Long term care (LTC) can be costly, depending on the type of care, where it’s provided and individual wealth thresholds. A key consideration when thinking whether you might ever need long term care is how long you might need it for. This can help you plan, and potentially save, accordingly.

Different types of LTC

There are three main types of LTC in the UK:

- Home care: Where you remain living at home, with anything from low-level to intensive care, across either a short or long-term period.

- Live-in care: If you have more intensive care needs but are reluctant to enter residential care, live-in care is an option. This is where carers live in your home with you, offering one-to-one support in your own surroundings.

- Residential care: If you find you have specific care needs or would benefit from a team surrounding and supporting you, deciding to move into residential care is the most effective option.

Residential care:

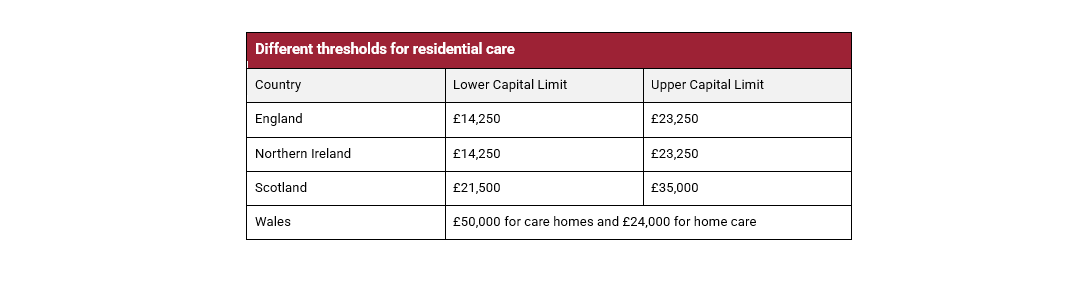

Different thresholds for residential care

Across the UK, there are different thresholds for how much you can have in savings and assets, known as ‘capital limits for care’. If your capital is above the top threshold in your area, you’ll need to pay for your care. Similarly, if you’re below the lowest limit, you’ll have your care paid for you. If you fall in the middle, you’ll qualify for partial funding, which varies depending on the country you live in:

Note: Prices accurate on 12/05/25 from Lottie

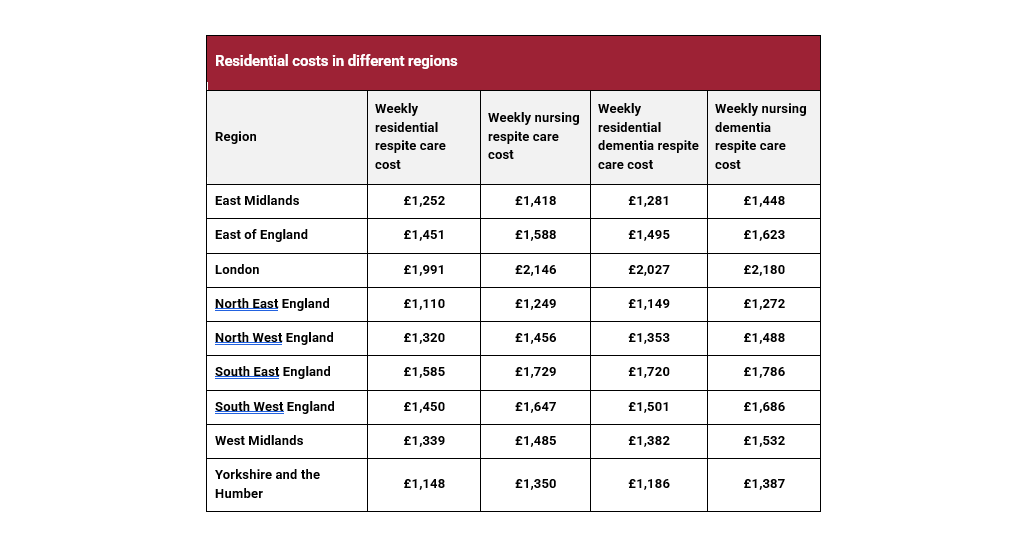

Residential costs in different regions

To make things even more confusing, while the average cost of a person’s care is £1,317 a week, on average (around £70,000 a year), this differs not only across type of care and country, but also across region. With costs in March 2024 showing that the Northeast of England is £1,110 a week while London comes in at £1,991, it could be the difference of almost £46,000 a year.

Note: Prices accurate on 12/05//25 from Lottie

Home care and live-in care:

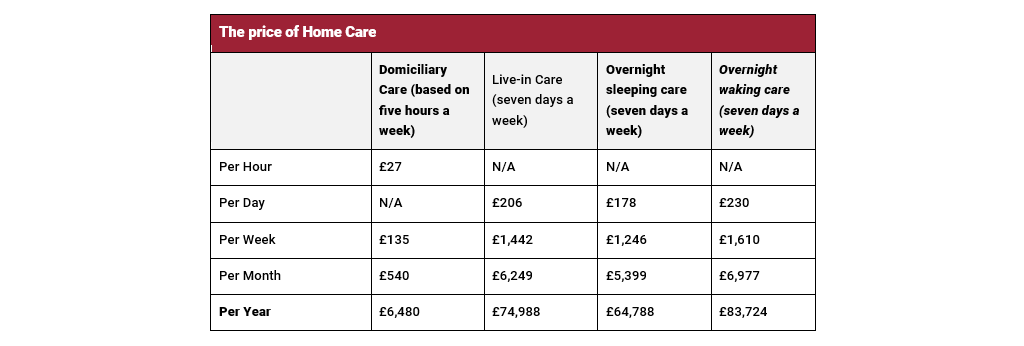

The price of Home Care

If you find you are mostly independent but need a little flexibility and help with specific tasks, having home (or domiciliary) care could be a suitable option for you.

Costs for home care vary across the UK, depending on what type of care you need. If, for example, you have five hours of care a week, it can be a lot cheaper to stay at home. However, if you need full, overnight waking care, the costs will be a lot higher.

Note: Prices accurate on 12/05//25 from Lottie

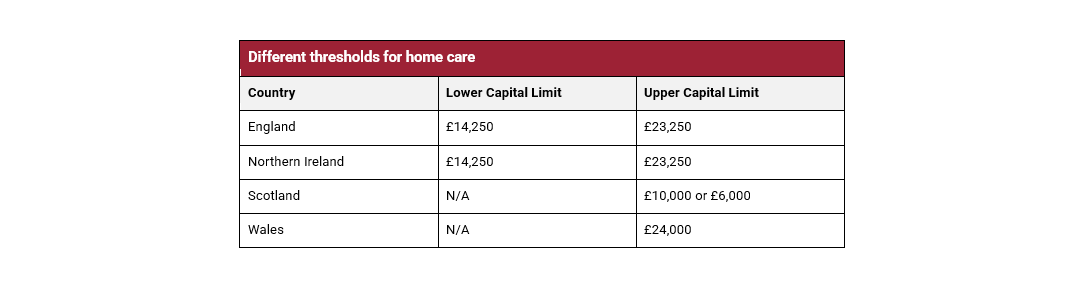

Different thresholds for home care

Similar to residential care, whether you need to pay for home care comes down to your savings and income.

The value of your property isn’t considered when the local council carries out your financial assessment, but they do consider your savings. If you’re above the upper savings threshold, you will need to self-fund your care. Similarly, below the lower savings threshold means you’ll gain the maximum support from your local council. Having savings that means you fall between the two gives you partial support.

Note: Prices accurate on 12/05//25 from Lottie

If you fall beneath Wales’ Upper Capital Limit, you can only be charged a maximum of £100 per week for your home care, regardless of the level of service you require. This means that, even with the minimum income amount in Wales, you’ll be left with £39.50 a week of expendable income.

In Scotland, you receive free personal and nursing care (£248.70 a week for personal care and/or £111.90 a week for nursing care) if you need it. If you’re over State Pension age, Scotland advises councils to disregard the first £10,000 of your savings – or £6,000 if you are under Pension age. After this, you will be required to make a weekly tariff contribution towards your home care in line with the rest of your savings.

If you are self-funding, single and above State Pension age, you must be left with an income of at least £228.70 a week (the Minimum Income Guarantee).

What you need to think about around care:

What is included in assessing care costs?

Firstly, while assessing your wealth, the local authority looking into your care costs will consider all your savings and assets. However, if you own any joint savings, they will be valued at 50% of the amount (with your partner of the joint savings owning the other 50%). If your wealth includes property, the value you owe is disregarded if your partner still lives there, if a close relative lives there and they are over 60, or if a child of yours who is under 18, or incapacitated, lives there.

Annuity, earnings not paid as income and pre-arranged third-party payments for residential care (not voluntary payments removing arrears) are seen as capital treated as income. Any funds available on request, unclaimed Premium Bond wins or disposed of capital is seen as notional capital.

How long will you need care?

When people think of LTC costs, they see the figure for the yearly sum and blanch, however it’s important to consider the length you may need the long-term care for overall. If you’re considering care in final years, for example, you may only need to factor in two to three years of care costs, meaning an estimated £210,000 per person for care home costs or £264,000 for full home care costs (using the costs in the The price of Home Care table above).

Ultimately, the way to approach your long-term finances is to ask yourself (and your partner, when planning for both of you) the following questions:

- How much do you:

-

- want to have for your care?

-

- leave in your inheritance?

Steps to making your decision

Once you’ve decided to dedicate funds towards your potential long-term care costs, are you going to set the money aside or consider downsizing? According to Dunstan Thomas’ Baby Boomer 2022 survey, 31% of those asked plan to fund their LTC with savings, with another 24% using their pension to so do. However, 23% expect to rely on the NHS, and a final 27% haven’t thought about it, despite them potentially needing care in the next 10 years.

Ultimately, you will need to remain flexible. Keeping the likelihood of care needs in proportion is important when considering the needs you may have to address. The most important requirement is not to obsess over it to a state that it affects your level of living now.

You may find the following articles we’ve previously published helpful when considering your own options and decisions:

Long term care funding and protecting your property – Courtiers Wealth Management

Understanding and planning care costs – Courtiers Wealth Management

Paying for care – Courtiers Wealth Management

How we can help

There are ways to ensure your wealth passes on to your family through trusts or financial planning. Courtiers is on hand to help guide you through your individual needs so you can approach the final stages of your life with confidence in your financial position.

We can work with you to review your investment arrangements, including whether an immediate needs annuity could be an option.

What is an immediate needs annuity?

Different to a pension annuity, an immediate needs annuity (also known as an immediate care plan) is specifically designed to fund long-term care. It can be useful for those likely to be in care for the rest of their lives, either in a care home or in their own home. These also tend to be flexible if you change care providers, as the insurer will rearrange payments to send to the new care home or carer.

As the payments are sent straight to the care provider, your immediate needs annuity insurer is not considered part of your income and, unlike other annuities, are considered tax-free. However, like other annuities, after the initial 30-day cooldown period, you’ll be locked into the plan and cannot cancel, change your mind, or get your lump-sum back (unless you pay for a capital protection clause for your family). You may also then be ineligible for certain means-tested state benefits, depending on the level of your payments.

An immediate needs annuity involves entering into a contract with an insurance company who, in return for some or all of your pension savings, pay you a guaranteed lifetime income to cover costs for long-term care costs, where the payments will not run out.

Ultimately, your upfront payment will depend on:

- Your age

- The state of your health and your life expectancy

- Current annuity rates

- The income you’ll need, and whether this will stay the same or increase over time

In some cases, you can pay a capital protection clause to enable your family to receive your lump sum back if you were to die earlier than anticipated.

Cashflow modelling and planning

We can also help you with cashflow modelling and planning. A cashflow model helps you review all your income, outgoings and the resulting cash balance. It shows your capital in a simple, linear projection. We build cashflow forecasting into our annual reviews, making sure you fully understand your financial situation.

While basic modelling tools are available, they do not offer the advanced features of our sophisticated cashflow software designed for Financial Advisers. Our software allows us to model almost every situation you could imagine and adjust for any changes. This includes tackling increasingly complex tax codes, pension legislation, savings requirements and any envisioned investment solutions.

Financial planning offers you more control over your financial future

Having a clear and detailed understanding of your current financial situation allows you to:

- Articulate your desired financial future to a monetary level.

- Gain a realistic investment timeframe, ignoring short-term volatility.

- Create a realistic investment strategy that fits your objectives and household budget.

- Strike a balance between the long-term cost of spending today and saving for tomorrow.

- Understand any tax implications around your decisions and plan accordingly.

- Ensure measures are in place when death or disablement may affect finances.

What we will ask you to help us with your financial planning:

- Data Gathering – you’ll be asked to provide any current and future expenditure details.

- Presentation – you’ll be presented with clear and concise lifetime cashflow modelling scenarios, showing you how your future financial objectives could play out.

- Ongoing – you’ll keep on track with your financial journey through annual reviews, ad-hoc experiences and catch-ups with your Courtiers Adviser.

We use Lifetime Cashflow Modelling and forecasting when we build your annual review, working with you to ensure you have a plan and focus your wealth on what you want and need to achieve.

You can learn more about Lifetime Cashflow Modelling in this article.