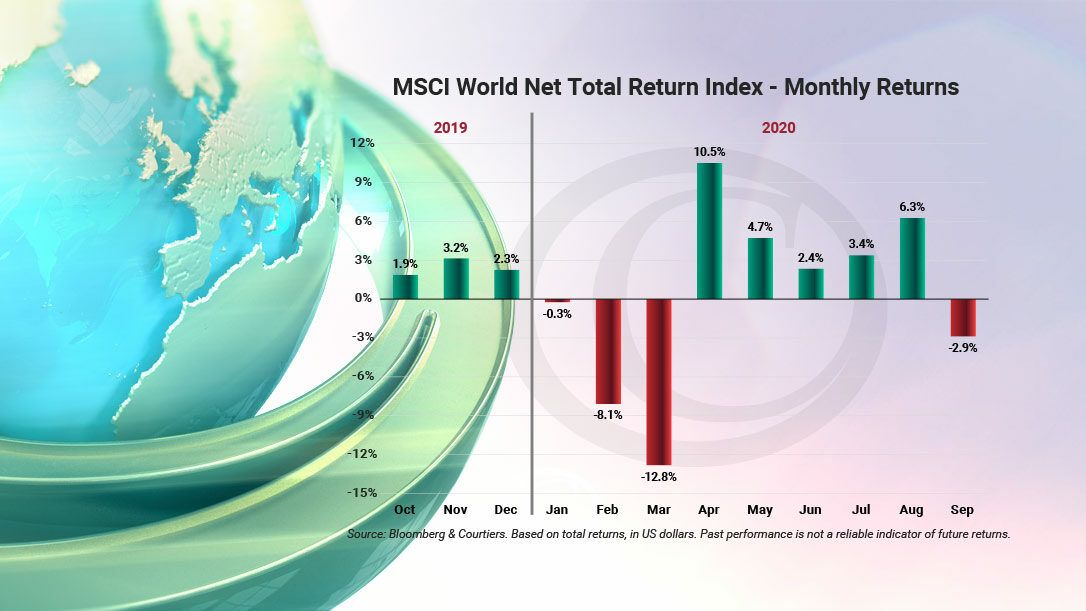

After months of steady recovery following a shock to markets earlier in the year, September saw global markets faltering as the second wave of the virus began to take effect.

The below chart shows that September has been the first negative month for global equities since March:

The US, which has seen by far the strongest recovery in its equity market over the last few months, was among the biggest fallers in September; the S&P 500 index declined -3.8%, as many of the big tech names such as Apple (-10.3%), Google (-10.1%) and Amazon (-8.8%) relinquished some of their recent gains.

With equity markets wobbling, there was a boost to bond markets, particularly in the UK where long-dated gilts appreciated +2.8%. With the UK’s benchmark interest rate still at its lowest ever level of 0.1% and Covid cases on the rise, speculation is rife as to whether the Bank of England will do what they’ve never done before and set the rate at a negative level.

The first US Presidential debate between Donald Trump and Joe Biden took place on 29th September, but it descended into chaos as there was more trading of insults than policy ideas. Following the debate, the market tilted towards a win for Biden, however Trump has just contracted the coronavirus, which throws plenty of uncertainty over future debates and the election itself.

A full round-up of September market performance

In the UK, the FTSE 100 index slipped -1.54%, while medium and smaller companies, measured by the FTSE 250 ex IT index and the FTSE Small Cap ex IT index, declined -3.17% and -3.26% respectively. In the US, the S&P 500 index shed -3.80% while in Europe the Eurostoxx 50 index lost -2.30%. However Japanese stocks measured by the Topix index rose +1.30%.

Emerging markets also had a difficult month, with the MSCI Emerging Markets index dropping -1.63%. Chinese stocks measured by the MSCI China index conceded -2.83% and Indian stocks measured by the IISL Nifty 50 PR index fell -1.23%. Latin American equities, measured by the MSCI Latin America index, declined -3.11%.

In the fixed income market, UK government bonds, measured by the FTSE Gilts All Stocks index, gained

+1.48% and long dated (over 15 years to maturity) gilts leapt +2.77%. European corporate bonds, measured by the Markit iBoxx Euro Corporates index, put on +0.32% while sterling denominated corporate bonds, measured by the Markit iBoxx Sterling Corporates index, returned +0.40%. In the high yield market, the Bank of America Merrill Lynch Euro High Yield index and the Bank of America Merrill Lynch Sterling High Yield index slipped

-0.61% and -0.21% respectively.

Commodities had a negative month. The S&P GSCI index, which consists of a basket of commodities including oil, metals and agricultural items, slumped -3.64%. The recovery in oil prices halted, with the price of a crude oil futures contract plunging -10.16%. The precious metals also faltered as the S&P GSCI Gold and Silver indices fell -4.19% and -17.83% respectively. However, in the agricultural markets, corn and wheat delivered +5.51% and +4.08% respectively.

In the currency markets, the pound reversed some of its recent gains as it depreciated -3.37% against the US dollar, -3.73% against the yen and -1.58% versus the euro.