less as a proponent of MAGA and more of MEGA – “Made Europe Great Again”.

In the interim, we will diversify and look to hold assets that are reasonably priced with a margin of safety, always ensuring we are doing everything we can to protect your wealth – as we always have done!