There are many ways for parents, grandparents and other relatives to support children in the family. Building them a pension pot in readiness for a fruitful retirement many decades later may not be one of the most obvious.

Obvious or not, for any parent or relative who wants to provide for the long-term financial security of a child, putting money into what is known as a Junior SIPP (Self-Invested Personal Pension) is attractive on many fronts.

Typically used by parents, grandparents, Godparents, uncles and aunts, Junior SIPPs are the ultimate long-term investment allowing money invested to grow for up to 57 years, a period of time which historically has produced impressive returns for investors.

Taking the FTSE 100 as an example, between 1984 and 2019, it rose by 654% in price and 1,377% on a total return basis, i.e. when dividends are included. This amounts to an annual price return of 5.8% and an annual total return of 7.8%. Although of course there is no guarantee that such impressive long-term returns will continue.

Example

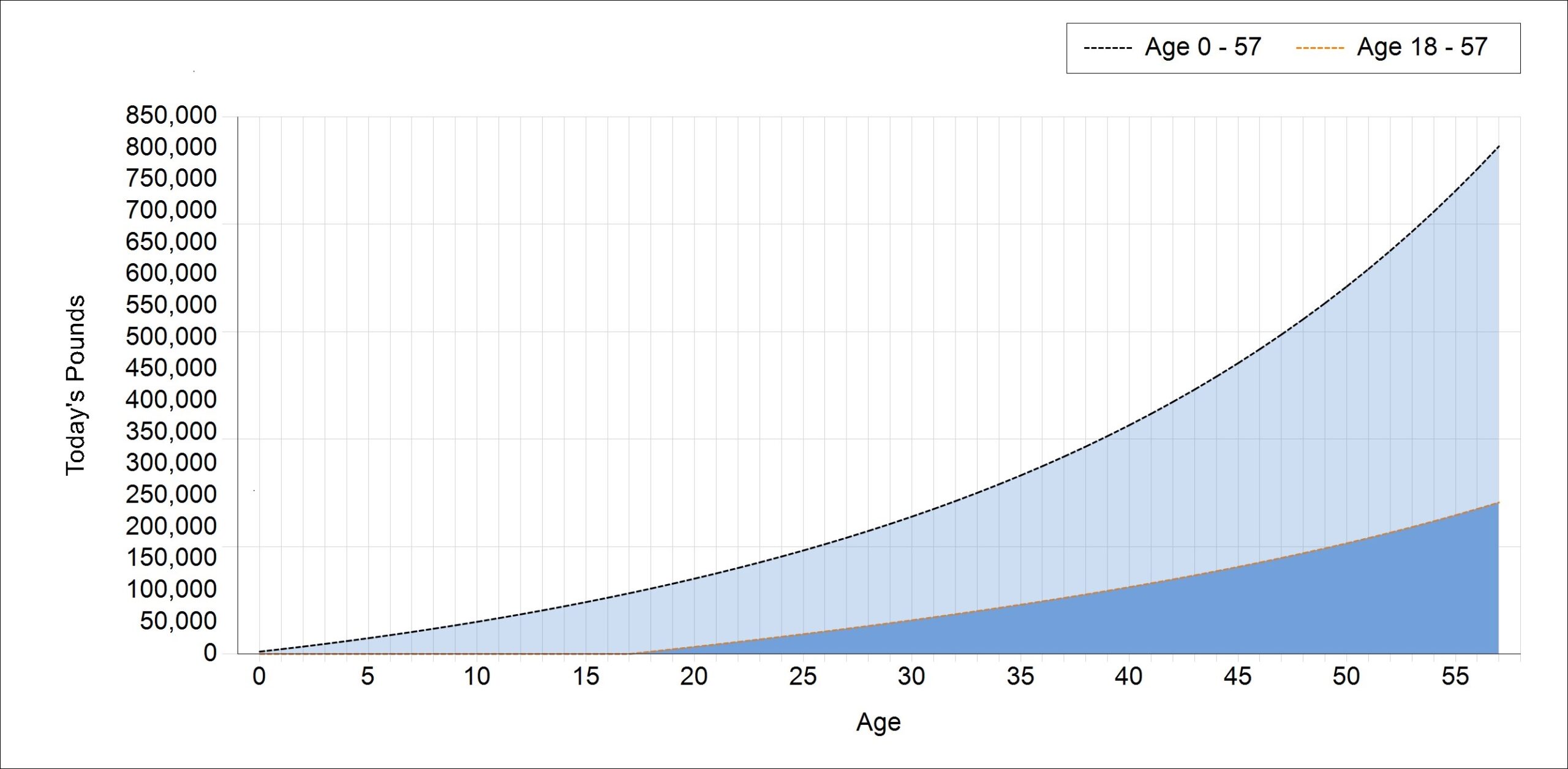

To illustrate how regularly investing relatively modest amounts in a Junior SIPP can grow into a substantial nest-egg, take our example of a child born on 16 September 2021. By contributing just £2,880 a year (£3,600 a year with 20% tax relief) from birth until the child is 18, after which the then adult continues to invest the same amount each year until they reach 57, the child’s retirement fund grows to over £800,000 in today’s money. This assumes contributions rise by 3% a year in line with inflation.

This compares to just under £240,000 if that same £3,600 a year is invested from the age of 18. In other words, due to the magical effect of compounding, whereby returns feed on returns, those first 18 years result in a nest egg more than three times greater.

This compounding effect means that the difference in performance between the two pension scenarios accelerates over time. As the chart below shows, between the age of 40 and their retirement age of 57, the SIPP invested for 57 years grows by £441k compared with £134k for the SIPP invested for 39 years.

Source: Courtiers

The above chart above is based on the following assumptions;

Child born 16/9/21.

Inflation is 3% per annum throughout the investment periods

The £3,600 invested in the first year increases each year by 3%.

Investment growth of 8% a year.

Other attractions

In addition to the benefits of having their money invested for longer than someone who starts paying into a pension later in life, Junior SIPPs have other attractions.

Junior SIPPs are tax-efficient

The annual contribution allowance is £3,600, with the parent or other donor needing only to contribute £2,880. The government tops up the rest with £720 in tax relief, effectively free money which can then be invested into the Junior SIPP, directly benefitting the child.

The maximum amount of £2,880 that a parent can pay in sits nicely under the £3,000 a year gifting allowance, which is exempt from Inheritance Tax. This would allow, say a grandparent, to contribute to the future financial security of a grandchild, while at the same time reducing the value of their own estate.

Indirect benefits

Although a child born today won’t be able draw on their Junior SIPP until 2078 when they reach the age of 57, it’s important not to ignore the indirect financial benefits. Knowing that they’ve already amassed what could be quite a substantial pension fund by a relatively young age means that they don’t have to put so much of their own income aside for retirement, giving them extra disposable income to use as they wish. This could be used for, say the deposit for a house. With an investment head start of up to 18 years, as our example illustrates they are likely to be in a fortuitous situation compared to someone who began to pay into a pension at the age of 18.

Complements other types of financial support

That said, having to wait for 57 years until they can draw on their investment may not suit everyone and every situation, particularly where there are short term financial needs, such as meeting university fees. For anyone wishing to help a member of the younger generations with shorter term financial needs, saving into a Junior ISA or opening a bare trust for them are two options, with each having the advantage that the child can access the assets when they reach the age of 18.

Key Features of Junior SIPPs

- Junior SIPPs (Self Invested Personal Pensions) were launched in 2011.

- Can be opened by a child’s parent or legal guardian, who would then be responsible for making investment decisions until the child reaches the age of 18.

- During this time assets within the Junior SIPP are held in trust.

- Contributions to a Junior SIPP are not confined to parents or legal guardians, and are often made by grandparents or other family relatives.

- At the age of 18, control of a Junior SIPP passes to the child now turned adult at which point it effectively becomes a normal adult SIPP.

- The pension access age is currently 55 but this rises to 57 in 2028.

- There is no Capital Gains Tax or Income Tax on investments held in a Junior SIPP.

- Income Tax may be due when the pension is eventually accessed, but not on any tax-free lump sum.

- They are tax-efficient (see above).

Other considerations

Being invested for up to 57 years increase the likelihood of breaching the Lifetime Allowance, currently at £1,073,000 in the 2021/22 tax year. This makes proper financial planning vital.

Contributing to a Junior SIPP can encourage youngsters to get into the investing habit. Education along the way can help instil a sound mindset when it comes to that pot becoming accessible.

Courtiers offers its own Junior SIPP, with clients able to transfer in funds from their existing Courtiers investments. Please contact your Courtiers Private Client Adviser if you would like further details.

In summary

Junior SIPPs can be an attractive option for parents, grandparents and others to provide a child with long term financial security. Ideally used as a way to complement other types of more immediate financial support, such as Junior ISAs or bare trusts, their tax efficiency provides an additional reason for giving them serious consideration.