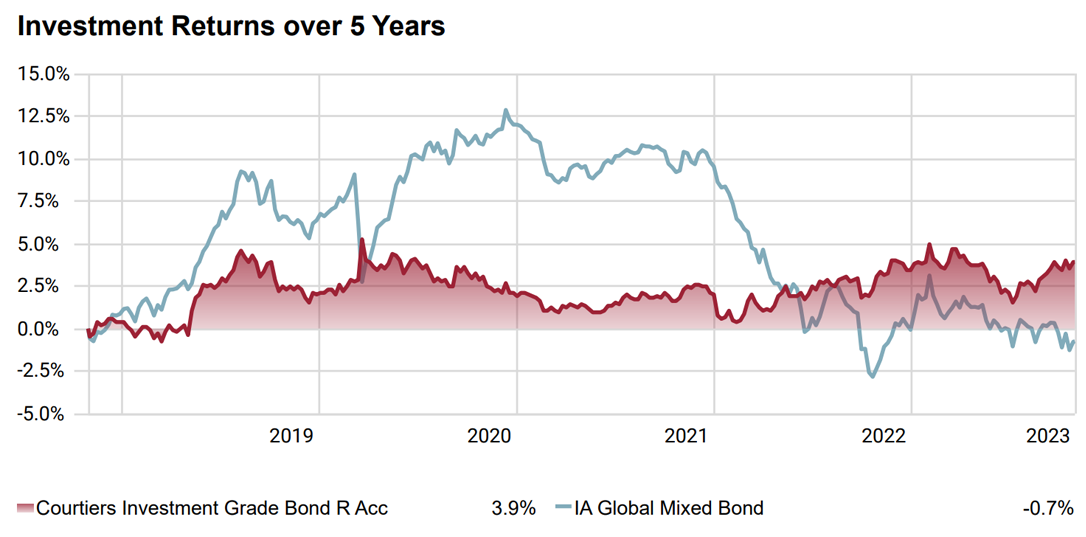

Bonds have had a torrid time in recent years, with some UK government bond fund prices (known as gilts) collapsing by 40% in 2022. At the start of October, it was reported that some US Treasury bonds had plunged by 53% in value since March 2020.

In contrast, by remaining true to its principles and purpose, over the last five years the Courtiers Investment Grade Bond Fund has proven to be a steady ship in choppy waters.

Source: Courtiers Investment Grade Bond Fund Factsheet (R Shares) to 31/10/2023

The fund, which launched in November 2015 alongside the Courtiers UK Equity Income and the Global (ex-UK) Equity Income Fund, invests predominantly in high grade UK government debt. The fund was developed “as a way for investors to diversify the risk of holding equity funds and as a place for investors whose risk profile reduces as they move towards retirement,” says Jake Reynolds, Courtiers Head of Asset Management. And throughout its eight years “it’s remained focused on doing just that.”

The key to explaining the performance of the Courtiers Investment Grade Bond Fund is to understand the relationship between bond prices and interest rates. In short, when interest rates rise as they did when the Bank of England raised the bank rate on 14 successive occasions between March 2020 and August 2023, bond prices fall, particularly long-dated bonds, the values of which are sensitive to rate rises. What caught many fund managers out was that in an attempt to secure a positive yield, they bought longer and longer dated bonds – those that mature in 15, 20, 30 years or even longer periods of time.

“Nothing brings interest rate risk to life more,” says Jake, “than a 100-year bond issued by the Austrian government in 2020”. Initially, as interest rates continued to decline, the bond’s value rose. However, as rates climbed its value plummeted and it is now trading at just EUR 3, down 97%. As inflation, which is generally bad for equities picked up in 2022 and the correlation between the two assets classes strengthened many investors, notably those with a mix of 60%/40% equity/bonds portfolios experienced the worst of both worlds.

In contrast, Courtiers continued to invest in short-dated bonds – 45% of the assets in the Investment Grade Bond Fund mature in less than five years (Fund Factsheet as of 30/09/23), whose values are less sensitive to interest rates. “We made sure we were doing our job as an active manager by steering clear of the risk and the damage that rising interest rates can do to long-dated bonds.”

Jake accepts that during much of the life of the fund, this has meant “going against the grain of interest rates declining” and potentially missing out as long-dated bonds appreciated in value. However, rather than follow the crowd, the focus of the fund always remained as “a risk diversifier” – a strategy that has subsequently proved effective. “We take lessons from history very seriously, and we considered that the big deviation from the interest rate’s long-term average was a big risk”.

Although many economists believe we are near or close to the end of the current interest rate raising cycle as the Bank of England seeks to return inflation to its 2% target, Jake says it’s still too early to stretch out the bond duration of the fund by increasing the fund’s exposure to long-dated bonds.

Although it might be tempting to buy long-dated bonds at collapsed prices, with inflation not yet tamed, a yield of 3.7% for 100 years on the 100-year Austrian bond, for example, “doesn’t make sense.”

As to when interest rates might come down, the Bank of England could start to ease interest rates perhaps as early as next year in response to falling core inflation and a weaker labour market. Not that interest rates will return to the near zero levels that continued for more than a decade following the 2008-2009 Global Financial Crisis. “The era of zero interest rates is very much behind us.”

Irrespective of where interest rates go, Jake says the fund “is going to keep doing what it’s doing – mitigating risks to allow people to be invested in the equities market so they can have fixed income government exposure without the interest rate risk we’ve seen in the past.”