Gary Reynolds, Chief Investment Officer, explains that the world is undergoing significant changes due to economic failures over the past 14 years. He criticises austerity measures post-global financial crisis, highlighting their ineffectiveness. While asset owners benefited, ordinary workers and new graduates struggled. Despite challenges, Gary continues to be optimistic about the future and explains why.

“[Yannis Varifakis said that] ‘The financiers (the bankers) received socialism and everybody else (the masses) got austerity’, and he was absolutely, absolutely right” – Gary Reynolds, Chief Investment Officer

Inflation and Gary’s top three budgets

Gary discusses the impact of inflation outpacing wage increases since 2010, which has hurt average families. He praises Joe Biden’s handling of the American economy (even if the general public saw it differently) which led to re-electing Donald Trump, and notes politicians’ efforts to address economic concerns. Gary highlights his favourite budgets over his working life are the following:

- Geoffrey Howe’s 1981 Budget: Initially criticised, it led to a decade-long economic upturn. Despite 364 economists predicting disaster, the economy turned around within months and continued to grow for the next decade.

- Kwasi Kwarteng’s Budget: A traditional Tory budget aimed at stimulating the economy through lower taxes. However, it was poorly presented and lacked coordination with key institutions like the Bank of England and the Office for National Statistics.

- Rachel Reeves’ Budget: A traditional Labour budget that increased taxes on businesses, reflecting Labour’s approach to economic management. Despite the higher taxes, Gary appreciates its honesty and straightforwardness.

Despite economic challenges, Gary believes that these budgets, although different in approach, have the potential to address the underlying issues in the economy. He emphasises the importance of understanding the broader economic context and the need for effective communication and coordination in implementing economic policies.

“When the consensus is that strong, you have to be very, very wary.” – Gary Reynolds, Chief Investment Officer

GND, GNW and PSNFL

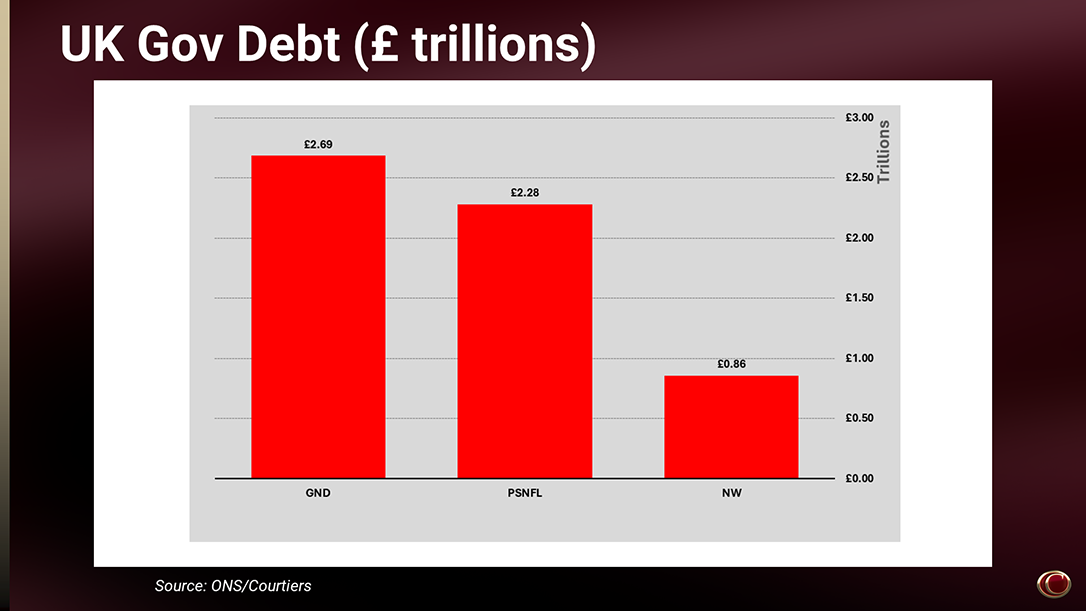

Gary discusses the issue of government debt, highlighting that the UK has £2.68 trillion in debt. He explains that without economic growth, the tax base doesn’t grow, leading to increased debt. He then sets up three terms that he expects the Government to start to use in the future to better understand the debt situation: Gross National Debt (GND), Government Net Worth (GNW), and Public Sector Net Financial Liabilities (PSNFL).

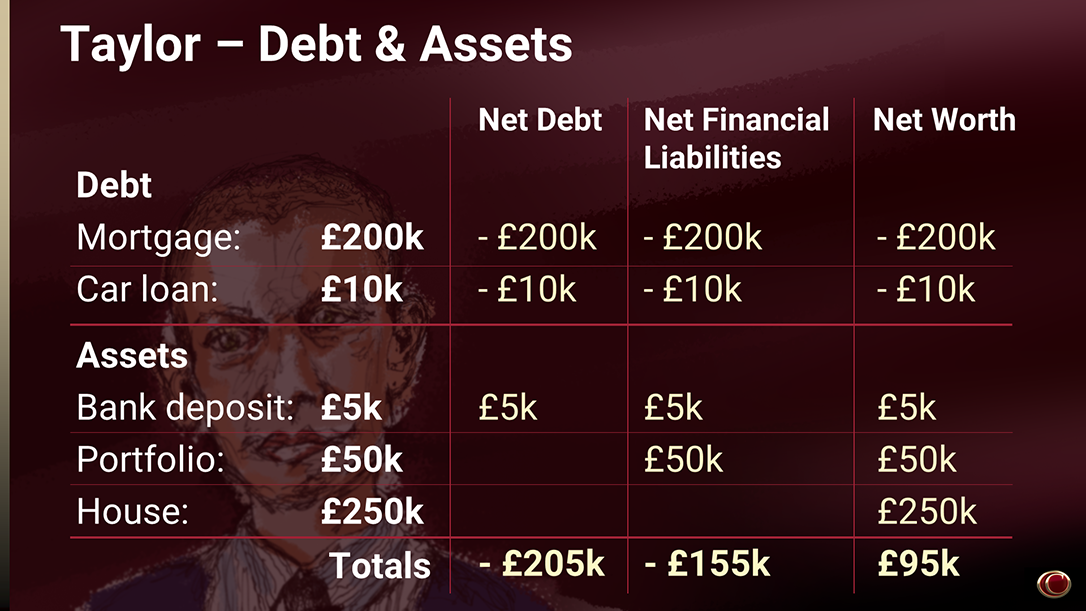

Gary explains that comparing a country’s finances to a household budget is misleading, as governments can print money, unlike families. He uses Taylor’s financial situation to illustrate different measures of debt and worth: net debt, net financial liabilities, and net worth.

“One thing you need to never forget is if a politician tries to talk to you about the country’s finances being similar to a household budget; they are not.” – Gary Reynolds, Chief Investment Officer

As an example, we can look at the table above for ‘Taylor’ using these new terms and link it back to how to view government debt.

To begin with, Taylor has a mortgage of £200,000 and a car loan of £10,000, contributing to the net debt. By subtracting liquid assets, such as Taylor’s £5,000 bank deposit, the net debt is £205,000. Similarly, for the government, net debt stands at £2.69 trillion.

Next, Gary introduces net financial liabilities, a more comprehensive measure. For Taylor, net financial liabilities include the mortgage and car loan minus both the bank deposit and financial assets (£50,000 in shares and bonds). This calculation results in net financial liabilities of £155,000. For the government, public sector net financial liabilities amount to £2.28 trillion – about £400 billion less than net debt, demonstrating a significant difference.

Finally, Gary discusses net worth (or Public Sector Net Financial Liabilities), a familiar concept in family finances. Taylor’s net worth is calculated by including the house’s value (£250,000), which, when combined with financial assets and subtracted by debts, amounts to a net worth of £95,000. For the government, net worth considers all assets and liabilities, resulting in a net worth of £86 billion.

These measures highlight significant differences in financial assessments, providing a clearer picture of economic health. Gross National Debt, Government Net Worth, and Public Sector Net Financial Liabilities are essential metrics for understanding the broader economic context and the effectiveness of fiscal policies. Gary underscores the importance of recognising these measures to make informed decisions and navigate economic discussions effectively.

Moving from GND to PSNFL

Gary explains that Blair’s government introduced tuition fees in 1998 and began recording Public Sector Net Financial Liabilities in 1997. This strategic move allowed the government to present a more favourable financial position by including assets like student loans, which total £220 billion. Gary emphasises the importance of understanding these measures and how they differ from net debt. He also discusses the challenges of measuring net worth, which includes all government assets and liabilities. Despite the complexities, Gary believes the overall financial position is not as dire as often portrayed. He criticises the tendency of governments to blame predecessors for financial issues, noting that both parties engage in this practice. Gary highlights that debt as a percentage of GDP, currently around 100%, is not unusually high by historical standards. He praises Gordon Brown’s handling of the global financial crisis, suggesting that the financial situation left by Labour in 2010 was not as bad as claimed by the Tories. Overall, Gary underscores the need for a nuanced understanding of government finances and the various measures used to assess them.

The UK Economy as a whole

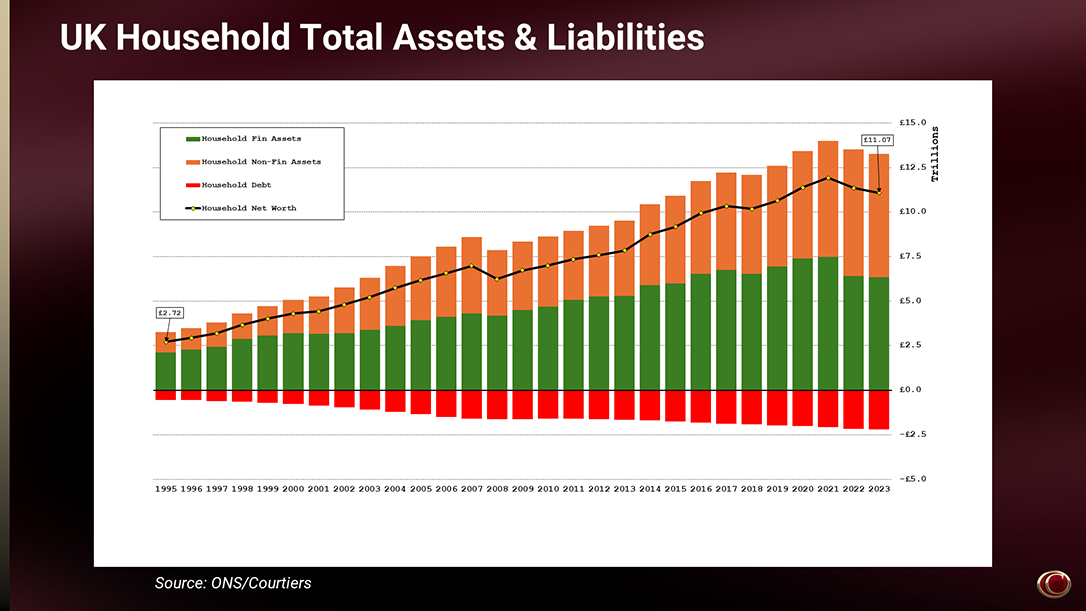

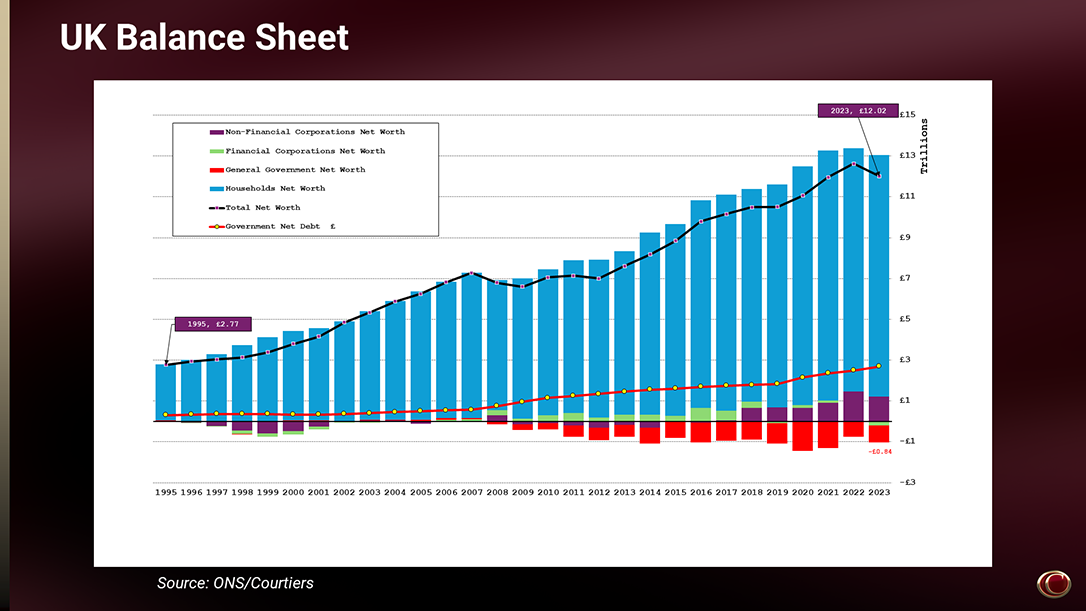

Gary explains that the government is in a relatively good position, despite political rhetoric. He highlights that the UK economy is not just about the government but also about families and companies. UK companies have £1.22 trillion in net assets, indicating strong financial health. Families are also in a good position, with significant financial and non-financial assets, despite recent declines in property prices. Overall, the UK economy has assets totalling £22.5 trillion, far exceeding the £2.68 trillion government debt. Gary emphasises that debt is a normal part of economic activity, balancing savers and borrowers. He concludes that the UK, with a net worth of £12 trillion, is in a strong financial position.

Reasons to be Cheerful

Gary concludes with reasons to be cheerful this Christmas:

- He highlights the UK’s innovation, exemplified by AstraZeneca and Oxford University’s COVID vaccine. The UK ranks fifth globally in innovation, behind Singapore, the US, Sweden, and Switzerland.

- Blair’s introduction of tuition fees in 1997/98 has boosted university funding, leading to flourishing universities like Imperial College London, Oxford, and Cambridge.

- The UK also has strong allies, with significant defence spending, ranking sixth globally.

- Financially, the UK has a robust balance sheet

In fact, a happiness survey places the UK as the happiest country: according to the Ray Dalio Great Powers Index, despite some regional variations in Europe.

Gary’s predictions for 2025

“Next year, the Magnificent Seven will underperform. That is my prediction. They will underperform in 2025. If I’m wrong, then I’ll do a forfeit.” – Gary Reynolds, Chief Investment Officer

Gary offers warnings and predictions for the next year:

- The “Magnificent 7” will underperform in 2025.

- The bond-bull market is over, and normal bond yields will return.

- Equity market valuations are polarised, making it a good time for stock picking.

- The UK and possibly Europe look cheap, with German stocks particularly undervalued.

- Trump may not prove inflationary, despite concerns.

- Austerity is over, presenting opportunities for disciplined investors.

Finally, Gary cautions against get-rich-quick assets like crypto, highlighting the risks. Diversified investments remain safer, as they are less likely to result in total loss.

Want more Client Seminar summaries?

We hope you enjoyed this Client Seminar summary. If you would like to read and watch more, Jake Reynolds, Asset Management Director, talks about Courtiers Investments in Charting the Course: Navigating Markets in 2024 and James Timpson, Head of Asset Management, talks about Markets and Courtiers Funds in Coming Up Trumps: A Review of Markets in 2024

We also sat down with Gary Reynolds to answer your questions from the Client Seminar in Client Seminar Q&A: Your Questions, Answered.

If you have any questions or would like to know when we will run the Client Seminars again, please don’t hesitate to contact your Courtiers Financial Adviser or get in touch through the Contact Us page.