Despite the summer traditionally being a quieter time for financial markets, this August saw the return of volatility to the markets with the second major wobble of the year. Once again it was increasing trade tensions that prompted the sell-off, with Donald Trump announcing via a tweet that the US would impose tariffs of 10% on a further $300 billion worth of Chinese exports. After falling considerably at the start of the month, global equity markets did manage to partially recover towards the end of the month, as seen in the below chart which shows the movement of the MSCI World index this year:

Source: Bloomberg. Past performance is not a reliable indicator of future returns.

Global equity markets are still having an above average year despite the two wobbles, with the index up +14.1% as of 31st August.

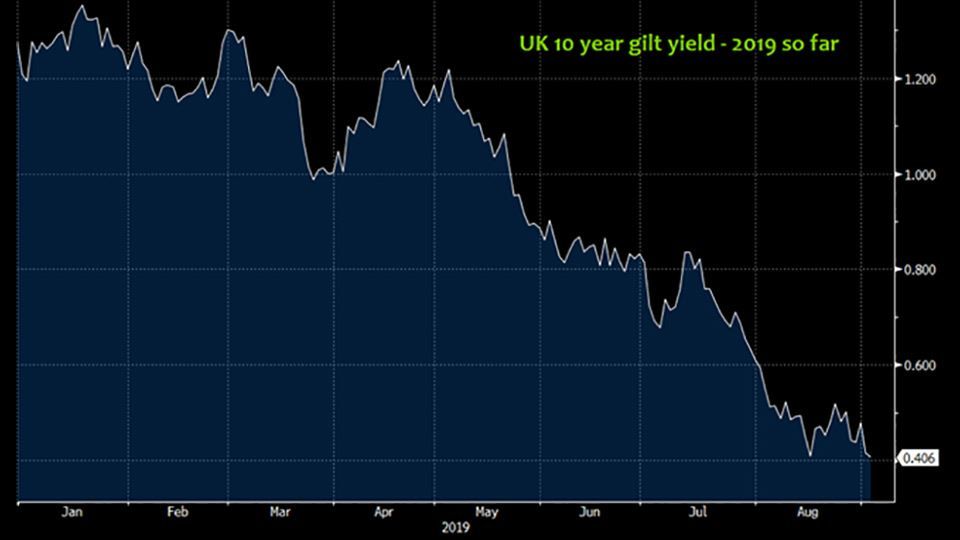

Meanwhile, bond yields have continued their unprecedented decline. At the time of writing, UK government bonds with ten years to maturity are yielding just 0.406%, as seen in the below chart:

Source: Bloomberg. Past performance is not a reliable indicator of future returns.

Rates are even lower elsewhere, particularly in the Eurozone. In Germany last month, the government managed to successfully sell a 30 year zero-coupon bond at a negative yield for the first time ever. In other words, the buyers have lent their money to the government, they will receive no coupon payments during the lifespan of the bond, and in thirty years when the bond matures they will receive less than they paid in.

With Brexit and the possibility of a general election dominating headlines at the moment, there are high levels of political uncertainty affecting financial markets. Since the downturn last month we have maintained a cautious stance in the multi-asset funds, keeping equity exposure and foreign currency exposure at relatively modest levels whilst monitoring the equity market and the options market for value opportunities.

A full round-up of July market performance

In the UK, the FTSE 100 index fell -4.08%, while medium and smaller companies, measured by the FTSE 250 ex IT index and the FTSE Small Cap ex IT index, declined -0.90% and -2.15% respectively. In the US, the S&P 500 index slipped -1.58%, while in Europe the Eurostoxx 50 index dropped -1.06%. Japanese stocks measured by the Topix index shed -3.37%.

Emerging market returns were also negative. The MSCI Emerging Markets index decreased -2.50%. Chinese equities measured by the MSCI China index lost -3.91% and Latin American equities, measured by the MSCI Latin America index, fell -1.02%. Indian stocks measured by the IISL Nifty 50 PR index declined -0.85%.

In the fixed income market, UK government bonds, measured by the FTSE Gilts All Stocks index, rose +3.53% and long dated (over 15 years to maturity) gilts surged +6.56%. European corporate bonds, measured by the Markit iBoxx Euro Corporates index, gathered +0.68% while sterling denominated corporate bonds, measured by the Markit iBoxx Sterling Corporates index, increased +1.40%. In the high yield market, the Bank of America Merrill Lynch Euro High Yield index and the Bank of America Merrill Lynch Sterling High Yield index captured +0.69% and +0.39% respectively.

Commodities had a mostly negative month. The S&P GSCI index, which consists of a basket of commodities including oil, metals and agricultural items, slid -5.62%. The price of a crude oil futures contract tumbled -7.27%. In the agricultural markets corn and wheat slumped -9.82% and -6.23% respectively. However the precious metals – often seen as ‘safe havens’ during times of market stress – enjoyed a positive month as the S&P GSCI Gold and Silver indices rallied +6.55% and +11.10% respectively.

In the currency markets, the pound had mixed fortunes as it ended the month flat (-0.02%) against the US dollar, up +0.82% against the euro and down -2.26% against the yen.