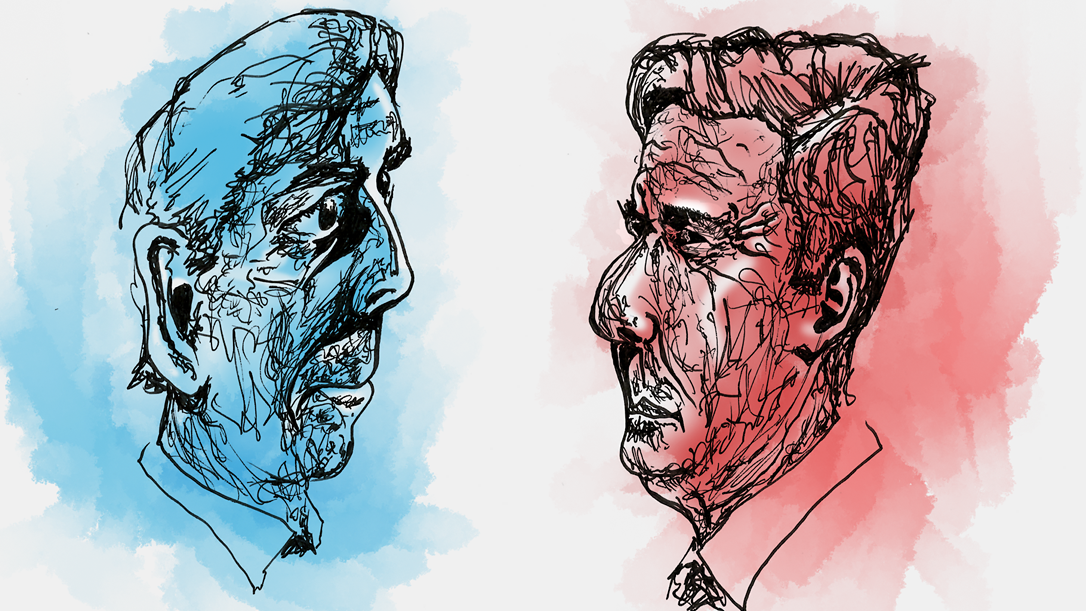

Yesterday, Rishi Sunak announced that the UK General Election will be on 4th July. Did this announcement cause any volatility in the market or suggest anything surprising on the horizon? Gary and Jake Reynolds offer their thoughts:

Jacob Reynolds, Head of Asset Management:

Jacob Reynolds, Head of Asset Management:

The election announcement had quite a muted market response, with the expected outcome being that we will end up with a Labour government. Markets were more rocked by inflation coming in above expectations, despite being the lowest in three years.

Historically, April is a ‘hot’ month for inflation as businesses adjust prices for the new fiscal year. This has pushed the prediction that the Bank of England will cut rates back from June to August.

The election will follow a similar path, with the potential for volatility if the campaigns do not play out as expected.

Gary Reynolds, Chief Investment Officer:

Gary Reynolds, Chief Investment Officer:

The traditional battleground for Labour and Conservative governments is whether we want more, or less, taxation and public spending. Historically, the Conservatives promised a smaller government with lower taxation and Labour the opposite. This ideological conflict is dead.

In the initial years of “new Labour”– after Tony Blair was elected Prime Minister in 1997 – his Chancellor, Gordon Brown, presided over an austerity policy that would make any Tory Chancellor proud. Conversely, Rishi Sunak’s government is spending more and raising higher taxes than almost any post-World War II government has before.

The blurred boundaries between Labour and the Conservatives gives financial markets a problem – which party should they prefer?

Sunak and Starmer will both fight hard for the centre ground, but at the same time, each leader needs to keep their extreme wings happy – although the extreme left is unlikely to derail Labour’s campaign. The Tory right, however, is either defecting to Reform or challenging Sunak’s policies as too centrist.

For this reason, the election is Labour’s to lose.

As neither party is proposing anything especially radical (and both constrained by a public debt circa 100% of GDP), markets are unlikely to be too worried about any extravagance from an incoming Labour government. In fact, markets generally hate uncertainty, so a possible calm period under a majority Labour government with a clear mandate for the country could give UK share prices a boost.

Our Investment Team will monitor developments carefully. Our Advisers and Technical Support Teams will keep an eye on signs of changes to tax policies, as we have done during every election period over the last 42 years and we will guide you, our clients, accordingly.