Note: We wrote this article before the news of DeepSeek hit the markets on Monday 27th January, causing one of the biggest drops of NVIDIA stock seen in US Stock Market history (according to Bloomberg). This highlights the risks there are in chasing the big tech stocks, and why we maintain our value position.

Is the market heading towards a correction, where prices drop by 10 or 20%? If so, what assets are likely to be affected, and what would be the best thing to hedge? Gary Reynolds, Chief Investment Officer, discusses the current market, looking at historical corrections to try to gain a vision of the future.

Assets priced way above their historical averages tend to suffer most in any correction. However, those priced below their historical averages provide (according to Benjamin Graham in his classic “Security Analysis”) a “margin of safety”. Overpriced stocks provide no safety margin whatsoever.

Of course, we are always trying to hedge against untoward outcomes, but we can never be sure exactly what an untoward outcome will look like or what may cause it. We cannot know for certain what different asset classes will do.

You don’t have to look very far in current markets to find assets at either end of the valuation spectrum. Some investments trade at eyewatering multiples by historical standards, with large US tech the main occupiers of this subset. Others – arguably every equity outside of the US and especially non-USD small-caps – look cheap by historical standards. Small and mid-cap American companies don’t look expensive either.

When we consider the likely contenders to kick-off a correction, we should look to the most over-priced assets. These are currently the Magnificent Seven (Mag 7), big US tech, Bitcoin and (possibly) gold.

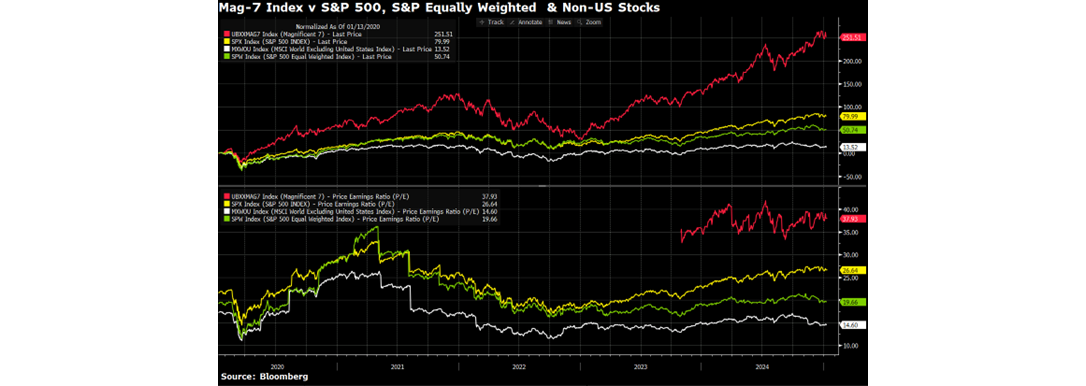

Above, we charted the Mag 7 Index, measuring performance and valuation metrics (historic PER) against the S&P 500, S&P Equally Weighted Index and MSCI World ex-US stocks. Its five-year results include the Covid-19 correction, which makes the Mag 7 return of 251.51% quite extraordinary, especially compared to the SPW’s 50.74% and a paltry 13.52% on average from non-US stocks.

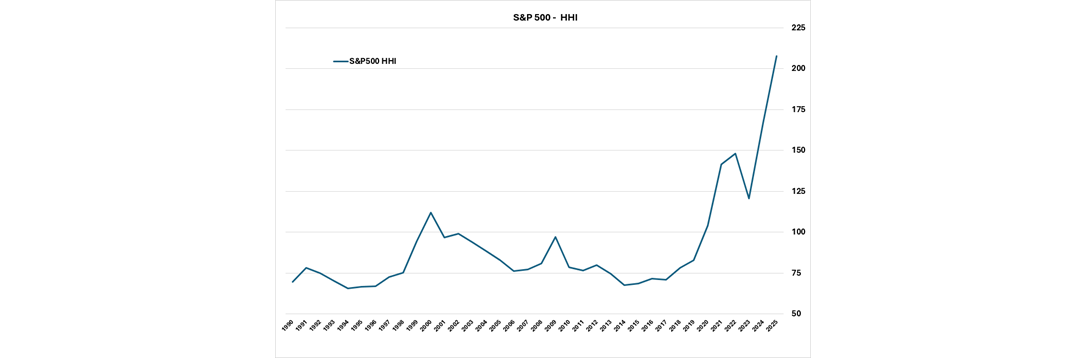

However, the Mag 7 are expensive, trading at an average of 37.93 times historic earnings. The S&P500 is also expensive at 26.64 times earnings. However, this is heavily influenced by the Mag 7, which now accounts for 31.68% of the S&P500 Index, so the S&P 500 Index’s concentration has shot to record levels.

Big US Tech’s main driver is the belief that AI will change the world. This makes chips, GPUs, CPUs and algorithm suppliers that run AI even more fabulously wealthy. Only time will tell if the AI devotees are justified in piling in to Mag 7 stocks at mind-blowing multiples. Judging by what happened in previous asset bubbles, history is not on their side.

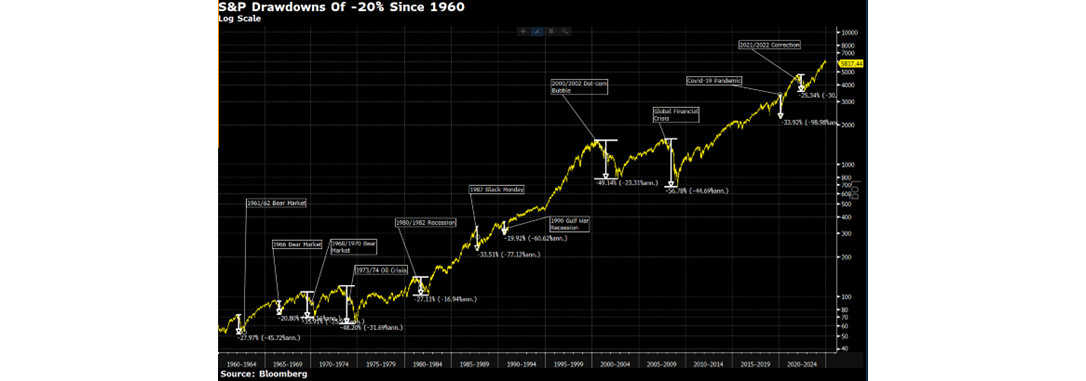

The market could move towards a correction, perhaps dropping by 10 or 20%, usually after a major economic event. To get some idea of what happens in a correction, I went back to the early 1960’s and looked at 11 instances where the S&P500 had drawn down by almost -20% or more in a correction.

Hedging

If you’re worried about an asset, the best hedge is not to hold it. However, the second-best hedge is to buy protections, such as options, where the pay-out is based directly on the movement of the hedged asset’s price.

If you are seeking to hedge against a decline in the value of US large tech because:

- AI is superseded by the next big thing and/or;

- Investors suddenly decide that paying over 180 times earnings for Tesla and big multiples on other Mag 7 members is sub-optimal to their long-term wealth

…then options on the SPX, or even S&P500 stocks specifically, could work.

A further problem to consider with any option strategy is the consequence that ‘time decay’ has on the option’s effectiveness when providing a credible hedge. An option just a week from expiry behaves very differently to one with a year to maturity. This means that the hedging capabilities of options on, say, the S&P500, will change due to time and the index price. These features can be managed through regular monitoring and frequent trading, but management creates extra costs.

Weighting To Value

Another way to hedge is to reduce exposure to overpriced assets, something we have been doing for the last three years. This worked to our advantage in 2022 as growth fell out of favour and value outperformed it by over 20%. UK equities did extremely well too and because our bond duration was short we dodged the sell-off in long-dated gilts, which collapsed by -41.57% (see below).

Ultimately, I expect the AI bubble to end, and I suspect it may end soon. As Faith Popcorn (CEO of marketing firm BrainReserve and author) once said, “Just before consumers stop doing something, they do it with a vengeance”. AI investors have been doing it with a vengeance for some time now, but can the Herfindahl–Hirschman Index (A measure of the size of firms in relation to the industry they are in) for the S&P get any higher? Or the PER spreads grow any wider?

They can, but at some time this will all unwind, as every bubble has done “per omnem historiam” and will do “ad infinitum” (which is just a posh way of saying some things have always happened, and will always happen, but the Latin somehow makes it more believable).

Courtiers take its responsibilities very seriously, knowing we are tasked with ensuring you, our clients, have capital intact for the rest of your lives and ensuring you can meet your target standard of living, all while staying at a risk level suitable for you. Expecting the AI bubble to burst and a market correction means that we will do everything necessary to protect your wealth and not over-expose ourselves to expensive assets.