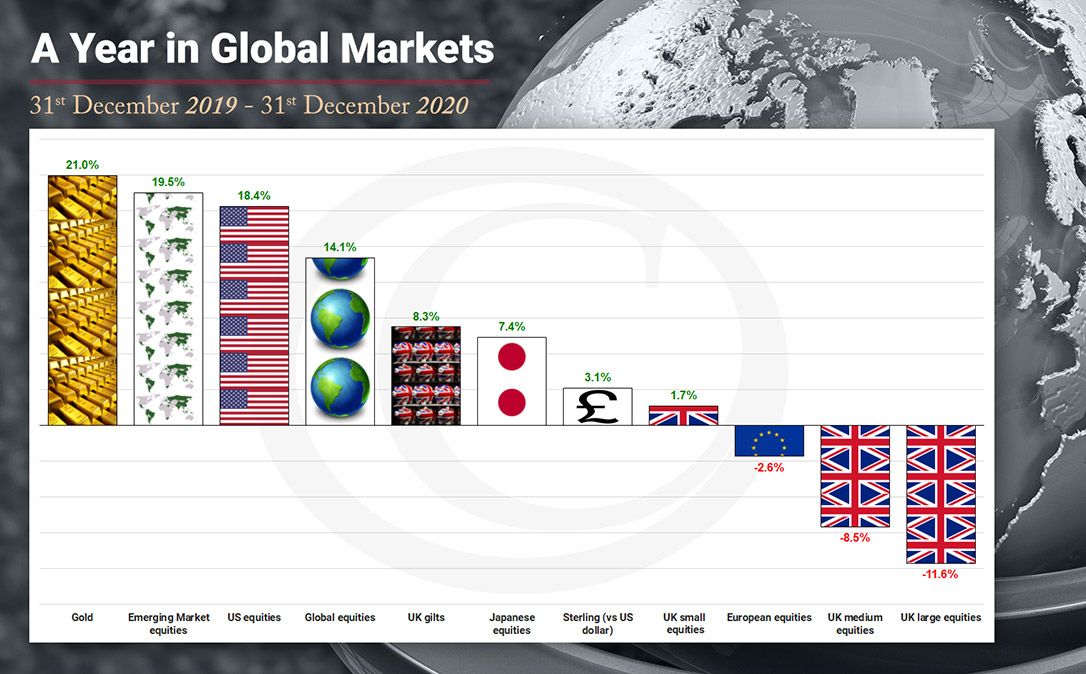

A tumultuous year ended with most markets posting gains in December, aided by continued optimism regarding the Covid-19 vaccinations. The UK market received a further boost from the announcement of a last-minute Brexit deal, unveiled by Boris Johnson on Christmas Eve. The pound reached its highest value against the US dollar since 2018, climbing to $1.3670 by the end of the month.

Despite positivity reflecting in markets since the vaccine announcement, 2020 was a negative year for the FTSE 100 index.

Other indices delivered strong returns in spite of the market crash in early 2020. The S&P 500 index in particular performed well due to the strength of the ‘Big 5’ tech stocks.

Looking around the world, the chart below shows returns in 2020 for some of the major global markets.

Source: Morningstar, Bloomberg & Courtiers. Chart shows total returns (i.e. includes income from dividends) from 31/12/2019 to 31/12/2020. All returns are in the local currency of the index. Gold in USD. Global Equities in mixed currencies. Past performance is not a reliable indicator of future returns.

Source: Morningstar, Bloomberg & Courtiers. Chart shows total returns (i.e. includes income from dividends) from 31/12/2019 to 31/12/2020. All returns are in the local currency of the index. Gold in USD. Global Equities in mixed currencies. Past performance is not a reliable indicator of future returns.

A full round-up of December market performance

In the UK, the FTSE 100 index gained +3.28%, while medium and smaller companies, measured by the FTSE 250 ex IT index and the FTSE Small Cap ex IT index respectively, gathered +6.54% and +6.69% respectively. In the US, the S&P 500 index rose +3.84% while in Europe the Eurostoxx 50 index climbed +1.79%. Japanese stocks measured by the Topix index returned +2.97%.

Emerging markets also performed well during the month, with the MSCI Emerging Markets index gaining +6.11%. In China, the MSCI China index put on +2.62% while Indian stocks, measured by the IISL Nifty 50 PR index, jumped +7.81%. Latin American equities, measured by the MSCI Latin America index, surged +8.47%.

In the fixed income market, UK government bonds, measured by the FTSE Gilts All Stocks index, grew +1.62% and long dated (over 15 years to maturity) gilts rose +2.80%. European corporate bonds, measured by the Markit iBoxx Euro Corporates index, gained +0.15% while sterling denominated corporate bonds, measured by the Markit iBoxx Sterling Corporates index, returned +1.67%. In the high yield market, the Bank of America Merrill Lynch Euro High Yield index and the Bank of America Merrill Lynch Sterling High Yield index picked up +0.83% and +1.04% respectively.

Commodities also had a positive month. The S&P GSCI index, which consists of a basket of commodities including oil, metals and agricultural items, delivered +5.97%. The price of a crude oil futures contract went up +7.43%. The precious metals performed well as the S&P GSCI Gold and Silver indices increased +6.42% and +16.91% respectively. In the agricultural markets, corn and wheat climbed +13.55% and +9.55% respectively.

In the currency markets, the pound had a good month as it appreciated +5.58% against the US dollar, +0.56% versus the euro and +4.16% against the yen.