Thank you for subscribing to News & Insights. We'll keep you updated.

Latest News & Insights

22

Mar

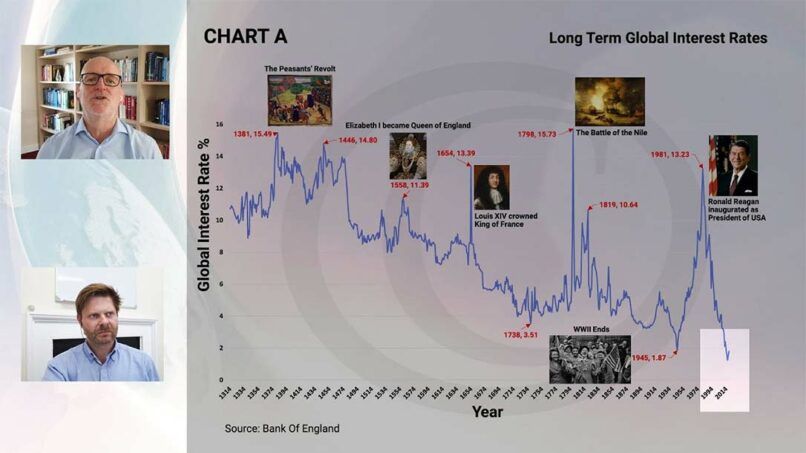

Could we fix interest rates by spending more?

After reading a few papers from the Bank of England’s Monetary Policy Committee around interest rates and UK spending, Gary Reynolds, CIO, reflects on how their stances differ to the US and suggests what would happen if we took a more Keynesian economic approach.

01

Mar

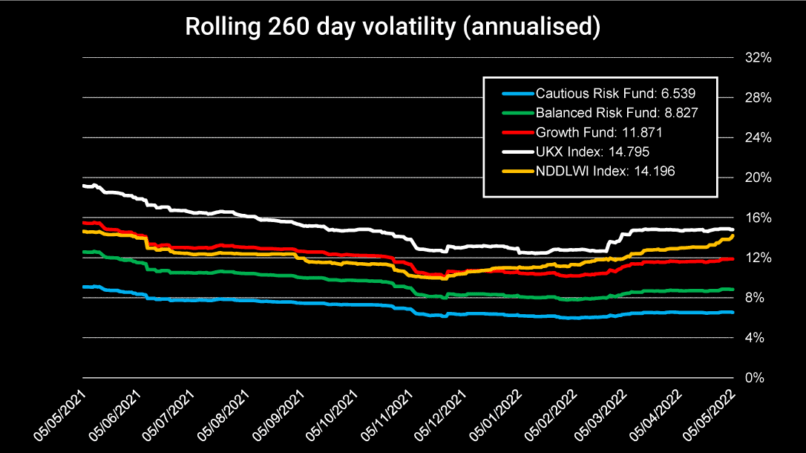

How we built the Multi-Asset Fund risk controls

We sat down with Gary Reynolds, CIO, to discuss how the funds are constructed, what risk controls mean for our Courtiers Multi-Asset Funds, and how they ensure your wealth is managed at an appropriate level of risk and diversification for you, including why we wouldn’t just add one of the ‘Mag Seven’ into the mix.

16

Feb

How financial planning is the key link that puts you in control of your capital

Rather than choosing a product and building your financial plans around it, the better way to ensure your finances work towards your goals is to create a financial plan. We run through how to approach this effective measure and what results you may gain.

26

Jan

What is lifetime cashflow modelling?

Essential to the advice we can give you, lifetime cashflow modelling ensures we can project, plan and proposition how to make your finances deliver to your lifetime goals. Key to a strong financial plan, lifetime cashflow modelling is at the heart of every Financial Planner’s arsenal.

16

Jan

Courtiers, Rams Rugby and the value of community

A focus on team, community and development - are we talking about the Rams, Courtiers or both? With the Rams reaching its 100th year and over 30 years of Courtiers sponsorship, we look at why we decided to sponsor them, and how the two share some of the same values and qualities.

20

Oct

Business cycles, recession and timing the market

Gary explains why the failure of the business cycle to behave as everyone thought it would and technological progress driven by AI could be the catalyst for a brighter future for the economy, as well as providing Courtiers with exciting investment opportunities.

16

Oct

Supporting younger generations

Bare trusts can be an effective way for families to build and then pass on wealth to younger generations, while providing children or grandchildren with a useful financial leg up as they enter adulthood. This article explains why they are popular with Courtiers clients, while highlighting potential drawbacks and complications.

11

Oct

Taking advantage of capital gains tax planning opportunities

With the tax take from capital gains tax predicted to rise to £26 billion by 2027-28, financial planning around capital gains tax (CGT) is more important than ever. This article outlines seven strategies used by Courtiers Advisers to help minimise clients’ CGT bills.

05

Oct

Politics, China, and exciting bargains

With the party conference season in full swing, Gary shares his thoughts with Leo on the state of UK politics, and whether it really matters who wins the next general election. He goes on to talk about the Courtiers portfolio, highlighting infrastructure funds and house builders as representing particularly good value.

04

Oct

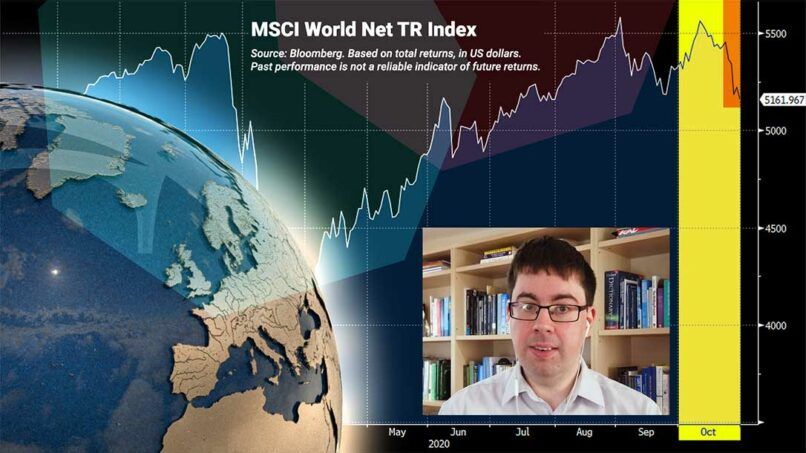

October 2023 – Market Update

After a strong performance so far this year, September saw a reversal in fortunes for some of the US’s largest tech companies, while UK markets did relatively well. James tells Leo what he thinks is going on and highlights some positive news about one of Courtiers holdings.

27

Sep

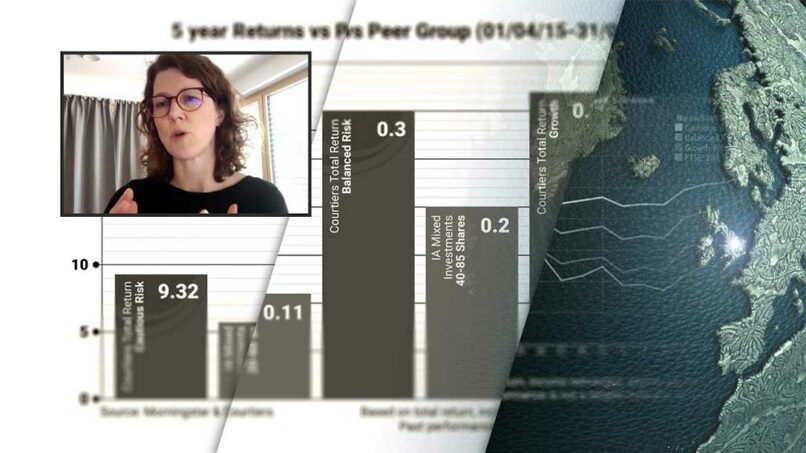

Courtiers funds harnessing the benefits of diversification

Constructing funds that are not concentrated in one sector is just one of the ways that Courtiers builds and maintains well-diversified funds. This article explains how, by diversifying in this and other ways the Investment Team reduces risk to grow long-term returns.

20

Sep

ISAs & Pensions compared (part 1)

Pensions and Individual Savings Accounts (ISAs) are two of the building blocks of UK household wealth, helping millions of people to meet their financial objectives and goals. In the first of three articles, we look at how the two match up during the accumulation phase of building wealth.

18

Sep

Clients in focus as Advisers have plenty to ponder

The potential drawbacks of higher interest rates on savings, an announcement on future taxation policy by the Shadow Chancellor, and the apparent rise of the ‘Bank of Family’ are three subjects covered by Paul and Rikki in the latest Quarterly Adviser Review. The joint Heads of Private Clients, also explain why they are excited about changes at Courtiers aimed at ensuring that the Advisory Service continues to evolve to the benefit of clients.

01

Sep

Big & expensive reigns proven short-lived

Large and very expensive US stocks have outperformed their small good value counterparts since late 2017. This research note, by Jacob Reynolds, Courtiers Head of Asset Management, shows that since 1951 comparable periods have been rare and short-lived, lasting around four years. After this, the biggest most expensive stocks underperformed and small good value stocks bounced back to deliver superior long-term returns.

09

Aug

Navigating inheritance tax/probate challenges

Having to pay inheritance tax before probate is granted while not being able to access the necessary funds because of delays in probate being granted is a chicken and egg scenario that’s become increasingly common. With the help of Graeme Clark, Chartered Financial Planner in the Courtiers Private Client Team, this article explores the various options available to those facing this frustrating situation.

03

Aug

August 2023 – Market Update

A recent US debt downgrade tempered the positive performance of equity markets in July, although Courtiers’ strategy of avoiding overpriced stocks means the impact on the Courtiers Funds has been relatively limited, says James Timpson, Fund Manager, Courtiers Multi-Asset Funds. James also mentions two new stocks recently added to the Courtiers portfolio.

26

Jul

Courtiers well placed as industry faces uncertain future, says CEO

In response to a report warning that one in six wealth management companies are set to disappear in the next five years, Courtiers CEO Jamie Shepperd says he’s confident the company is well placed to weather the storm and to continue to meet the needs of clients and their families.

21

Jul

Two ways to switch ISA or SIPP provider

Switching an ISA, SIPP or personal pension to another provider such as Courtiers needn’t be hard work. However, it’s important to follow the correct process. There are two ways to do it - cash transfers and in specie transfers. This article considers the ins and outs of each.

11

Jul

A tale of two companies

In this research note, Gary Reynolds, Courtiers CIO, explains why despite higher revenue and profits, and better cash flow, Stellantis, the owner of a number of global marques, including Peugeot, Maserati and Vauxhall is valued at around $56BN while Tesla is valued at a staggering $835BN, around 15 times higher.

The outperformance of growth stocks such as Tesla since the beginning of 2023, only accentuates the differences in valuations between growth and value stocks and creates considerable opportunities for value investors like Courtiers, he says.

07

Jul

James Timpson reflects on 10 years at Courtiers

James Timpson, Fund Manager, Courtiers Multi-Asset Funds joined the company in June 2013. Here James reflects on those 10 years. He talks about what he’s learnt, dealing with market volatility, team ethos, and how despite a few ups and downs along the way the funds have delivered strong long-term performance for Courtiers investors.

05

Jul

July 2023 – Market Update

This year’s market rally in the US has been dominated by just a few large tech companies, says James Timpson, Fund Manager of the Courtiers Multi-Asset Funds. While a combination of limited exposure to tech, stubborn inflation and higher interest rates means the UK market has underperformed, it also means the UK represents great value.

06

Jun

Harnessing the power of AI

Courtiers Research Intern Dr Tom Humberstone explains why he’s excited about AI (Artificial Intelligence). He considers its potential uses within investment management and explains how if introduced and managed in the right way it could lead to better outcomes for Courtiers clients.

02

Jun

June 2023 – Market Update

James Timpson, Fund Manager, Courtiers Multi-Asset Funds discusses what he describes as “a fairly topsy-turvy month” for markets in May, with tech stocks riding the AI wave bolstering the US market and the UK market struggling by comparison. He expresses relief that the US debt ceiling won’t be breached, at least for now, and explains why Courtiers is sticking to its value investing guns.

25

May

Courtiers Advisers getting to grips with taxation challenge

With support and advice from their Courtiers Adviser, there’s plenty that clients can do to ease the impact of government tax policies, say Graeme Clark, Head of Private Clients and Paul Kemsley, Senior Private Client Manager in their latest Adviser Review.

16

May

Why Courtiers is backing unloved UK market

While London’s status as a global hub for equities is under threat and many investors are shunning the UK, Jacob Reynolds, Courtiers Head of Asset Management, says there are good reasons why Courtiers isn’t following the crowd. Indeed, he says, the Investment Team has increased its exposure to the UK market.

04

May

May 2023 – Market Update

James Timpson, Fund Manager, Courtiers Multi-Asset Funds reflects on a less volatile month for markets in April, which saw gains across a broad range of indices, particularly the FTSE 100 index. James goes on to suggest that with this week’s collapse of US bank First Republic, concerns over the stability of the banking sector haven’t gone away and are continuing to impact markets.

04

Apr

April 2023 – Market Update

Banking shares weighed heavily on markets in March, with the collapse of Silicon Valley Bank in the US and Swiss bank Credit Suisse sending shockwaves through the banking sector. The uncertainty led to speculation that central banks might curb their enthusiasm for further interest rate hikes, says James Timpson, Fund Manager, Courtiers Multi-Asset Funds.

30

Mar

Abolition of the lifetime allowance

The abolition of the lifetime allowance announced in the recent Budget represents one of the biggest shakeups in UK pensions for many years. As this article illustrates, guidance published since the Budget has done nothing to dispel the significance of the changes, nor the resulting controversy, with the Labour Party pledging to reverse them should they become the next government.

21

Mar

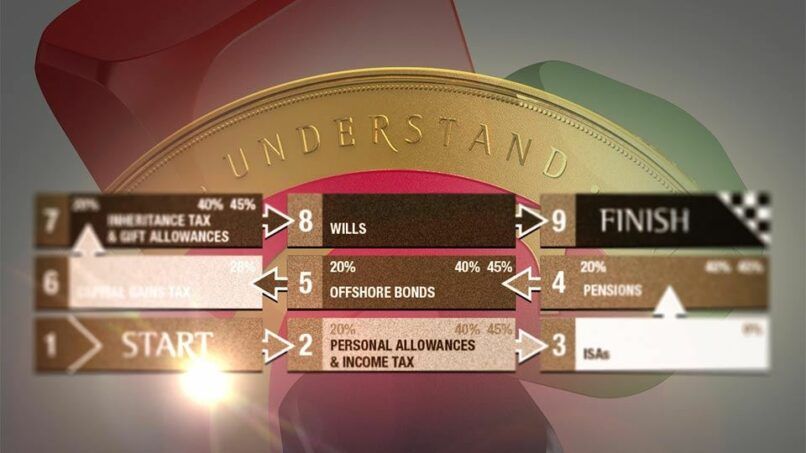

Focus on: Investment bonds

Investment bonds sit towards the complex end of the spectrum of financial products. But their potential to deliver long-term capital growth, their ability to produce income on which tax is deferred and to pass on or gift wealth in a tax-efficient way means they can be worth considering.

15

Mar

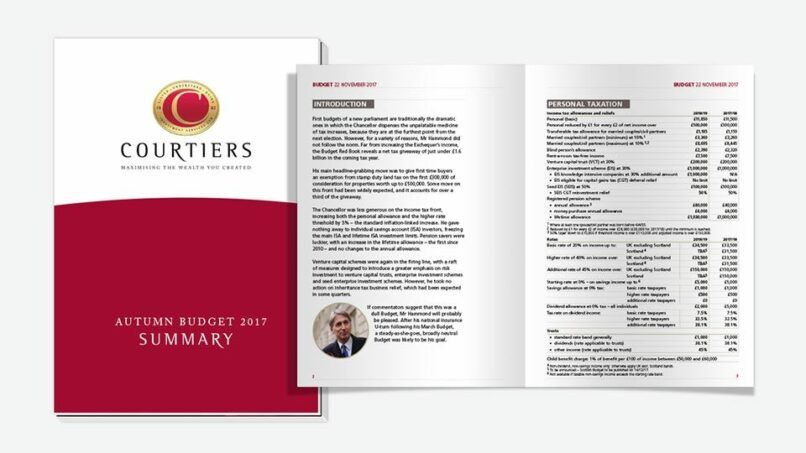

Spring Budget Response

Jeremy Hunt’s first Budget contained several measures that are good news for those wanting to boost their pension savings and may encourage some older workers not to retire or even to return to the workforce. Any hopes of tax cuts were dashed. The Investment, Private Client and Corporate Teams give their initial responses.

13

Mar

Say ‘Yes’ to end-of-year financial planning opportunities

Putting more into your pension, topping up your ISA and making use of your gifting allowances are just three of the things you could do before the end of the tax year on 5 April to mitigate the impact of government taxation polices that are dragging more and more people into paying more tax.

08

Mar

Spring Budget: what next?

A lot of water’s flowed under the bridge since the then Chancellor of the Exchequer Rishi Sunak delivered the last Budget back in October 2021. After last year’s Growth Plan fell apart, Jeremy Hunt was brought in to steady the ship. Next week will be his first Budget, so should we expect more of the same, or with the government’s finances healthier than anticipated could tax cuts be in the offing?

02

Mar

March 2023 – Market Update

The FTSE 100 Index, launched way back in 1984, was the standout performer in February breaking through the 8,000 barrier for the first time. In contrast, after a generally positive start to the year, most other global equity markets were hit by lingering volatility, which saw the S&P USD 500 Index decline by nearly 2.5%.

02

Feb

February 2023 – Market Update

After suffering their worst year since the global financial crisis, equity markets bounced back in the first month of 2023. The MSCI World NR index, which tracks the global developed equity market, rose 6.50% in January, amidst expectations that central banks would ease rate hikes over the coming year. European stocks in particular saw a healthy bounce during the month, with the Eurostoxx 50 NR index climbing nearly 10% in its best performing January to date.

13

Jan

‘We’re just the custodians,’ says Courtiers CEO

Courtiers CEO Jamie Shepperd outlines his long-term vision for the company and explains why succession planning is central to ensuring that the company remains true to its original values and ethos and to maintaining its commitment to delivering an exceptional client experience.

30

Dec

Past, present, career advice and a dose of hubris

As we approach the end of 2022, CIO Gary Reynolds looks back at the last 12 months, looks ahead to 2023, and explains why as he approaches 50 years working in financial services, advice from the recent winner of Strictly Come Dancing is so pertinent to anyone contemplating a career in the sector.

29

Dec

Courtiers’ Charity of the Year

As Courtiers’ Charity of the Year, Thames Valley Adventure Playground will be the focus of much of the fundraising for good causes by Courtiers employees over the next nine months. This article details the valuable work the charity does and explains why supporting a charity each year is so important for Courtiers and its employees.

23

Nov

Courtiers taps into that winning habit

The team sitting at the top of the third tier of English rugby and a three-time winner at Cheltenham have one important thing in common – they are both backed by Courtiers. But whether it’s on or off the rugby field or the racecourse, Courtiers’ ambition to constantly aim higher and its pursuit of excellence remains undimmed.

17

Nov

Autumn Statement Response

Chancellor of the Exchequer Jeremy Hunt promised to put the country’s finances on an even keel, giving heavy hints that he would target those with the broadest shoulders. The Investment, Private Client and Corporate Teams give their initial assessment of today’s Autumn Statement.

04

Nov

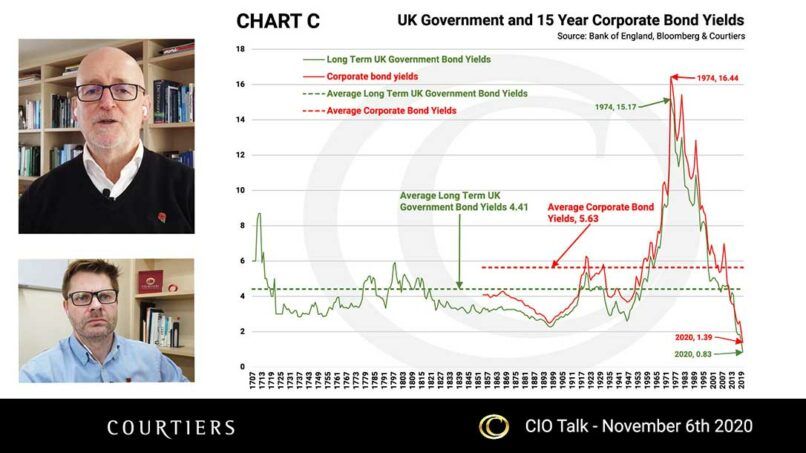

Hype, Armageddon, and why bonds are buyable again

Amid all the lurid headlines about the longest recession since the 1920s, Gary Reynolds, Courtiers CIO, takes a resolutely optimistic stance. Fears of financial Armageddon are unlikely to be realised, he says. Meanwhile, inflation could peak sooner than many expect, which would make the value of companies Courtiers holds at very low multiples extremely attractive.

03

Nov

November 2022 – Market Update

Markets staged a recovery in October, with global equities up 7% for the month and the FTSE 100 3% higher. As James Timpson, Courtiers Deputy Fund Manager explains, China was the notable exception, where stocks were off 16%, although with no direct investments there the Courtiers Funds weren’t hit. Both gilt prices and the value of the pound versus the dollar also recovered from their September lows.

28

Oct

A few questions on the table…

After the demise of Trussonomics, the worst is probably over, says CIO Gary Reynolds as he runs a critical eye over the economic and tax polices of Rishi Sunak’s new government. He assesses the performance of the Courtiers Funds and explains how avoiding long dated bonds helped the Investment Team to navigate the recent storm and how it’s now moving to take advantage of lower prices.

19

Oct

Inflation – let’s get personal

With inflation rebounding to its 40-year high in September, few statistics are capable of grabbing the public’s attention like the monthly figures on prices released by the Office for National Statistics. But how do the official figures published each month compare with the inflation rate in individual households? The personal inflation calculator created by the Office for National Statistics will give you a good idea.

07

Oct

UFPLS: Look before you lump it

The ability to take a lump sum from pension savings is a useful feature of modern pensions. One possibility is to take an uncrystallised funds pension lump sum (UFPLS). While a UFPLS has its attractions, it also has its limitations, not least the way such withdrawals are taxed.

04

Oct

October 2022 – Market Update

September proved to be a difficult month for investors, with a potent cocktail of economic and geo-political uncertainty pushing valuations lower pretty much across the board, says Courtiers Deputy Fund Manager, James Timpson. The market’s unfavourable reaction to Kwasi Kwarteng’s so-called mini-budget hit the pound hard against the dollar, although it subsequently staged a recovery, while markets began October more positively.

30

Sep

Burgers, bookcases, bonds and a new Courtiers Fund

CIO Gary Reynolds puts the events of the past week in perspective, explains the relevance of Big Macs & BILLY bookcases, reviews the performance of the Courtiers Funds and responds to recent BoE and market moves. He also looks forward to the launch of the Courtiers Ethical Value Equity Fund.

22

Sep

Adviser review: Taking events in their stride

In their latest Quarterly Adviser Update, Graeme Clark, Head of Private Clients and Paul Kemsley, Senior Private Client Manager, consider the impact of continuing economic instability and market volatility on clients’ finances and give their thoughts on what might lie ahead.

30

Aug

Carry forward – a pension saver’s tax-saving grace?

Tax relief on pension contributions is one of the most valuable aspects of the UK pensions system. In certain circumstances, individuals are allowed to carry forward unused allowances from previous tax years, raising their tax-free annual allowance above the usual £40,000.

16

Aug

Pensions: A stronger nudge towards Pension Wise

New rules introduced at the start of June aim to help members of pension schemes make better decisions when they access their pension savings by nudging them in the direction of Pension Wise, the free government backed service. What are the new rules, and will stronger nudge actually work?

12

Aug

CIO Comment: Britain’s just not working

CIO Gary Reynolds expounds on his recent paper ‘Britain’s just not working’ and on the key issues holding back the UK economy. He highlights the failure of recent governments to address the causes of the country's economic malaise and explains why he is sceptical of one of the Bank of England’s recent forecasts on inflation. He points out how current difficulties and ongoing uncertainty are throwing up good opportunities to buy stocks at decent prices.

04

Aug

Insurance: putting a premium on life

Around two in three adults in the UK don’t insure their life. This article asks why this is, explains the different types of life insurance available, and looks at how life insurance can provide valuable financial protection for partners, dependants and other family members.

02

Aug

August 2022 – Market Update

After the doom and gloom of June, world markets rallied by nearly 8% in July. James Timpson, Courtiers Deputy Fund Manager looks back at a month that was noticeable for a reversal of some recent trends, with US tech stocks Apple and Amazon advancing, bonds staging a recovery and oil prices falling back as a result of a slowdown in the Chinese economy.

25

Jul

Should buy-to-let landlords set up limited companies?

The abolition of mortgage interest tax relief in April 2020 sent seismic waves through the buy to let market. In response some landlords chose to set up limited companies to hold their properties. More than two years’ on from the ending of this valuable relief, does incorporation still make sense?

23

Jun

Clients urged to stick to long term plans and goals

With people’s finances under increasing strain from 40-year high inflation and myriad other external factors, clients should work closely with their Adviser to help them stick to their long term plans and goals, say Graeme Clark, Head of Private Clients, and Paul Kemsley, Senior Private Client Manager in their latest Quarterly Review.

21

Jun

Taxman or Tax scam?

When contacted by someone purporting to be from HMRC it pays to be vigilant. Is the person, email or text really from HMRC, or is it a scam perpetrated by fraudsters? This article highlights the sort of things these criminals get up to as they seek to part you from your money and gives advice on how you can avoid falling victim.

16

Jun

Putting Communi-Tee at the heart of golf (Includes update)

It is important for Courtiers that the organisations with whom it partners share its own commitment to the community and wider society. That’s why it is delighted to support a former Men’s Captain at Badgemore Park’s efforts to raise funds for three charities that are close to the hearts of the club’s members.

14

Jun

CIO Talk: Coping with tough times

Since the start of the year, it’s been a tough time for markets, with several experiencing falls of

more than 20%. Set against these benchmarks, Courtiers Funds have performed impressively, says Gary, as he outlines the Investment Team’s approach to stock selection. Looking ahead, he refuses to be ‘a doomster’, and sees great opportunities in clean energy.

14

Jun

Are annuities set for a comeback?

The rise of income drawdown and persistently low interest rates led to a collapse in the sale of annuities. With rising interest rates already feeding through into higher pay outs and the security of a guaranteed income in retirement, could annuities be about to make a comeback?

26

May

Life’s not a lottery – as these 9 numbers show

While winning a lottery is never a dead cert, there are some numbers we can choose that could help us control our affairs, and especially our finances. This article highlights how reaching certain ages can open the door to financial services and planning opportunities.

13

May

Value never went away

Following the 2008/09 global financial crisis, growth investing enjoyed a golden period. Head of Asset Management, Jacob Reynolds argues that this was just a blip and that value stocks are back in vogue and on track to continue their long-term outperformance of their growth stock counterparts.

01

Mar

Ukraine Update

Russia’s invasion of Ukraine has shaken markets around the world. By comparison, Courtiers multi-asset and equity funds suffered only modest declines. In the face of the biggest crisis in Europe since the Second World War, Gary says Courtiers Investment Team will continue to adopt the approach that it has used successfully during many previous periods of crisis to protect investors’ wealth.

22

Feb

Japanese Market’s Eastern Promise

More than 30 years after the Nikkei 225 hit its all-time high, this index of leading Japanese companies continues to languish at levels far below its peak. Despite a long history of disappointing investors, Trainee Analyst Sam Keen says there are tentative signs that things could be about to change.

14

Jan

Keep watchful as government rejects CGT and IHT proposals

Despite the government rejecting radical proposals that would have resulted in higher Capital Gains Tax and Inheritance Tax bills, the tax burden from these two taxes is continuing to rise, heightening the need for tax and estate planning.

17

Dec

Courtiers 2021 Client Seminar

The 2021 Courtiers Client Seminar was an opportunity for clients to hear directly from the Investment Team as they shared their knowledge and insights on a range of topics and issues. You can read a summary of their presentations below. Or if you prefer, why not watch a video of the whole event, which also includes a Q&A session.

02

Dec

Courtiers Advisers helping clients stay the course

As 2021 draws to a close, the UK is facing strengthening economic headwinds in the new year. However, by working closely with their Courtiers Personal Adviser, clients can limit the impact on themselves and their family, allowing them to continue to live the life they want.

29

Nov

Paying for care

Last week the House of Commons passed a controversial amendment to the Health & Social Care Bill that could have lasting consequences for how much people in England pay for social care. Under the new rules, who will pay the bills, which currently average almost £35,000 a year, and are often much higher?

03

Jun

Inflation shouldn’t mean erosion of wealth

With inflation set to rise and interest rates at historically low levels holding too much cash risks seriously damaging your financial health. However, investing for the long term in line with your risk appetite can mitigate the effects of inflation on your wealth.

19

Jan

Inflation measure changes and impact on DB schemes

While the UK Statistics Authority wishes to align the Retail Price Index (RPI) measure of inflation with the Consumer Price Index including owner occupiers' housing costs (CPIH) from 2030, we look at the potential impact on Defined Benefit Pension Schemes.

09

Nov

Markets jump up – the Biden effect or vaccine hopes?

Stock markets rallied strongly this morning with most European markets up more than 5%. But was this really the markets expressing joy at the election of Joe Biden, or rather a huge rally on news that Pfizer has trialled a successful Covid-19 vaccine?

02

Oct

Pension freedoms – freedom for who?

The rollout out of pensions freedoms is under the spotlight. While their introduction undoubtedly helped many while generating significant revenue for the government, Joe looks broadly to establish whether they’ve been more harmful or beneficial for the general public.