Lifetime cashflow modelling is the heart of every Financial Planner’s arsenal. Essential to their craft and the advice we can give you, our integrated cashflow modelling tools ensure we can deliver on your finances.

But what is lifetime cashflow modelling? And, when you know the benefits and considerations around producing a cashflow model, how can it help you?

In its simplest form

A cashflow model helps you review all your income, outgoings and the resulting cash balance. It shows your finances in a simple, linear projection.

You can create a basic model using a financial calculator, but if you want to create a more complicated projection, you will need to use a spreadsheet or a cashflow tool.

Utilise our superior cashflow abilities

Basic modelling tools can’t compete with the most sophisticated cashflow software available to Financial Advisers. Our software allows us to model almost every situation you could imagine, as well as to adjust and incorporate any changes necessary. We can tackle any increasingly complex tax codes, ever changing pension legislation, your savings requirements and any investment solutions you envision.

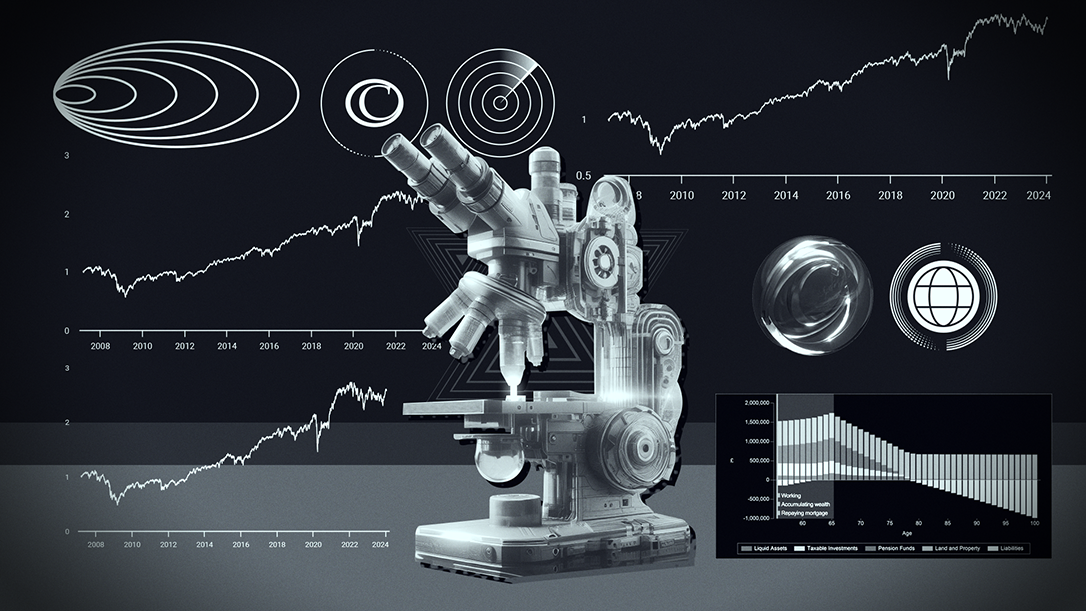

Distilling complex information into a pictorial representation of your lifetime cashflow offers you a powerful tool to assess your financial needs. Being able to simplify and forecast your cashflow while accounting for inflation, taxation and investment growth offers you a huge advantage when you need to make financial decisions.

How can a Financial Planner help you?

Working with a Courtiers Financial Planner adept in cashflow modelling allows you to gain:

- A clear and comprehensive financial arrangement summary.

- An income and expenditure analysis, and the planning assumptions used.

- An understanding of, and ability to plan for, any shortfalls that may occur.

- Defined goals and objectives into a monetary value.

- An understanding of how to achieve your financial goals and financial independence.

- Adequate provision for dependants in the event of death or disability.

- A consideration of the tax consequences of different strategies.

- Appropriate investment strategy development for capital and surplus income, in line with your risk attitude and financial flexibility or accessibility.

Using a Courtiers Financial Planner ensures you benefit from greater clarity about your financial situation, enabling you to make informed decisions.

The cashflow model process

You will need to focus on these two factors when working with Courtiers to build your cashflow model:

-

- Let’s start with the data

The starting point for any cashflow model is the data fed into it. The accuracy of the data used in the model is crucial but it doesn’t mean you need to analyse expenditure down to each item; a consolidated expenditure figure works well. To ensure financial goals are achieved, it’s worth thinking about the specific needs you want to cover. While accruing enough to be able to retire comfortably is a good goal, knowing how much income that would require ensures you know what to work towards. The same applies for any other objectives you have – the more specific and numerically focused, the easier it will be for your financial adviser to design the best plan for you. - Using our assumptions

Assumptions are averages that remain constant throughout time with no accounting for periods of negative investment returns or abnormally high inflation. It’s not only your financial data that needs to be accurate; some default assumptions could skew the data if not questioned. For financial software, assumptions arise around inflation and investment growth rates. Your plans can also change, which could significantly alter assumptions. To help, being upfront and honest about your goals will limit or reduce these wrong assumptions, which ensures your financial plan meets your desired goals and objectives.There are no set rules around the assumptions used, but many are based on historical data across the business. At Courtiers, we use a custom-built ISRRA (Investment Strategy Risk Return Analysis) tool, refined to project and forecast your financial plan.

- Let’s start with the data

Some common assumptions include:

-

Inflation Rate

Inflation affects both income and expenses. Typically, Financial Planners assume a 3% annual inflation rate, however if you’re reaching, or in retirement, you may experience a higher personal inflation rate than the rest of the population.

More complex models can use several different inflation rates for different types of income and expenditure.

-

Investment Returns

To calculate your investment growth over time, you will need to apply an estimated rate of return. Returns vary across different asset classes and the underlying tax structure; Cash ISAs are generally lower than bonds, which are generally lower than equities. Furthermore, growth rates that might have seemed appropriate 10 years ago might be considered high by today’s standards.

-

Life Expectancy

People tend to underestimate their life expectancy and often anchor assumptions on their parents or grandparents. Life expectancy has risen over the past few decades, so you may have more years than you expect that you need to account for.

-

Tax Rates and Allowances

The government has repeatedly shown you cannot rely on things to stay the same, especially when dealing with tax rates and allowances. Despite frozen personal allowances and tax bands for some years, most assumptions allow for annual increases in line with inflation.

Tax rates are typically held at current rates for planning purposes, but if the government decides to change rates, planning assumptions also need to change.

Staying on track

When preparing lifetime cashflow modelling, everything is assumed to travel in a straight line. However, this doesn’t usually happen in financial markets. Assumptions used for growth rates, budgeting and taxes, which are used as the basis of any cashflow modelling, can be hard to plot.

Regular reviews ensure you can keep your finance plans on track. This is especially important if your finance projections are far out; like a flight plan needing constant adjustment to account for changing weather conditions, a cashflow model needs to be adjusted each year to take account of any financial turbulence and changes in direction.

The model is only ever a guide and reflects a snapshot in time. There are too many variables subject to change which prevent the model from accurately predicting future outcomes. It’s also only as good as the information available at the time it is produced and must be kept updated with changing circumstances.

How we present this to you

Using these tools we handle a lot of complex information and turn it into a simple graphical output. We also deliver detailed reports, so you can interrogate the numbers.

Courtiers can use cashflow modelling to help you make better decisions, offering you information as clearly as possible. Using a single chart, we can help you project your financial future and advise you on how to deliver and meet your goals.

Simple changes to the way any information is presented can mean you gain the best out of these tools, so if you ever feel there could be a better way to view the information presented to you, your adviser will always welcome your views.

Courtiers’ Financial Advisers can guide you and help you with cashflow modelling, discussing any assumptions while planning what you may need to work towards. Working together with you, we can create a flexible lifetime cashflow model that helps you deliver on your financial goals. If you are interested in knowing more, read about lifetime cashflow modelling from one of our Financial Planners, including an example and case study.