Courtiers clients now have greater choice with the launch of five tailored investment portfolio combinations. These are designed to appeal to clients based on their willingness and ability to deal with different levels of risk.

For example, if a client expressed an appetite to deal with 60% equity risk, 30% of their assets can be invested in the Courtiers UK Equity Fund, 30% invested in the Courtiers Global (ex UK) Equity Income Fund, and the balance invested in the Courtiers Investment Grade Bond Fund.

A higher risk client may opt for the Courtiers 100% Equity Portfolio, which is 50% in the Courtiers UK Equity Income Fund and the other half in the Courtiers Global (ex UK) Equity Income Fund.

Alongside the Courtiers 60% Equity and Courtiers 100% Equity Portfolios, are the options for 20%, 40%, and 80% Portfolios.

These combinations enhance flexibility and expand the opportunities to benefit from the investment approach surrounding Courtiers Funds, which have delivered strong returns.

The Courtiers UK Equity Fund and Courtiers Global (ex UK) Equity Income Fund were launched in November 2015. In the period since their launch to 10th May 2021, the UK fund has returned 71.96%, making it the top-performing fund in its Investment Association Sector, while the Global Fund has returned 86.75%.

The returns generated by these two funds highlight the strong performance of the value strategy followed by the Courtiers Investment Team.

This approach is heavily based on the investment principles of Benjamin Graham, who was the mentor for one of the world’s most successful investors, Warren Buffett, aka the Sage of Ohama.

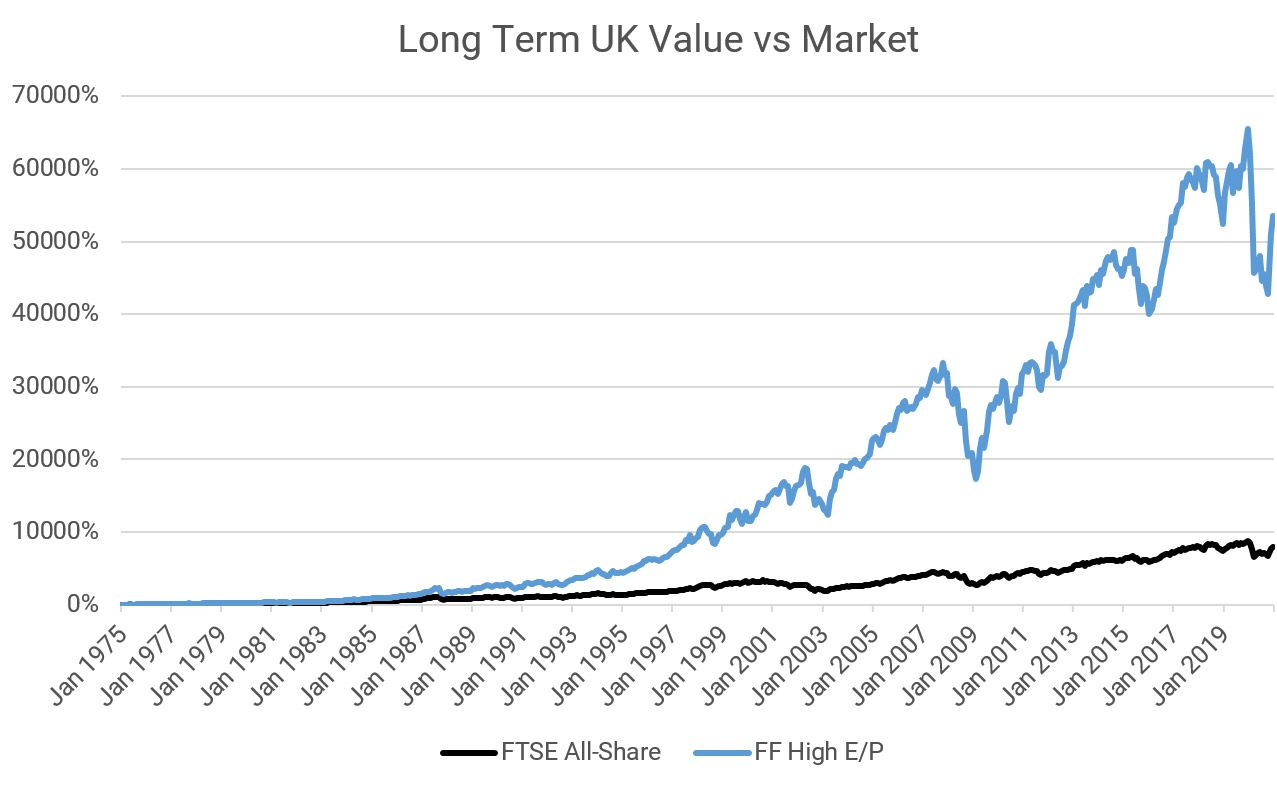

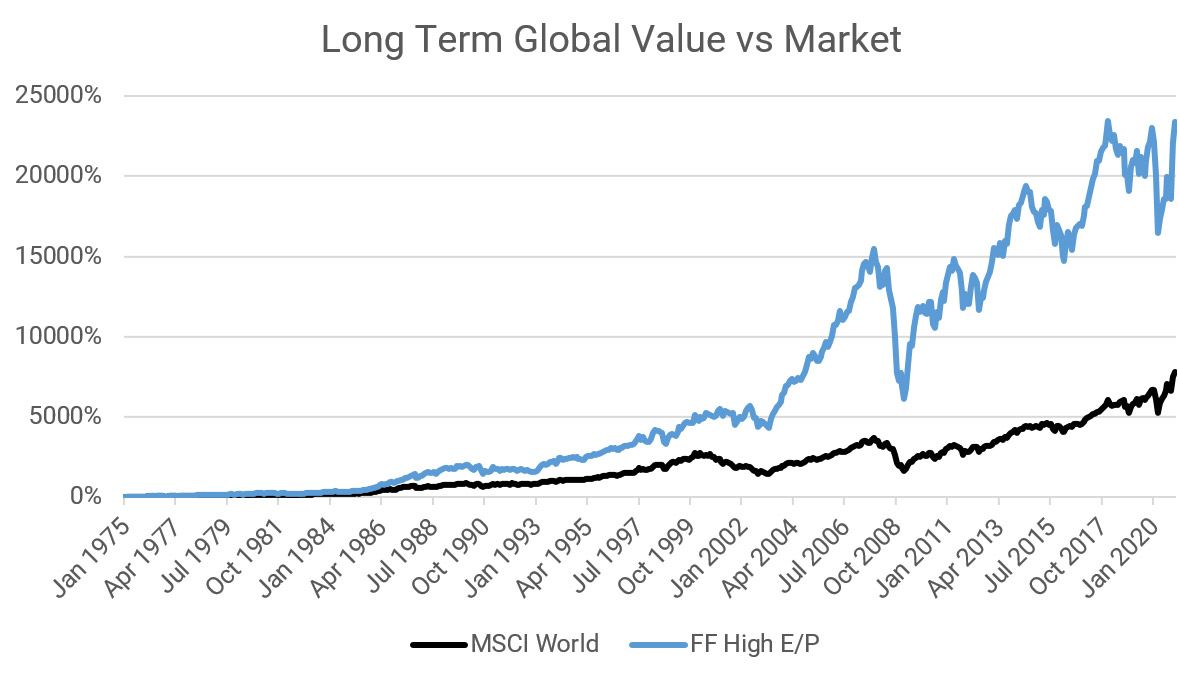

The success of this approach has also been confirmed by research going back as far as 1975 by academics Eugene Fama and Kenneth French. Constructing their own portfolios of value stocks by taking the top 30% of stocks in their respective benchmarks based on their earning yield (earnings per share divided by price per share, or E/P), they showed that over the long term, value stocks outperform both the market as well as expensive growth stocks in the UK and the Global Equity Investment Sectors.

From 1975 up to March 2020, an investment in the MSCI World and FTSE All Share would have delivered a total return of 10.15% and 10.23% per annum respectively. However, investing in the Fama and French High E/P Global and UK Value Portfolio, would have produced a total return of 12.86% and 14.96% per annum respectively.

As the charts below show, the increase in return from value investing makes a huge impact in the long run. For example, the Fama and French UK High E/P Value Portfolio would have grown a £1 investment in 1975 to £536 by the end of 2020 versus just £80 for £1 invested in the FTSE All-Share. Similarly, a $1 investment in the Fama and French Global High E/P Value Portfolio in 1975 would have grown to $233 by the end of 2020 vs a MSCI World investment which would have grown to $77.

Earnings yield is one of the metrics used by the Courtiers Fund Management Team in their stock selection. Alongside this metric, the team also uses cash flow yield, dividend yield and financial strength metrics.

Since their launch in 2015, the Courtiers Equity Funds have behaved similarly to the Fama and French Portfolio of value stocks in the corresponding country or region.

Figure 1 – Fama & French UK High E/P Value Portfolio vs FTSE All-share Since 1975

Source: Fama/French Data, Bloomberg, Courtiers – March 2021

Source: Fama/French Data, Bloomberg, Courtiers – March 2021

When asked about Courtiers new tailored investment portfolios, Jacob Reynolds, Head of Equity Analysis, commented; “Whilst past performance is not an indicator of future returns, we believe that the market inefficiencies that create the outperformance of a value approach are still present, and this is the optimal way to provide our clients with the best returns in the long run.”