Gary Reynolds, CIO, talks about how decisions across the world – from those on oil prices to the US economy – have an impact on the UK market, and global financial conditions. He also brings it all closer to home, focusing on whether Courtiers would ever short the “Magnificent Seven” for our clients (spoiler alert: we wouldn’t).

Money Supply, Liquidity and Asset Prices

Economists’ views are poles apart on this subject. A few years ago, I attended a one-day conference, presented by economist Gordon Pepper, on The Liquidity Theory of Asset Pricing (LTAP). Gordon was pro-LTAP even though his economist colleagues at TS Lombard (then Lombard Street) hotly contested the theory.

You obviously need money in an economy so that we can buy possessions, including assets. Without a trusted money supply, we would revert to bartering for goods and assets and quickly become paupers. However, a small amount of money circulating quickly within an economy can be sufficient. This is known as the “velocity of money”.

How to track the velocity of money

Put simply, the velocity of money is how many times all the money in the economy circulates.

To put it in context:

- A factory owner pays a worker £1,000.

- The worker pays that £1,000 to a shop owner for a new bike.

- The shop owner then pays the £1,000 to their supplier.

- The supplier pays the £1,000 to the factory owner for more bikes.

While £4,000 has passed hands, only the same £1,000 has passed between the people. Therefore, the money changes hands four times per unit of time.

Taking this to its broader perspective, the velocity of money is a ratio of a country’s gross national product and the money supply of that country. If the velocity of money is higher, you can conclude people are purchasing goods and services at a faster rate.

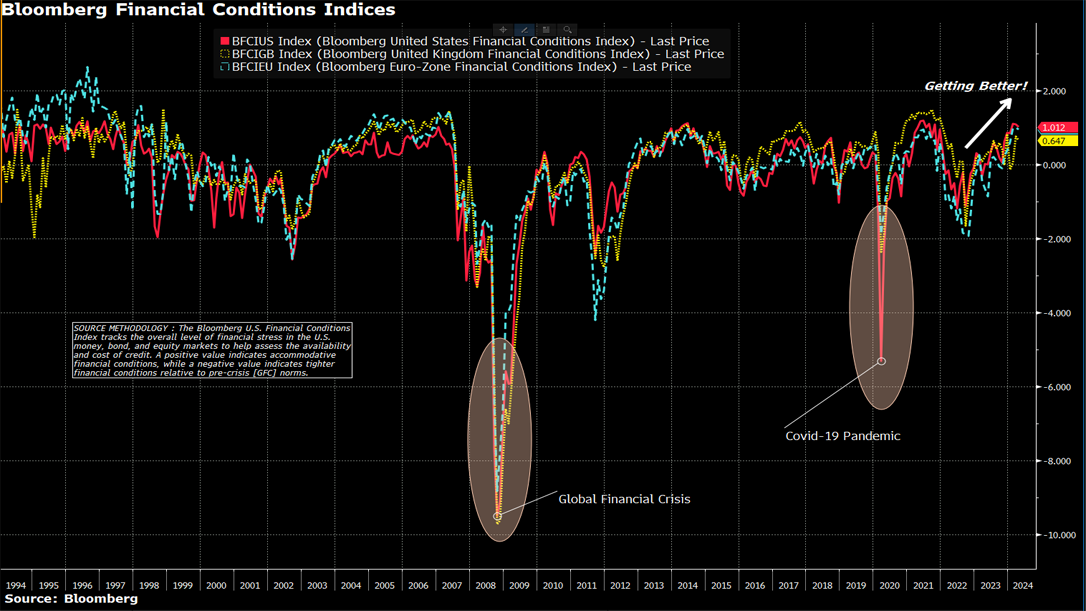

Global financial conditions have been improving recently, as highlighted by the chart below, and I see no reason to get spooked by data on money supply and/ or liquidity.

Source: Bloomberg, 11/04/2024 at 10am. Past performance is not a reliable indicator of future returns. The mention of any stocks or shares should not be taken as a recommendation to deal.

Profiting From Derivatives

Derivatives: In investing, derivatives are used to hedge a position, increase leverage or speculate on an asset’s movement.

Short selling is a perfectly legitimate investment practice, but if we were looking to find an opportunity to make money for our investors, we wouldn’t be looking to short one or more of the “Magnificent 7”.

Shorting tends to only be followed by speculators because the risks from a naked-short position are astronomical (where you sell shares in an asset you don’t own, borrowing, or securing the right to borrow them – and without any hedge position to off-set risk). We have used short positions in the past, but only where the downside is hedged.

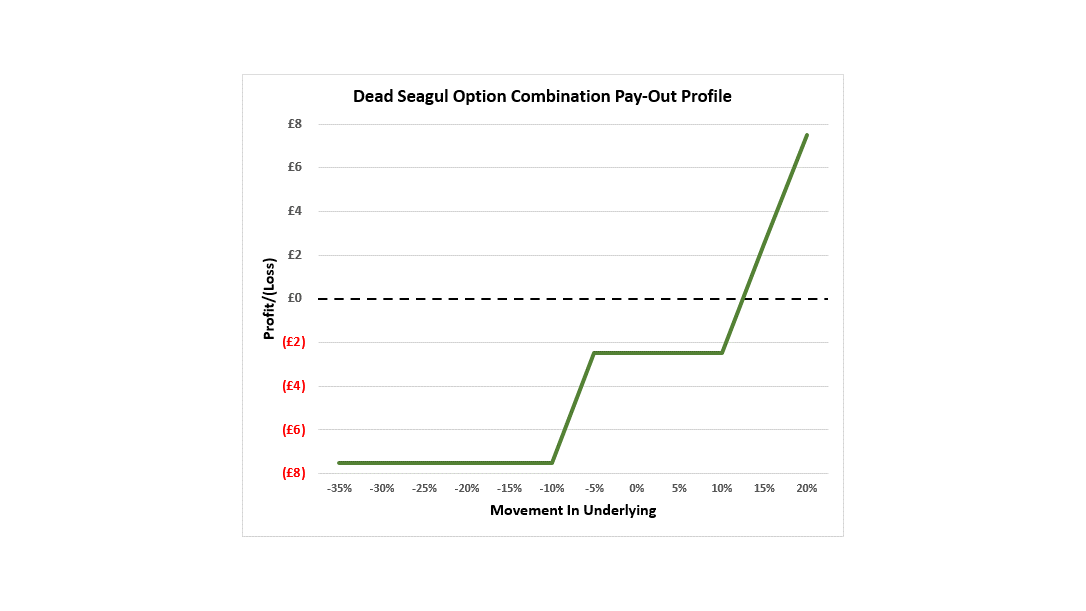

A particular strategy is a combination of options that produces a payoff profile known as an ”inverted” or “dead” seagull. Even on this type of position, an out of the money short put is covered by a long put, even further out of the money on the same position.

Courtiers is very good at what we do, but we only work in this way for a specific range of clients willing to take some risk, but not too much. Our clients do not use us for speculation.

Source: Courtiers, created on 12/04/24

Oil

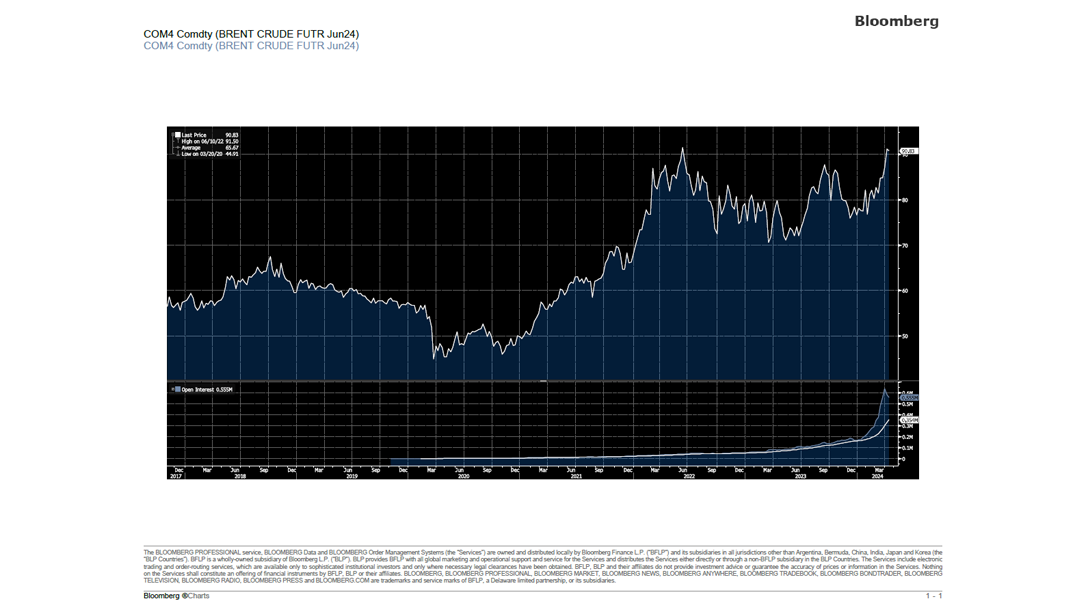

The concept of “peak oil” (i.e. that we would run out of oil in the next 100 years) is long gone, proving 1970s Saudi Oil Minister, Sheik Ahmed Zaki Yamani, correct. He said, “The stone age didn’t end because we ran out of stones [and the oil age will not end because we will run out of oil]”.

Source: Bloomberg, 11/04/2024 at 10am. Past performance is not a reliable indicator of future returns. The mention of any stocks or shares should not be taken as a recommendation to deal.

There is ample oil reserve around the world, even though we are burning it up at the rate of 100 million barrels per day, especially since the Americans discovered shale oil. Most of today’s issues around the oil price are where suppliers, especially OPEC+, seek to maximise prices on their remaining reserves by rationing supplies to the market.

The Virtuous Circle

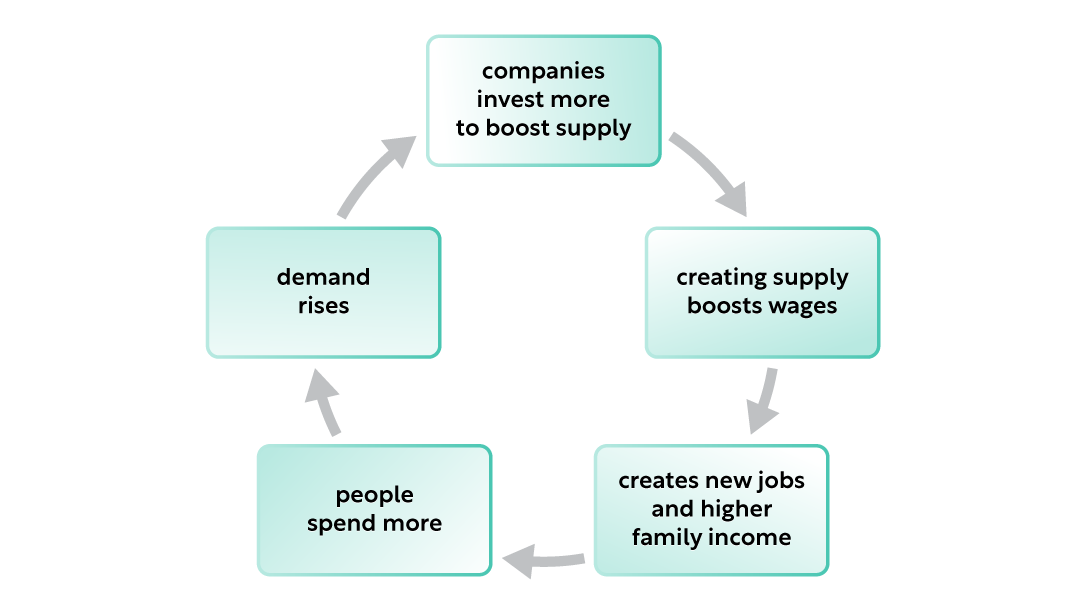

“Is the US’s improving economy and financial conditions driving new goods purchases? Unequivocally, ‘yes’.” – Gary Reynolds, Chief Investment Officer.

As we discussed in an earlier article – could we fix interest rates by spending more? – This is how we get good growth in an economy. People demand more, businesses increase supply and in doing so take on more people, thus increasing demand, which stimulates even more supply. Just like the diagram below expresses:

President Biden seems to have done, and is doing, a good job with the US economy, using what can be described as 21st century Keynesianism.

It would be nice if Keynes’ country of birth could rediscover some of his magic too.

In summary

While many factors are affecting the global economy, Courtiers is assured in its position and confident in what it can – or can’t – deliver to its clients. If you would like to discuss anything further or want more information on anything mentioned above, please contact your Courtiers Adviser.