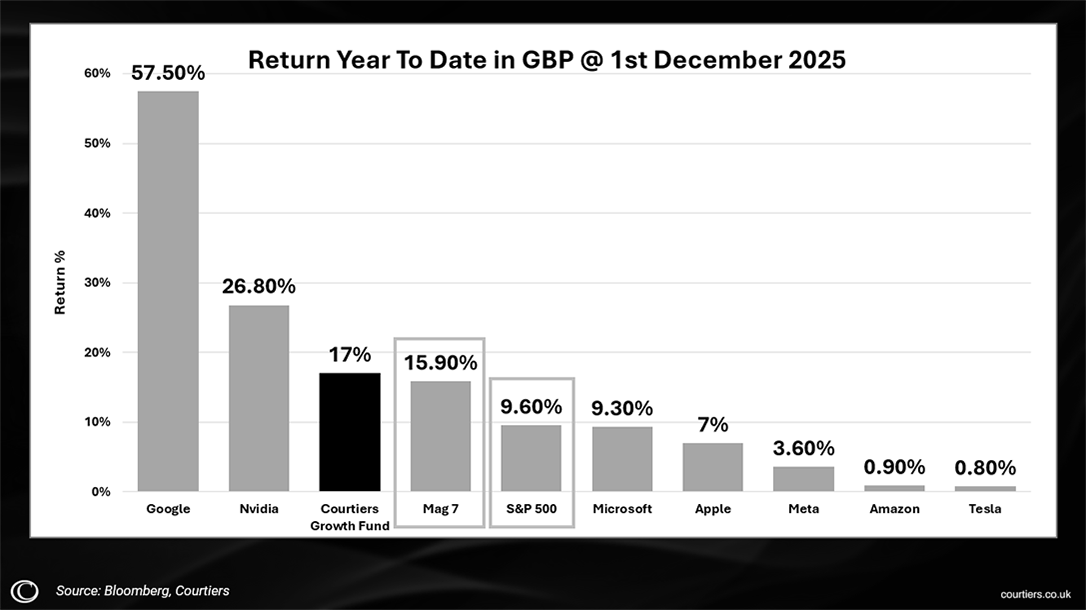

The Magnificent Seven may have outperformed the market, but our Courtiers Total Return Growth fund outperformed the Mag 7.

At our 2025 Client Seminars, Gary Reynolds took to the stage to look back on the market and economics that dominated the year. And he also looked back on his prediction from last year:

“The “Magnificent 7” will underperform in 2025.”

Was he right? Well. The Mag 7 outperformed the S&P 500 – the market it’s related to. The S&P500 gave a 9.6% return, the Mag 7 offered a 15.9% return. However, relative to its domestic major, the Courtiers Total Return Growth fund outperformed the Mag 7 with a 17% return, meaning relative to Courtiers, the Mag 7 underperformed.

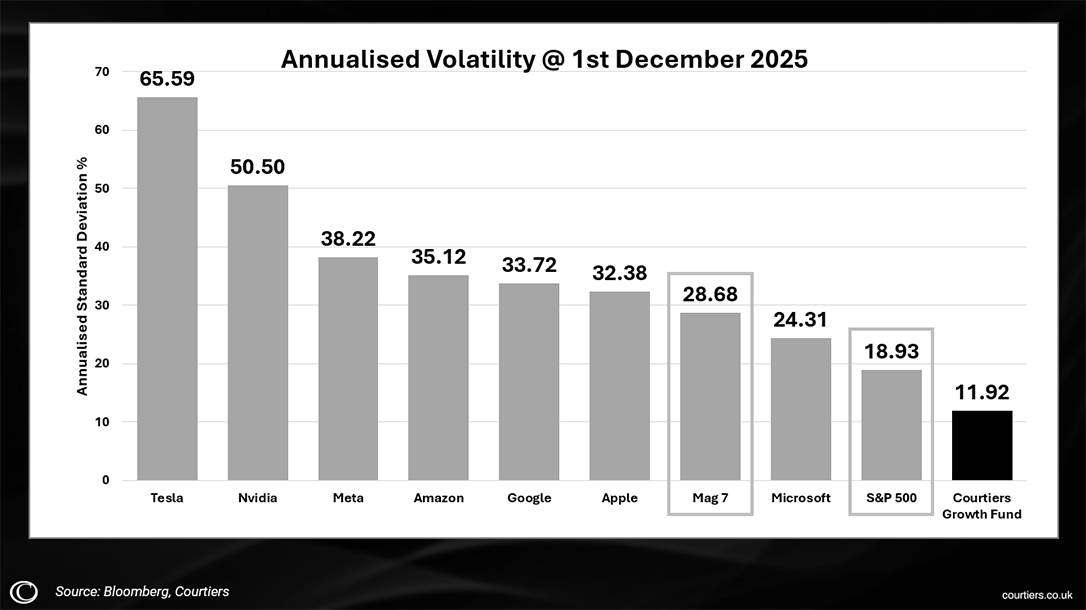

Plus, when we look at the volatility of the Mag 7, The S&P 500 and the Courtiers Total Return Growth Fund, Courtiers has a lower volatility, meaning it’s less likely to lose clients’ money.

The chart shows annualised volatility of the Mag 7 at 26.68% and the S&P 500 at 18.93%, while the Growth fund came in at 11.92%. You can see some of the companies in the Mag 7 hit whopping levels of volatility this year – 65.59% for Tesla and 50.50% for Nvidia.

Read more Client Seminar articles

Gary Reynolds explains The Invisible Black Hole.

James Timpson covers Positive returns for Courtiers Funds in 2025.

Jake Reynolds addresses equities and stocks in Attacking the difficult questions we had this year.

If you have any questions or would like to know when we will run the Client Seminars again, contact your Courtiers Financial Adviser or get in touch through the Contact Us page.